Despite pressures, NZ household saving hits $424m in December quarter

New Zealand’s household savings remained in the positive territory for the third consecutive quarter, with Stats NZ reporting a net savings of $424 million in the December quarter.

Household income rises, spending increases

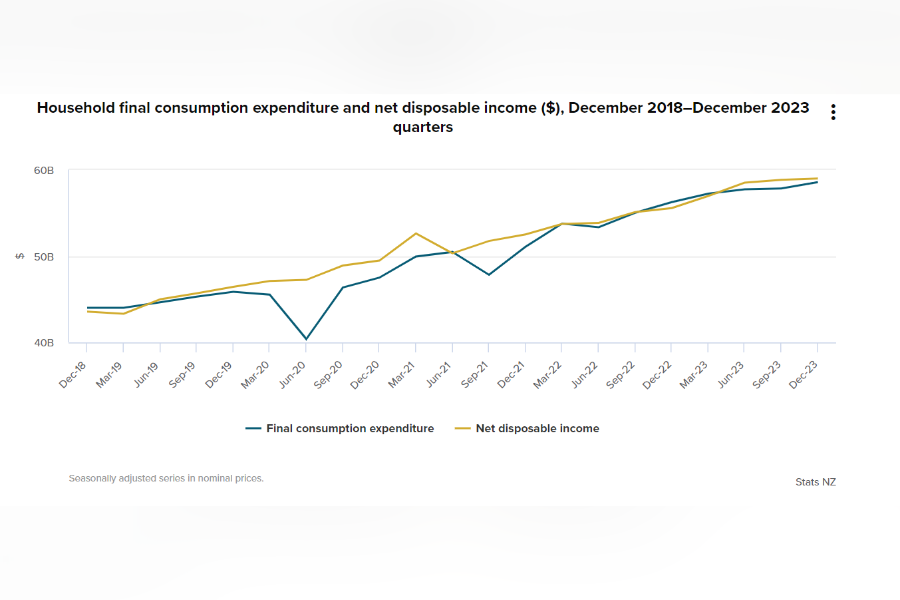

Household net disposable income saw a modest increase of 0.3%, reaching $59 billion, while household spending went up by 1.3% to $58.6bn.

“Across all households, saving has remained positive despite cost-of-living pressures,” said Paul Pascoe (pictured above), senior manager for national accounts institutional sectors at Stats NZ.

Savings ratio declines

Despite the continued positive saving trend, the household saving ratio – which measures saving against net disposable income – dipped from 1.7% in September to 0.7% in December.

“The overall level of household saving declined in the quarter as spending increased at a faster pace than net disposable income,” Pascoe said.

Drivers of income and spending

The quarter saw total income receivable by households increase by $1.2bn, fuelled by rises in wages, social assistance payments, and income from interest-bearing assets.

Conversely, household income payable also rose, mainly due to higher income tax payments, contributing to the increased spending, particularly on transport services like air travel.

Boost in household net worth

Household net worth rose 0.4% to $2,324bn in December, fuelled by a 1.4% increase in land and residential building values.

“The increase in house prices this quarter is the main contributor to the increase in household net worth,” Pascoe said.

Household financial assets grew with insurance and pension funds up by $6.7bn (4.6%) and currency and deposits by $4.8bn (2.0%), while equity and investment shares fell by $14.2bn (1.4%). Financial liabilities rose 1.3%, largely from higher mortgage values.

Read the Stats NZ media release.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.