Banking group reveals the answer

BOQ Group has surveyed its customer pool and found that a third of savers are setting aside money to buy a house in 2023.

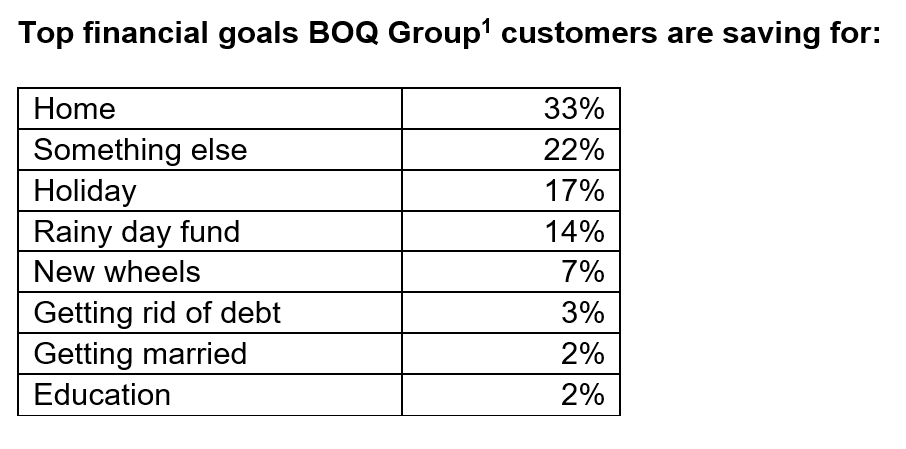

BOQ Group, which includes Bank of Queensland and digital banks Virgin Money and ME Bank, asked more than 10,000 of its customers what their financial goals ae for 2023 to find out what Aussies are saving up for this year. Most (33%) said they are saving up to buy a home.

Source: BOQ Group

The survey showed that 17% of BOQ customers are saving up for a holiday, while 14% are setting aside money for a rainy day. A new set of wheels is the top financial goal of the year for 7% of BOQ Group customers, over settlement of debt (3%), getting married (2%), and education (2%). The remaining 22% said they are saving up for something else.

In keeping with the survey and to kickstart the new year, BOQ Group general manager for everyday banking and deposits Sophie Tilden (pictured above) shared her number one tip for Australians looking to achieve their financial goals for the year – embedding the right behaviours for saving.

“For some ‘live-for-today, plan-for-tomorrow’ types, regular savings habits may not come naturally,” Tilden said. “If you’re one of these people, consider introducing processes such as automatic transfers or round-ups that help you set, forget, and save.”

Her number two tip to reaching financial goals? “[Avoid] the temptation of dipping into your savings for unnecessary purchases.”

Tilden observed that a significant number of BOQ Group customers had opted for some of the banks’ “behavioural savings” products that either separated the customer’s savings and spending allowance or took away some of the customers’ ability to tap into their savings at all.

“Of the customer funds held at BOQ Group, many customers opt for a high-interest ‘behavioural savings account’ where customers separate their savings and everyday spending between two accounts,” Tilden said.

She added that over a third of customers took the behavioural settings of their BOQ accounts a step further and stowed their money in a term deposit or used Virgin Money’s unique ‘locked saver’ feature.

“Now that the RBA has increased the cash rate, it’s the perfect time to shop around and ensure your money is earning the most competitive interest rate,” Tilden said.

Apart from supporting customers on the savings front, BOQ Group has recently made major investments to enhancing the broker experience in its home-lending business.

Last April, BOQ announced that it had bought an electronic lodgement service which facilitated end-to-end processing of loan applications, allowing brokers to receive verified decisions on their loan applications with the bank in as few as two days from lodging an application.

Later in the year, the bank announced that it had smoothed out key “friction points for brokers in loan approval, simplifying its policy for self-employed borrowers and implementing a single-file-ownership policy so that brokers had a single point of contact throughout the lodgement and approval process.

What are your top financial goals for 2023? Let us know in the comments below.