But risks loom as the Reserve Bank raises rates

In the three months to October, 1,514,000 mortgage holders, constituting 30.1%, were identified as “at risk” of experiencing mortgage stress – a modest decrease from the previous month, new research from Roy Morgan has revealed.

Michele Levine (pictured above), CEO of Roy Morgan, said the October figure incorporates the interest rate increases from May 2022 to June 2023 but excludes the recent November increase, with the reduction in mortgage stress attributed to the extended hiatus in OCR hikes from July to October.

“A close analysis of the underlying factors shows that a combination of factors led to the easing of mortgage stress in the latest figures,” Levine said. “Over the last several months household incomes and employment have both increased strongly while there’s been a reduction in the amounts borrowed and outstanding.”

Meanwhile, the number of mortgage holders deemed “extremely at risk” now stands at 967,000 (19.7% of mortgage holders), significantly surpassing the long-term average over the past 10 years, which was 14.1%.

More “at risk” households since RBA's interest rate hikes

Since the RBA initiated a series of interest rate hikes in May 2022, the number of Australians “at risk” of mortgage stress has surged by 707,000. With current interest rates at 4.35%, the highest in over a decade, 30.1% of mortgage holders remained at risk, near the peak reached the previous month.

Although the latest figure falls below the record high during the Global Financial Crisis 15 years ago, the difference is attributed to the larger size of the current Australian mortgage market. The record-high 35.6% of mortgage holders in mortgage stress occurred in mid-2008.

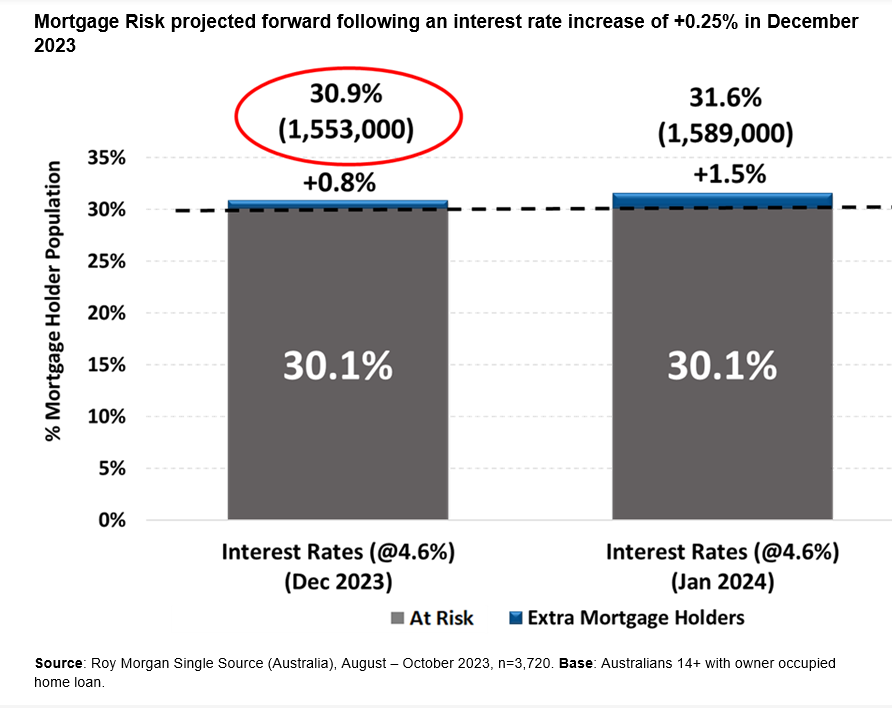

Further stress likely if RBA raises rates in December

Roy Morgan’s modelling anticipates an additional strain on mortgage holders if the RBA raises rates by 0.25% in December. The “at risk” category is expected to climb to 30.9%, affecting 1,553,000 households – an increase of 39,000 from October. Further projections for January indicated a potential record high of 31.6% (1,589,000) of borrowers “at risk” of mortgage stress.

Unemployment holds key influence on mortgage stress

While interest rates draw attention, Roy Morgan emphasised that unemployment is the primary factor impacting an individual or household’s ability to meet mortgage obligations. Roy Morgan estimated that one in five Australian workers are either unemployed or underemployed.

“The employment market in Australia has been exceptionally strong over the last year and this has underpinned rising household incomes which played a part in reducing overall mortgage stress in October,” Levine said in a media release.

“However, rising interest rates over the last year have caused a large increase in the number of mortgage holders considered ‘at risk’ and further increases in the months ahead will spike these numbers even further even as people adjust their lifestyle choices to deal with increased payments.”

About the Roy Morgan survey

The findings are part of Roy Morgan’s ongoing Single Source Survey, based on extensive interviews with over 60,000 Australians annually, including 10,000 owner-occupied mortgage holders.

Roy Morgan evaluates the risk of mortgage stress in two ways for mortgage holders. Borrowers are deemed “at risk” if their mortgage repayments exceed a specific percentage of their household income, taking into account their overall income and spending patterns. Borrowers are classified as “extremely at risk” if the proportion of their household income dedicated solely to the “interest only” component surpasses a certain threshold.

September quarter results of the Roy Morgan survey can be found here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.