Advantedge is making lodgement and settlement quicker and easier with these digital tools

Advantedge is making lodgement and settlement quicker and easier with these digital tools

MPA: What digital enhancements has Advantedge introduced recently, and how are brokers responding?

Brett Halliwell: IDyou and ZipID are two mobile phone apps that brokers can use to collect and verify their customers’ identification documents. The apps allow brokers to take pictures of their customers’ documents so they can submit the entire application to Advantedge in a single PDF. You literally can do a full ID and have it done and dusted within a couple of minutes and all automatically uploaded and verified straightaway.

While it is really quick, easy and convenient for the broker and the customer, there has been some reluctance to take up the technology. We’ve found that brokers are worried about the security and storage of their clients’ documents on their phones. To be clear, the images of the documents don’t actually sit or remain on the phone at all; they’re uploaded into the provider’s web services and stored on secure IT infrastructure, so the risk is not one they should be worried about.

MPA: How will brokers benefit from becoming more accustomed to these digital tools?

BH: Like any type of new technology, it just takes a little while to get comfortable with it, understand it and use it in a consistent manner. Brokers will benefit from forming some new habits, and over time they’ll realise it’s much easier and more convenient. Ultimately, I’m sure this is the way the industry will move, and every ID verification will some day take place using these kinds of tools. It just takes a while for that to be the norm and the habit in the way brokers conduct their business.

BH: With the manual process, the broker needs to fill out a form, tick a number of boxes, and transpose the identification numbers. The broker then has to sign it, and the customer has to sign it. Despite that manual process being relatively easy, what we’re finding in our operations environment is that it’s not uncommon for brokers to get it wrong. We don’t think Advantedge is different from any other lender … and yet we’re seeing things that are being missed or overlooked. The documents that they’ve uploaded might not be clear or can’t be read, so putting all of that together, we really do encourage and would love to see uplift in brokers using these tools in every single instance.

The benefit to the customer is that it’s quicker and easier; the benefit to the broker is getting it right and eliminating errors. On our side, we can effectively get the information instantly, and we find it of much better quality and compliance. This puts us in a position where we can get an unconditional ‘yes’ back to the broker more quickly.

MPA: Advantedge also now off ers digital document signing (DocuSign) with MSA National. How does that work?

BH: Once the loan has been unconditionally approved, documents can be automatically generated by MSA within one or two business days. Then they are sent electronically to the customer and, if requested, to the broker as well. That can happen on the same day that the documents are generated. So the broker and customer can have documents in their inbox within 48 hours of unconditional approval. From there it’s just up to the customer to sign the documents electronically. That very frequently occurs within 24 hours. Digital signing enables a faster and simpler settlement process for brokers and customers.

Our partners at MSA National say 18% of documents are now being signed and returned within three hours, and 60% are signed and returned within three days, as of April 2018. Put into context, that’s the same time it usually takes for paper documents to be received by the customer by express post. This digital innovation is shaving fi ve to seven days off the settlement process and leading to increased conversion.

MPA: How have brokers responded to DocuSign?

BH: We’ve had very high utilisation of DocuSign and very strong feedback from both brokers and customers; they really love the experience and they identify how convenient it is.

One piece of reluctance that is completely understandable is that brokers tell us that, as part of the superior service they provide, they like to walk through the documents and explain the various clauses to their customers in person.

We’ve got a lot of brokers who have started doing that exact walk-through process with the digital documents. They’ll meet the customer wherever it’s convenient and provide that guidance on their tablet or laptop. From a customer perspective, I think it looks a lot more professional for the broker to be presenting it electronically, and it certainly allows the broker to still have the same quality conversation with the customer.

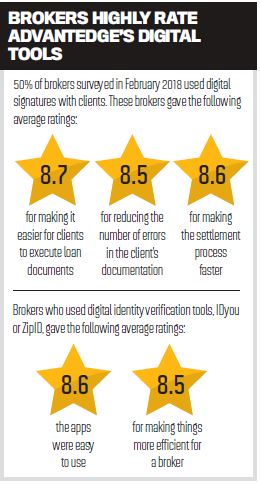

BH: Advantedge ran a survey in February 2018 to get feedback from brokers and customers about our service. The Net Promoter Score from brokers was +45, which increased from +38 a year ago. Brokers who used digital identity verification or digital signatures with their clients rate their experience of both highly.

We’re absolutely delighted that customers also highly regard Advantedge, with our score improving to +38 from +23. So that means customers love the experience they get from Advantedge. By comparison, the major banks’ NPS scores are usually in the range of -15 to -10. Having a +38 score is incredibly high and is incredibly unusual in the industry.

In that survey, we also asked customers what they thought of the broker who helped them take out an Advantedge white-label loan. The score reached an all-time high, with customers giving brokers an NPS of +78, up from +70 in August 2017. I think you’ll find that NPS scores of that magnitude are absolutely unheard of in pretty much any B2B business.

From our perspective, it really validated that, if we can give great customer service to the broker and the customer, then the customers are going to feel very positive about the broker they’ve used, and that will in turn cement the relationship that the customer has with the broker on a long-term basis.

MPA: Do you have any tips for brokers on how they can improve their digital fl uency and become savvier in the online age?

BH: There’s a lot they can do within their own business. I’ve seen a lot of brokers do a reasonably detailed fact-find before they even meet the customer. Once they have a face-to-face conversation, it’s then a matter of digging in and understanding that information. That to me is a superior customer experience, rather than sort of expecting customers to turn up with a handful of bank statements and other documents and getting into the detail at that time. If you’ve done some of the hard work in the beginning, the broker is in a better position to add value.