Last week's few rises were mostly on new customer variable rates

The past week saw a continuation of fixed rate reductions, with several lenders implementing cuts across various loan terms, as indicated in the latest weekly interest rates wrap-up of RateCity.com.au.

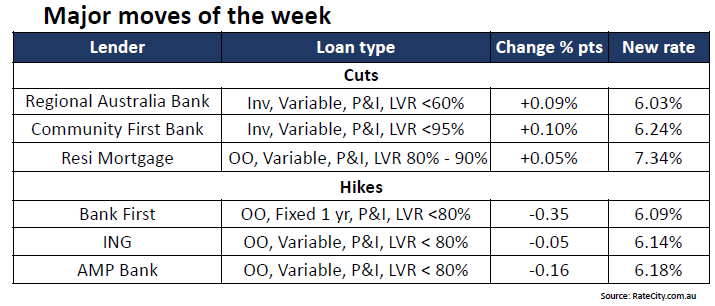

ING announced decreases across the majority of its loan portfolio, with reductions of up to 0.40 percentage points on its fixed rate loans and 0.15 percentage points on its variable loans, setting its lowest advertised variable rate at 6.14%.

AMP also reduced fixed rates across all loan terms by up to 0.40 percentage points, alongside cuts to variable rates of up to 0.30 percentage points.

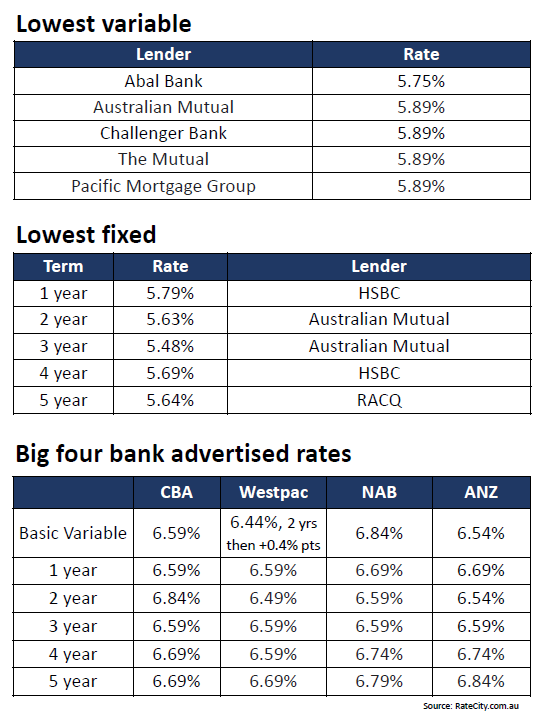

Abal Bank now offers the lowest variable rate at 5.75%, while Australian Mutual leads with the lowest fixed rates for various terms, highlighting competitive movements among lenders.

Major banks have also adjusted their rates, with Commonwealth Bank of Australia’s basic variable rate standing at 6.59% for one and two years.

“The hikes, though few, were almost exclusively on new customer variable rates,” said Sally Tindall (pictured), research director at to RateCity.com.au. “Across all hikes this last week, more than a third were less than 0.10 percentage points, and only two above 0.15 percentage points.

“Looking ahead, we’re expecting to see similar patterns of activity from lenders across the market. Fixed rates are likely to continue to see cuts, while tweaks to variable rates will continue as lenders battle it out for new customers.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.