ASB warns of persistent highs

Central banks globally, including New Zealand’s Reserve Bank (RBNZ), maintain restrictive monetary policies to combat persistent inflation.

In ASB’s latest Home Loan Rate report, Nick Tuffley (pictured above), ASB’s chief economist, discussed the implications of these rates on mortgage decisions and the anticipated timeline for rate reductions.

New Zealand’s OCR remains at a high of 5.5%, influencing the mortgage market significantly.

“Sticky domestic inflation pressures suggest that the OCR will remain on hold for a while longer,” Tuffley said.

He also adjusted the timeline for potential rate cuts, now expecting the RBNZ to start reducing the OCR in February 2025, a delay from the previous forecast of November 2024.

Long-term vs. short-term mortgage rates

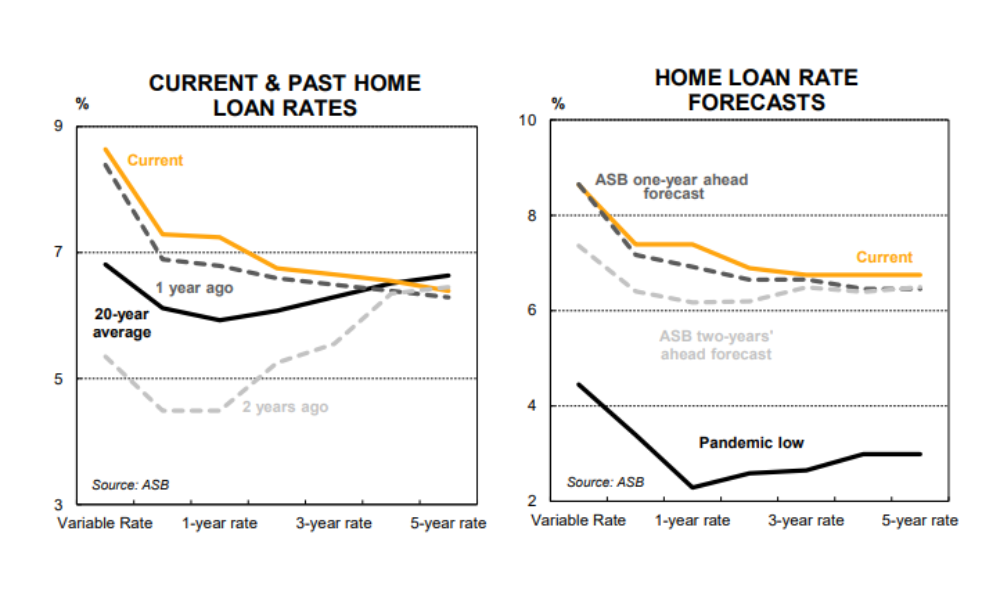

Different mortgage terms are influenced by a variety of factors, including global central bank policies and local economic conditions. While short-term rates are expected to remain stable due to ongoing inflationary pressures, long-term rates have begun to ease slightly.

“However, with the five-year fixed rate now below its 20-year average, substantial falls from here are unlikely,” Tuffley said.

Choosing the right mortgage strategy

The choice between short-term and long-term mortgage rates involves a trade-off between rate stability and flexibility.

Tuffley urged borrowers to consider their personal financial situations and the need for flexibility when selecting a mortgage term. He pointed out that while long-term rates offer more certainty, they historically carry higher costs.

ASB on future outlook and recommendations

Despite the current high rates, there are indications that mortgage rates could lower in the future due to factors ranging from RBNZ policy adjustments to changes in the global economic landscape.

However, Tuffley cautioned that “high inflation pressures mean the OCR looks like it will stay higher for longer than earlier expected,” suggesting a more cautious approach to borrowing and mortgage strategy selection.

Read the ASB Home Loan Rate report April 2024.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.