"We can see now that many home buyers have started to put their searches on hold as rates have been increasing"

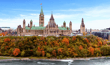

Amid market observers’ predictions of another 50-basis-point hike in the Bank of Canada’s policy rate announcement next week, many would-be home buyers have frozen their plans seemingly indefinitely.

This is because they are likely to get less house for their money in the current economic climate, according to Steven Tulman, president and co-founder of Clover Mortgage.

“We can see now that many home buyers have started to put their searches on hold as rates have been increasing. And this is really in order to assess their financial situation, and potentially revisit what kind of homes they intend to purchase,” Tulman told Canadian Mortgage Professional in a recent episode of CMPTV.

This cooling down was particularly apparent in recent home sales numbers. Data from the Canadian Real Estate Association showed that home sales fell by 12.6% nationally from March to April, while the home price index ticked down by 0.6% to $866,700.

Read more: What’s next for Canada's mortgage market?

There might be a glimmer of hope just beyond the horizon, though.

“My feeling is that these trends will continue. However, we won’t see a crash of any sort; we’ll only see the market begin to normalize, [to the point where] where a home will take about two to three months to sell,” Tulman predicted.

“We’ll continue to see them being listed at more realistic values, which will result in much less frustration for the average home buyer,” he added. “I think this is much healthier overall for both the Canadian economy and for people’s psychological states.”

Tulman stressed that the role of the broker is even more important in such an environment. This is especially applicable in terms of keeping a weather eye on lenders’ offerings, as rates are changing “almost on a daily basis.”

Listen to the full interview with Steven Tulman on CMPTV here.