Homeowners await rate cuts

The New Zealand housing market has shown increasing stress for households in recent months, Gareth Kiernan (pictured above), chief forecaster and operations director at Infometrics, noted in a new analysis.

After a brief rally in early to mid-2023, buyer demand has softened as high mortgage rates persist and expectations of interest rate cuts by the Reserve Bank are pushed further into the future.

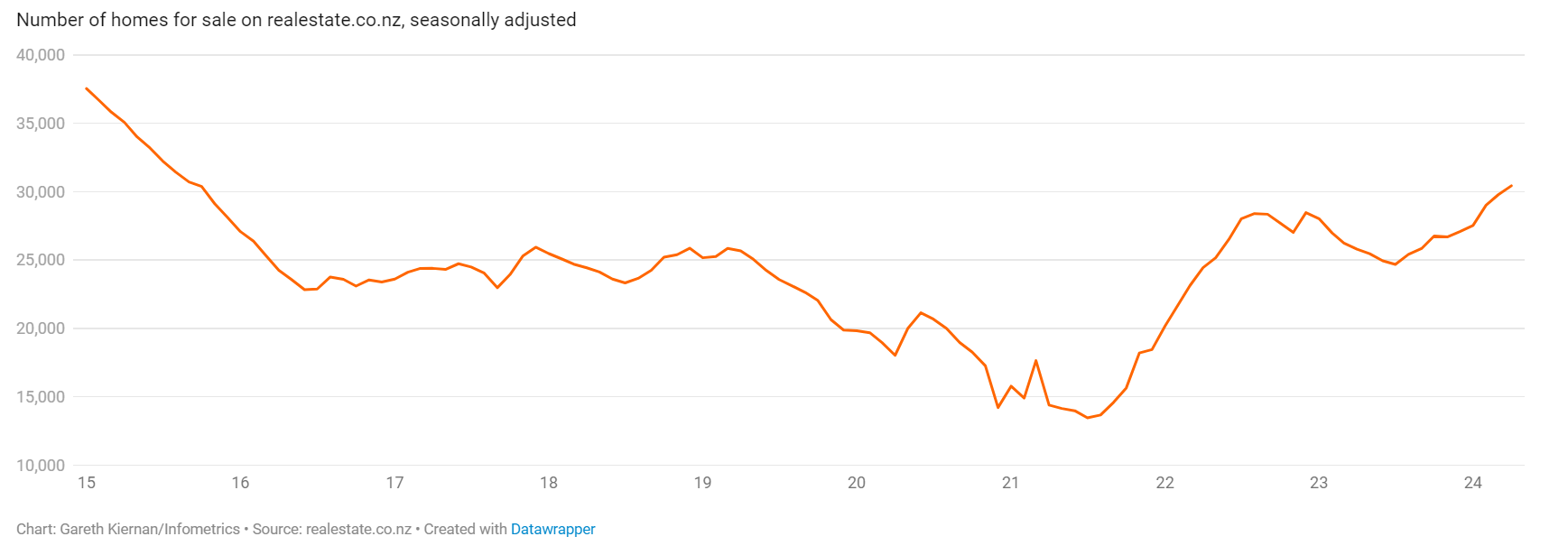

More properties for sale

The stock of housing for sale on realestate.co.nz has increased by 23% since July last year, reaching its highest level since 2015. Wellington and Wairarapa have seen the biggest increases, up 43% and 35%, respectively.

Auckland, Bay of Plenty, and Coromandel also experienced rises of 30% or more, where affordability metrics remain highly stretched.

More properties for buyers to choose from

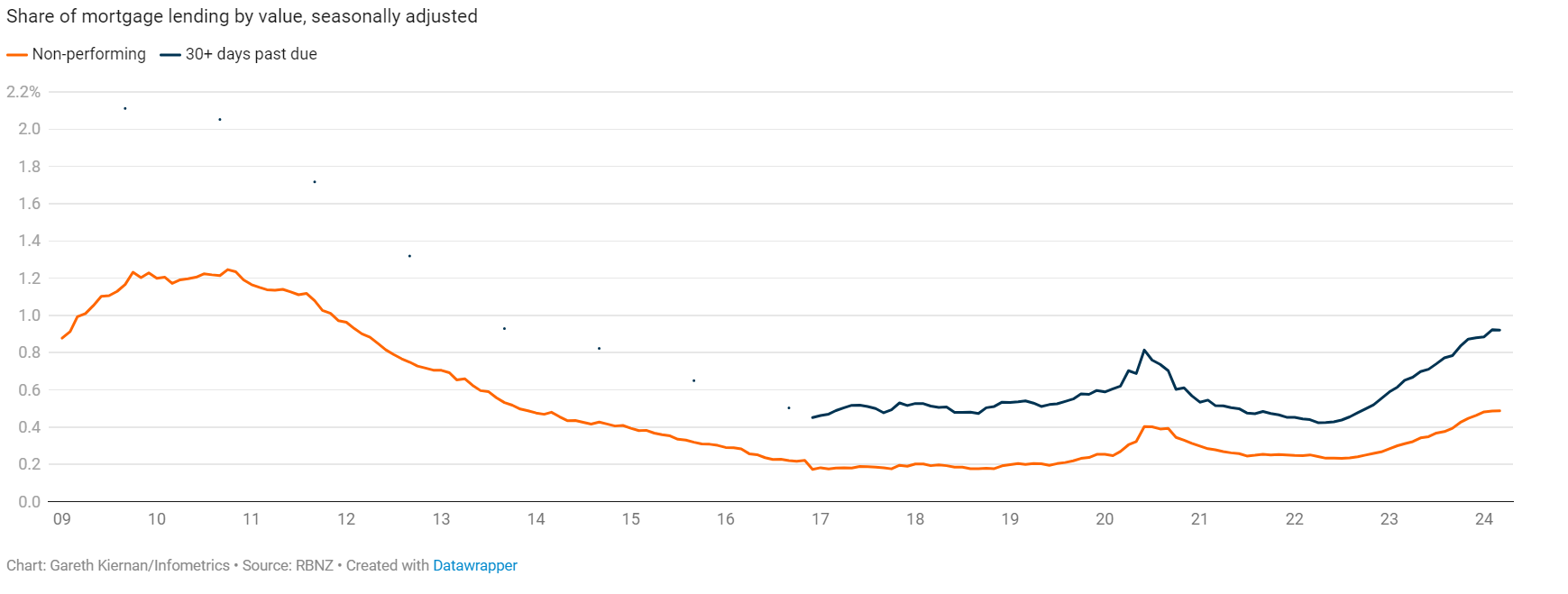

Struggling with mortgage payments

Higher numbers of new listings and increased stock suggest more people are struggling with larger mortgage payments.

“The proportions of non-performing and overdue mortgage lending have trended upwards since mid-2022 and are now at their highest levels since 2013,” Kiernan said.

Many homeowners have exhausted their cash reserves and are facing mortgage rates of 6.5% or higher.

Bad mortgages on the rise

Higher rates for longer

Savings have provided a buffer, but with expectations for interest rates to stay higher for longer, mortgage rate relief is delayed. Only those rolling off one-year rates or shorter can refix at a lower rate, and only if they’re willing to fix for three years or longer, the Infometrics analysis showed.

Short-term fixes preferred

Despite the potential benefits of long-term fixes, a record 69% of new fixed lending in the last two months has been for terms of six or 12 months.

“People are betting on interest rates coming down and do not want to get stuck on rates above 6.5% out until 2027 and beyond,” Kiernan said.

Limited buyers and competition

The combination of high mortgage rates, a weakening labour market, and constrained buyer numbers suggested that vendors will have to work hard to secure a sale over the next 12 months. With numerous options available, buyers can shop around and negotiate prices.

“We continue to expect limited house price growth in 2024, despite large population gains, with interest rates trumping demographic demands," Kiernan said.

To read the Infometrics analysis in full, click here.

See LinkedIn post here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.