The top mortgage broker course providers play a key role in helping you build a thriving career. Find out our picks for the best training providers

Mortgage brokers play a key role in helping Australians achieve their homeownership dreams. They assist homebuyers in securing a loan that fits their financial situation. That’s why extensive training is necessary if you want to be one.

If you want to pursue a career as a mortgage broker, there’s no shortage of training providers to choose from. Depending on your learning style, you can take in-person classes or self-paced online courses.

To help you with your search, we’ll list the best providers of mortgage broker courses in this guide. We will discuss the benefits of each training provider, what courses they offer, and how much training costs. Read on and take your pick from our list of mortgage broker course providers.

What are the top mortgage broker course providers in Australia?

If you’re looking for a great course provider, your best bet would be to go with a registered training organisation (RTO). These providers partner with national finance and mortgage broking bodies. There are six in total, offering both in-person and online courses.

Here’s an overview of each one to help you with your decision. The list is arranged alphabetically.

1. AAMC Training Group

AAMC Training Group has partnered with the country’s top industry associations to provide mortgage broker training to their members. Courses are mostly offered online but exclusive on-site training is also available for companies with at least 10 participants.

If you’re looking for flexible study arrangements, you have two options:

- virtual Zoom sessions where you can interact with instructors and fellow students

- self-paced online courses that come with materials and assessments

AAMC Training’s finance and mortgage broker courses are recognised by industry bodies:

- Mortgage and Finance Association of Australia (MFAA)

- Finance Brokers Association of Australia (FBAA)

- Commercial & Asset Finance Brokers Association of Australia (CAFBA)

Online Certificate IV courses cost $597, while virtual classes are priced at $997. For the Diploma, self-paced courses cost $997, while Zoom tutorial fees are $1,597.

The Victoria-based training provider also offers Recognition of Prior Learning (RPL). This is accessible to professionals with years of experience in financial services who want to earn a full mortgage broking qualification.

To show its commitment to environmental preservation, AAMC Training has pledged to plant a tree for each student taking any of its virtual classes.

2. Finance and Related Services Training Academy (FARSTA)

FARSTA offers both the Certificate IV in Finance and Mortgage Broking and Diploma in Finance and Mortgage Broking. It also provides RPL for industry professionals with years of loan writing and lending experience.

You can choose between face-to-face classes and self-paced mortgage broker courses.

The in-person programs are handled by finance industry experts and culminate with an open book exam. Classes are held in Brisbane, Sydney, and Melbourne. The fee is $1,315 for the Certificate IV course and $1,040 for the Diploma course.

The distance learning program comes with course assignments and ends with a final exam. The course fee is $765.

FARSTA also offers a two-day assessment block for those who want to get their qualifications faster.

FARSTA is a nationally recognised training provider and a member of the MFAA. Its mortgage broker courses also meet FBAA requirements.

3. Institute of Strategic Management (ISM)

ISM’s mortgage broker courses can be taken online – both self-paced and livestreamed – and in-person.

The training provider also offers a free consultation to help you prepare a personalised training program that matches your career goals. Once you enrol, you will be paired with a “completion coach” to track your progress and guide you in your studies. ISM also considers your past qualifications to determine the simplest and quickest path for you to complete the course.

The fee for the Certificate IV course is $595 while the fee for the Diploma course is $1,295. Both courses are self-paced.

ISM can also assist students in finding government-funded courses.

4. Kaplan Professional

Kaplan Professional is a popular choice for Australians looking for self-paced online mortgage broker courses. The provider doesn’t conduct live online sessions.

Kaplan offers the Certificate IV program for $340 and the Diploma course for $680.

Kaplan’s programs use its tried-and-tested three-phase strategy:

- Prepare: go over concepts and terms likely to be included in the exams

- Practice: apply the knowledge you gained by answering practice questions

- Perform: take a simulated exam

To assess what you’ve learned, you will be given written and oral exams. Each mortgage broker course ends with a supervised, open-book examination.

Instructors are available to answer your questions. Each program also comes with a dedicated email support team to address issues and concerns.

5. Technical and Further Education (TAFE) NSW

TAFE NSW is Australia’s largest vocational education and training provider. Apart from finance and mortgage broker courses, it offers a wide selection of programs for various industries. These include agriculture, media, engineering, environment, Aboriginal culture, and community services.

You can take the Certificate IV course virtually or on the Bankstown campus. The course fees are not yet available on TAFE’s website.

The Diploma course, meanwhile, is accessible only through virtual classes. The course fee is $2,010. Self-paced online classes are not available for this course.

All students can access TAFE NSW’s student support programs and services, including:

- disability support services

- language, literacy, and numeracy (LLN) support

- Aboriginal support and learner support

- careers, counselling, and pathways services

- libraries

- scholarship programs

- LinkedIn Learning

- student associations

TAFE NSW provides training and education to more than 430,000 students each year. These include aspiring finance and mortgage broking professionals.

6. National Finance Institute (NFI)

The National Finance Institute is a registered training organisation that specialises in courses for the financial services sector. The courses are delivered through face-to-face workshops, virtual classes, and eLearning. The institute has campuses in Melbourne, Sydney, Brisbane, Gold Coast, and Perth.

Currently, however, all mortgage broker workshops are conducted remotely via Zoom.

The three-day Certificate IV virtual workshop costs $1,295. Distance learning, which includes hard copies of study materials and online access, costs $895. You can also enrol in the self-paced online program for $695.

The Diploma virtual classes are held for two days. The course fee is $1,145. You can also do distance learning for $845 and online learning for $645. A certificate IV and diploma package costs $1,240 but is offered only as a self-paced online program.

Apart from mortgage broker courses, NFI offers credit management, finance, and business leadership and administration programs.

What qualifications do I need to be a mortgage broker in Australia?

If you want to become a mortgage broker in Australia, there are two courses you need to take:

1. Certificate IV in Finance and Mortgage Broking (FNS40821)

The Certificate IV in Finance and Mortgage Broking is the entry requirement for anyone aspiring to become a mortgage broker in Australia. You also need to complete the course to apply for membership with the FBAA and MFAA.

The Certificate IV course covers a range of topics, including:

- legislation and regulatory framework

- lending institutions and loan types

- loan fundamentals

- lending fundamentals and ethics

- the loan process

- calculation of fees

- financial statements and corporate entities

- productivity and marketing skills

- products, services, and business planning

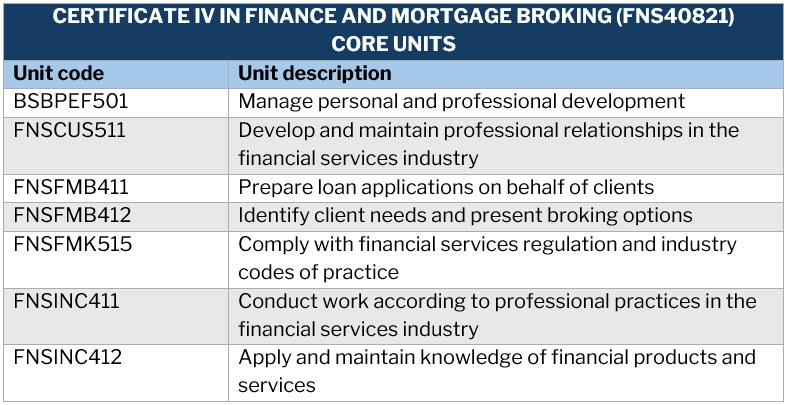

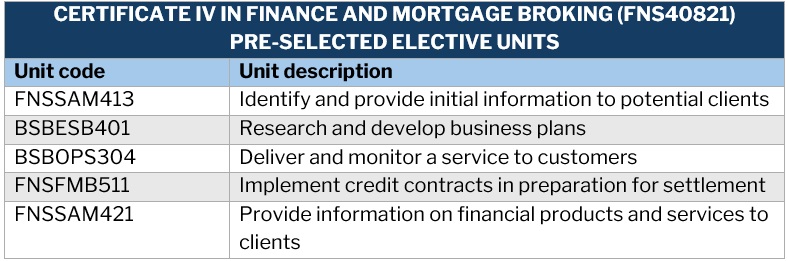

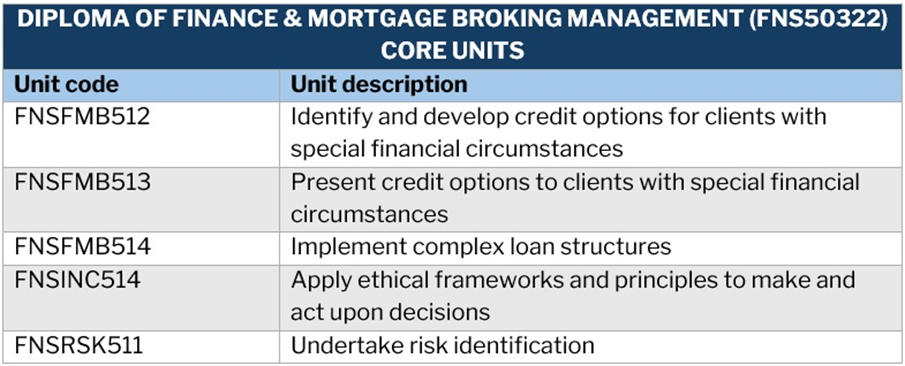

The course consists of 12 units of competency – seven core units and five pre-selected elective units – detailed below.

Mortgage broker course - Certificate IV in Finance and Mortgage Broking (FNS40821) core units

Mortgage broker course - Certificate IV in Finance and Mortgage Broking (FNS40821) elective units

If you have been working in a related profession for years, you may be able to reduce the required units to complete the mortgage broker course. This can be done through recognition of prior learning from RTOs.

There are no formal requirements for those who want to take the Certificate IV course. Some states impose a minimum age limit of 18 years old and completion of secondary education.

2. Diploma of Finance and Mortgage Broking Management (FNS50322)

Taking the Diploma of Finance and Mortgage Broking Management course is necessary if you want to progress your career. You will need to complete the course if you want to hold senior roles or are planning to open your own mortgage broking company.

The diploma course must be completed within 12 months after finishing the certificate IV course. It is also required if you want to maintain your membership with the MFAA.

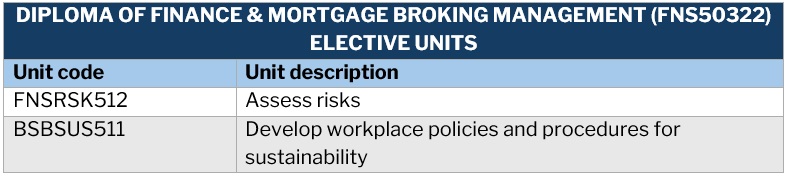

The Diploma course can be taken as an upgrade or a full diploma course. The upgrade mortgage broker course is for those who have completed the Certificate IV course. It consists of seven pre-selected units:

Mortgage broker course - Diploma of Finance and Mortgage Broking Management (FNS50322) core units

Mortgage broker course - Diploma of Finance and Mortgage Broking Management (FNS50322) elective units

Mortgage broker course - Diploma of Finance and Mortgage Broking Management (FNS50322) elective units

The full diploma course is for those who want to become mortgage brokers but haven’t taken or don’t want to take the certificate IV course. It has 10 core units and five pre-selected units, a combination of the FNS40821 and FNS50322 courses.

What skills can you learn from these mortgage broker courses?

The Certificate IV in Finance and Mortgage Broking course will teach you the skills you need to do your job. These include:

- preparing loan applications – this comes with a deep understanding of industry laws and regulations

- building and maintaining relationships not just with clients, but also with colleagues

- learning how to manage your personal and professional wellbeing

You must complete the Certificate IV course before you can work in the financial and mortgage brokerage business.

The Diploma of Finance and Mortgage Broking Management course will teach you how to lead and manage a team and solve complex mortgage broking issues. You’ll also learn how to apply your broking skills in different sets of circumstances.

The Diploma course is necessary for career progression and for venturing into commercial mortgage broking.

Read more: How to become a commercial mortgage broker

Is the mortgage broker course hard?

To complete a mortgage broker course, you will need to get at least 85% of your answers correctly in the final exams. These are open book exams and supervised by an instructor. If you fail the test, you can take it again until you pass, depending on the RTO.

Whether a mortgage broker course is hard to pass depends on your choice of training provider. Most RTOs provide plenty of support to help students complete the courses. These include access to tutor and training materials and a personalised training program that fits their career goals.

That’s why it’s important to make a side-by-side comparison of several RTOs so you can pick the one that matches your training needs the best.

Mortgage broker courses are just one of the many requirements to enter the profession. If you want to start a career in the industry, this guide on how to become a mortgage broker in Australia can help.

Do you have experience working with the mortgage broker course providers on our list? How was it? We’d love to see your story below.