Ombudsman calls for change

The Australian Financial Complaints Authority (AFCA) has reported a record-breaking 100,000 complaints in the calendar year 2023, just ahead of the fifth anniversary of the Hayne Financial Services Royal Commission.

This marks the first time that AFCA has recorded such a high volume of complaints in a single year, highlighting the escalating challenges faced by consumers and small businesses in the financial sector.

David Locke (pictured above), chief ombudsman and CEO of AFCA, expressed concern over the unsustainable increase in complaint volumes.

“Scam-related complaints to AFCA have nearly doubled between 2022 and 2023,” Locke said in a media release. “They continue to be of great concern to us. We are also seeing the impact of increased interest rates and cost-of-living pressures, with complaints involving financial hardship also significantly higher.”

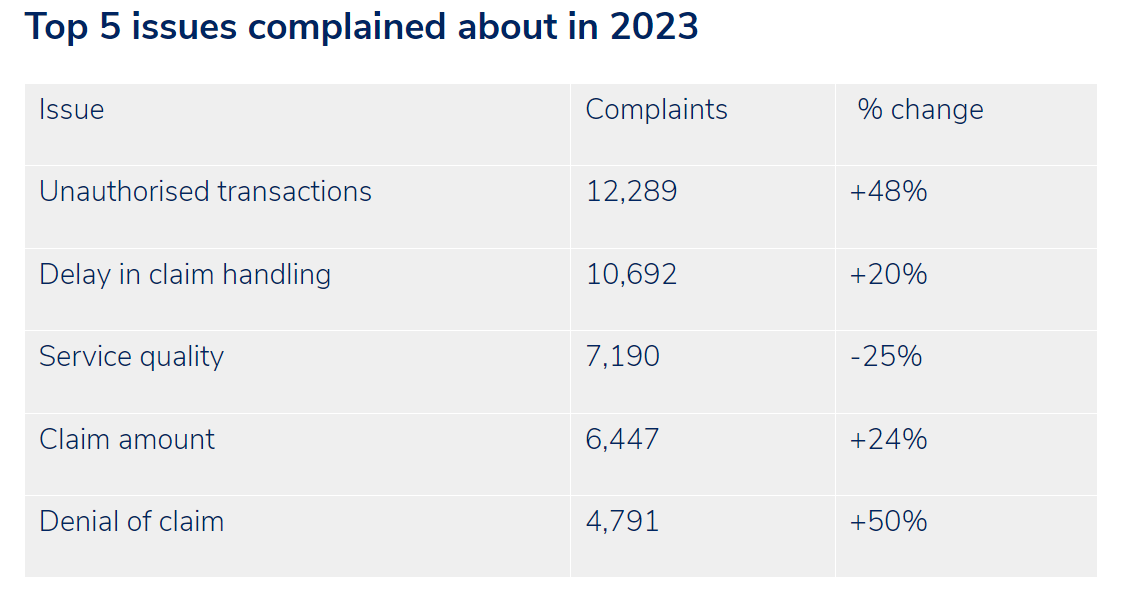

In 2023, AFCA received a total of 102,790 complaints, reflecting a notable 23% jump from the previous year. Preliminary data indicated that consumers and small businesses secured $304 million in compensation and refunds, a substantial 38% rise from the preceding year.

Scam-related complaints, which surged by 95% to 8,987, and financial hardship complaints, which increased by 29% to 5,396, were among the key contributors to the overall rise in complaints.

Additionally, complaints regarding various financial products covered by AFCA, including banking and finance, insurance, investments and advice, and superannuation, also experienced notable increases.

AFCA’s call to action

Locke emphasised the need for anti-scam initiatives by both industry and government to combat this serious and organised crime. He expressed the hope that 2024 would witness a decline in overall complaints, with financial firms working more effectively to address issues internally, reducing the pressure on external dispute resolution systems like AFCA.

“We believe many financial firms could be doing a better job of handling complaints within their own internal complaints processes, so only the most complex cases reach AFCA – which is the role we are meant to play,” Locke said. “Instead, the volume of complaints reaching us is putting unnecessary pressure on the external dispute resolution system and inevitably causing further delays for consumers.”

He highlighted that in their last operational year, the three schemes that preceded AFCA collectively received 52,000 complaints, representing approximately half of the current complaint volume being handled by AFCA.

AFCA’s journey

Established in response to the 2017 Ramsay Review’s recommendations, AFCA began operations in November 2018, just before the final report of the Hayne Royal Commission in February 2019.

Since its inception, AFCA has received more than 420,000 complaints, securing $1.3 billion in compensation or refunds for consumers. The ombudsman service’s systemic issues work has also benefited 4.9m people, resulting in more than $380m in compensation.

“The Ramsay and Hayne reports both highlighted the room for improvement,” Locke said. “Five years on, our work as an ombudsman service shows that the need for a strong consumer protection framework remains.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.