Survey reveals shifts in lender and investor trends

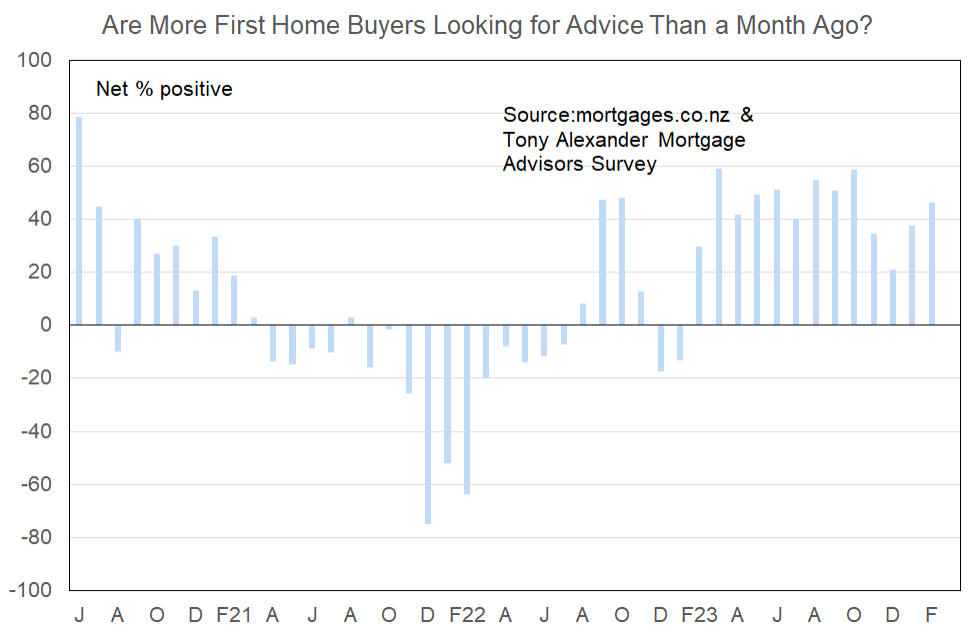

The latest findings from a survey conducted by mortgages.co.nz and independent economist Tony Alexander (pictured above), drawing on responses from 53 mortgage advisers, indicated a significant presence of first home buyers in the early months of 2024.

Despite the uncertain interest rate environment, a net 46% of respondents observed an increase in first home buyers seeking mortgage advice, marking a noticeable uptick from previous months.

Mortgage advisers shared varied experiences with bank lending practices. While some banks have become more supportive of first-home buyers, challenges remain, particularly for those with less than a 20% deposit. Nonetheless, incentives such as cash back offers and competitive rates are being extended to attract first-time buyers, despite high LVRs.

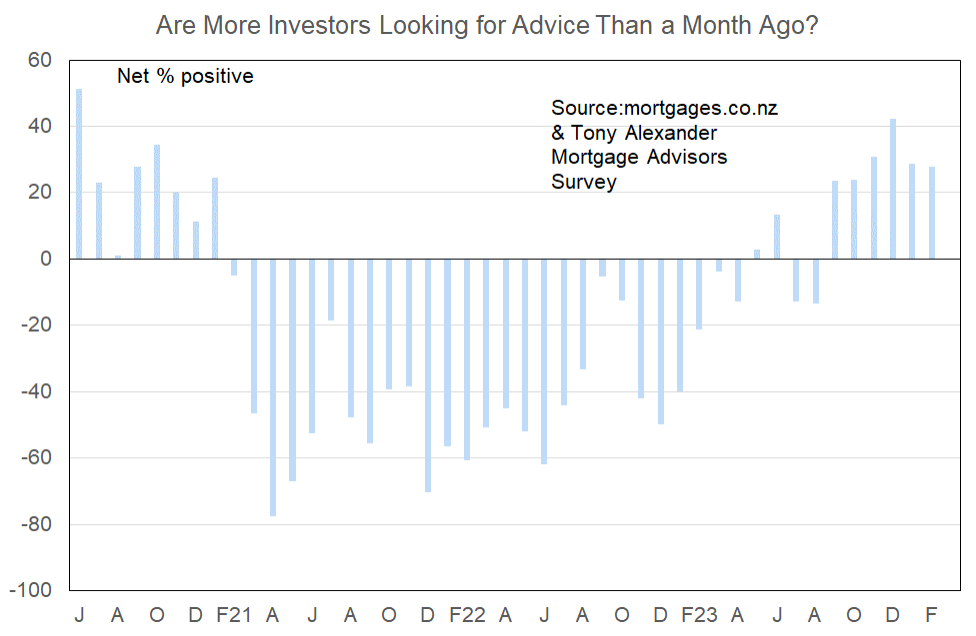

Investor engagement in the housing market

The survey also shed light on investor activity, which has seen a slight increase since the latter part of 2023, possibly influenced by political forecasts. However, the return of investors to the housing market has been gradual, with a net 28% of advisers reporting more investor inquiries, mirroring figures from January.

Lenders’ willingness to advance funds

A promising development for the housing market has been the growing willingness of banks to lend, with a net 43% of mortgage brokers reporting an increased openness from banks, the highest level of confidence seen since May of the previous year.

Interest rate fixing preferences

Amidst ongoing interest rate uncertainties, an overwhelming majority of clients are opting to fix their mortgage rates for a year or less, with six-month terms gaining particular popularity.

“No-one has interest in fixing long and this reflects the widespread expectation amongst borrowers that the next change in interest rates will be a decrease – though when that will happen is impossible to accurately predict,” Alexander said in a media release.

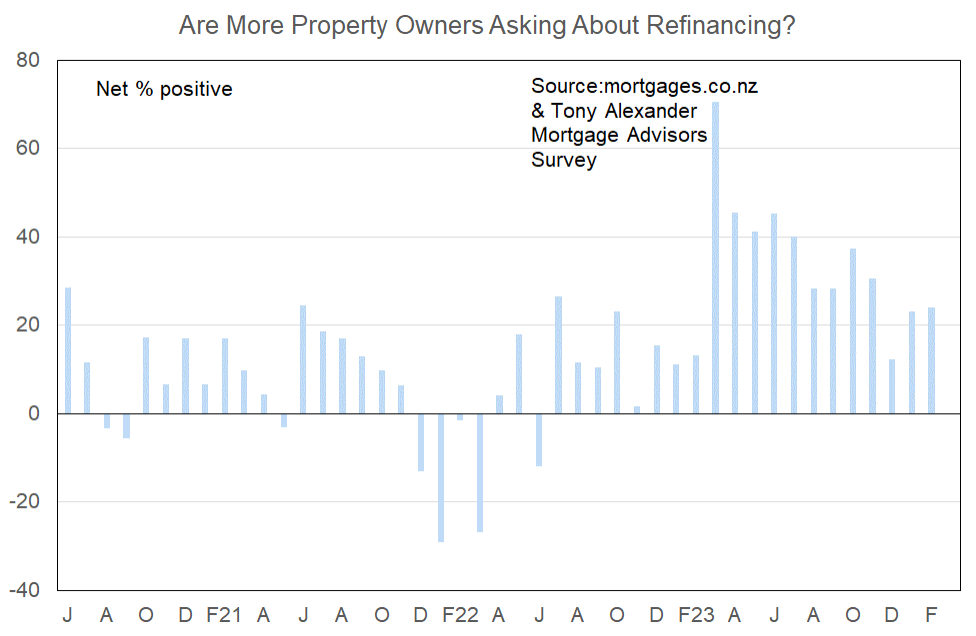

Refinancing Trends

The survey indicated a slight decrease in the number of property owners inquiring about refinancing options, suggesting a wait-and-see approach among existing mortgage holders in response to the fluctuating interest rate environment.

Download the mortgages.co.nz & Tony Alexander Mortgage Advisers Survey report here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.