Specialist lending helps customers who have a range of needs

If there’s one word that sums up why brokers should include specialist lending in their customer offering, it’s ‘flexibility’.

Unlike prime lending, which accounts for the bulk of mainstream lenders’ home loan customer bases and relies on conforming PAYG clients, specialist loans are flexible enough to cover a wide range of customers and income types.

This flexibility is even more important now as Australians face a major squeeze on their household budgets due to higher interest rates and inflation. Many are struggling with the rising costs of mortgages, groceries and other household expenses.

For borrowers who are self-employed or in short-term employment, such as contractors or those working in the gig economy, or who might have a credit impairment holding them back, specialist loans from non-bank lenders can provide a worthwhile solution when the banks have shut them out.

In this sector focus, MPA explores the benefits of specialist loans and how non-bank lenders Pepper Money, Rate Money and Resimac are working with their broker partners in this space.

Specialist lending defined

While there’s no single, accepted definition of specialist lending, Rodney Cottam, regional sales manager NSW, ACT and Queensland at Resimac, says specialist lending is designed for customers who fall outside of the traditional lending profile.

“It’s a product that isn’t offered by mainstream lenders due to the additional time and risk required to service these customers,” Cottam says.

“As it’s solutions-based, specialist lending takes into account each borrower’s individual situation in a way that isn’t possible with prime lending. It’s suited for those who may have credit impairments or interrupted repayment history due to a number of reasons, such as illness, marital separation and certain life events.”

Cottam says there’s a common misconception that specialist lending is purely for borrowers with credit issues.

“It’s actually useful for borrowers who may not have credit issues but nevertheless don’t meet the requirements for prime lending – they may have short-term employment or receive different types of income, for instance – and/or have greater requirements that aren’t accommodated by the prime products, such as needing to consolidate ATO debt.”

Ryan Gair, CEO of self-employed lending specialist Rate Money, says specialist lending originated as a means to provide mortgage products tailored to borrowers who might not meet the conventional criteria established by traditional lenders.

“The core value of specialist lending is its flexibility and its dedication to offering solutions for those typically underserved by standard mortgage offerings,” Gair says.

“The landscape of specialist lending has significantly evolved, leading to the emergence of organisations dedicated entirely to niche markets such as medico loans or SMSF funding. Despite this diversification, the primary focus remains on serving the self-employed sector.”

Barry Saoud, general manager mortgage and commercial lending at Pepper Money, says whether you call it non-conforming, alternative or specialist lending, these are all just different ways to describe borrowers’ circumstances that don’t fit the banks’ criteria.

“Specialist loans are special in that they are designed to provide options for borrowers who just don’t tick the ‘typical’ bank boxes,” Saoud says.

“There are many reasons a borrower may not meet the lending requirements set out by traditional lenders. For some it may be a case of not meeting credit-scoring conditions; for others it may be down to previous missed payments or because they can’t provide certain income verification documents.”

Income type is a good example of this, with many people now earning money in non-traditional ways, “from the self-employed to shift workers, casual workers, people with more than one job, people with income from benefits, and so on”.

Saoud says non-banks such as Pepper Money have the flexibility to make lending for these real-life situations possible.

“We understand the needs of different types of borrowers, and we intimately understand risk. That allows us to develop real options that meet these needs and fill the gaps.”

Opportunities for brokers

For brokers, Rate Money’s referral model is designed to be highly rewarding, says Gair. “Straight away you are dealing with an expert in specialist lending, ensuring that the speed to ‘yes’ drastically increases, which is what everyone is looking for these days.”

Gair says this means that brokers are not only in a position to ensure their clients are receiving first-rate advice but they can also feel comfortable knowing they are paired with the right product – including no application and no valuation fees, no risk fees and a competitive interest rate.

“Rest assured, this product is positioned to excel as a leading choice among competitors. You’ll also receive the benefit of upfront commissions without the fear of clawbacks.”

Brokers working in specialist lending can extend their offerings to a wider range of clients, Gair says. “This approach not only enhances your professional reputation but also ensures that your clients receive the best possible support in their journey to homeownership.”

Gair says Rate Money’s comprehensive broker support empowers the non-bank to navigate specialist lending with confidence, “whilst your clients benefit from our competitive and cost-effective lending solutions with nil risk fees”.

Saoud points out that brokers are aware of the growing cohort of borrowers that require a specialist loan, but there are common misconceptions about non-bank lending to demystify:

- Non-bank specialist loans are not just a short-term fix

“It’s just not the case,” Saoud says. “We can and do work with brokers to reassess their clients’ rate and overall position as their situation changes to give them options across a lifetime of lending needs.”

- Non-bank specialist lending is not just residential

Saoud says there’s a need to build awareness of the non-bank opportunity for brokers beyond residential lending. “Commercial property lending is on the rise, and the demand is strong.”

- Non-bank specialist lending has evolved

“It’s crucial to keep up to date,” says Saoud. “Pepper Money recently removed clawbacks on commercial property loans, is expanding the funding of commercial properties across Australia, including in non-metropolitan and regional areas, and we have simplified our fees and reduced legal charges.”

- Specialist lending is not hard work

Some brokers may perceive specialist lending as too hard because it requires a different approach, says Saoud, but the reality is that it’s not harder to do than a bank loan. “We arm the broker with tech that doesn’t require them to know our product options, credit policy or rate card – this is all automated for a quick and efficient ‘yes’, often when the bank has said ‘no’. ”

Pepper Money has developed a simple and user-friendly pre-application tool – the Pepper Product Selector (PPS) – which allows a broker to quickly and easily understand if the non-bank has an option for their client with an indicative rate and repayment.

Cottam says specialist lending enables borrowers to act now instead of waiting until they’re eligible for a prime loan.

“There’s an opportunity cost that borrowers have to consider when navigating their home loan options. Specialist loans mean borrowers don’t have to miss out on opportunities to improve their financial position, such as by purchasing a property or consolidating debts.”

Brokers who offer their clients a specialist lending solution can say yes to more customers, leading to a better overall experience, Cottam says.

“As a leading non-bank lender, Resimac’s specialist lending products cater for a vast majority of borrowers, including self-employed customers who want to pay out ATO debts, provide funds for working capital in their business, or have only been in business for six months.”

Resimac supports brokers through its highly experienced national team of business development managers and relationship management team, “who are on call to workshop scenarios and work closely with the underwriters to help get deals over the line”.

“Our BDMs are also on the road every day to provide education and training to help brokers better understand our products, policies and processes,” Cottam says.

“Where possible, we also get our credit assessors to discuss applications they’re evaluating with the broker to help reach a favourable outcome.”

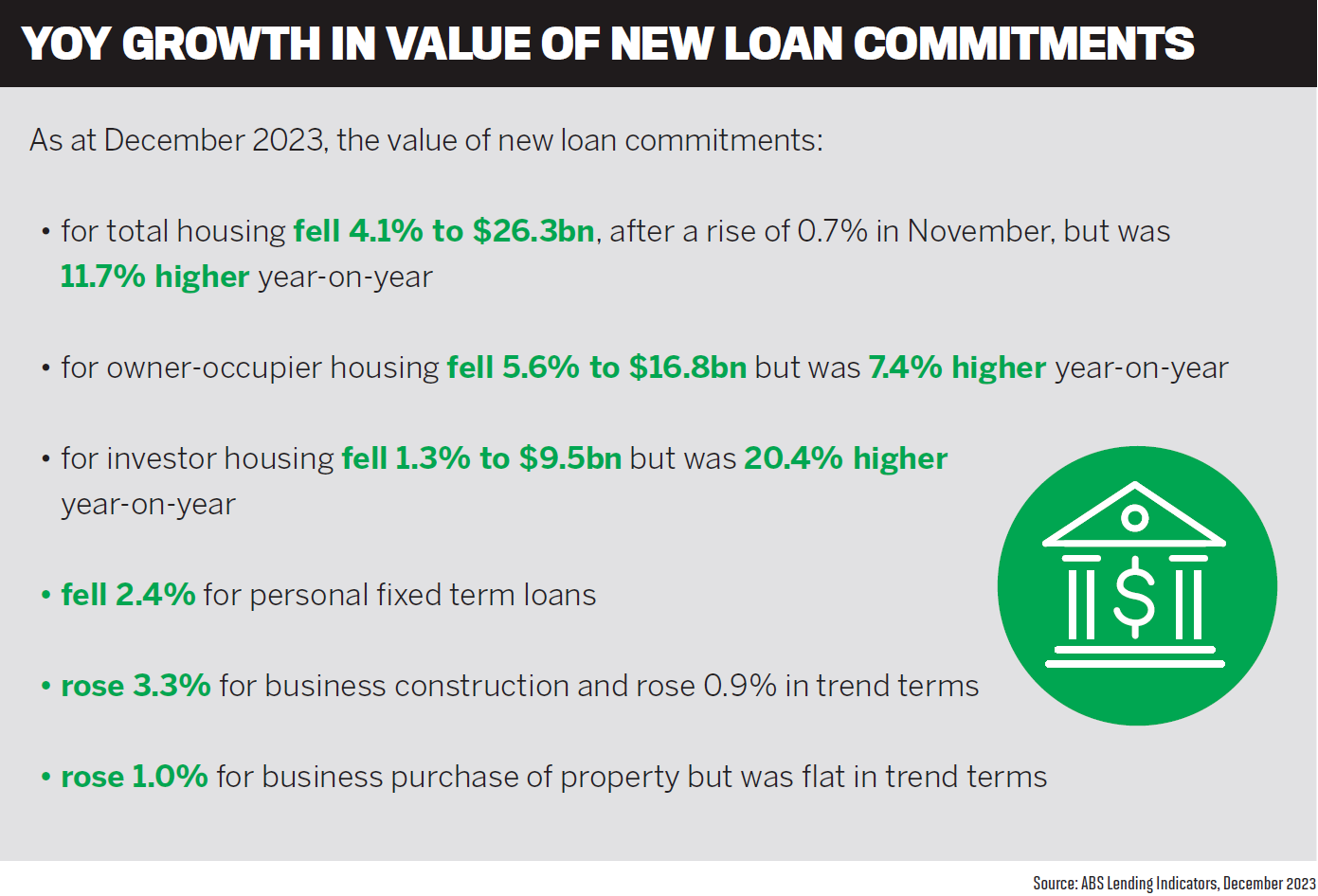

Market trends

Saoud says the needs of many borrowers are evolving in a shifting and volatile environment, and demand for specialist lending options will grow more than ever.

“With interest rates and inflation impacting the disposable income position of most Aussie households, this means mortgage, credit card, personal and car loan borrowers could have a higher probability of missing payments across the next six to 12 months.

“If this is the case, I think we’ll see a significant increase in the number of borrowers that will no longer qualify for a traditional bank ‘prime’ loan.”

Saoud says with CCR data capturing 24 months of repayment history and the firm serviceability buffers in place, traditional lenders will have even greater visibility and control of who they lend to and how much.

“As a result, we can expect that more borrowers are likely going to fall out of the bank’s credit and policy requirements. But non-banks like us with specialist options allow these borrowers the chance to consolidate their debts and consider the whole picture.”

Cottam says the specialist lending market is always growing, and he “anticipates that it will continue to grow due to the challenges of the current economy”.

“In a tightening cycle with the increased cost of living, borrowers with several high-interest debts like credit cards, car loans and personal loans could be finding it difficult to stay on top of their repayments and other bills. This can lead to defaults, mortgage arrears and, in the worst-case scenario, bankruptcy.”

Banks typically won’t lend to borrowers who have more than a couple of small paid defaults, so specialist lending solutions such as those offered by Resimac can help put borrowers into a better financial position.

Cottam says by refinancing their home loan into a specialist lending solution, customers can consolidate an unlimited number of debts (at up to 90% LVR for Full Doc and up to 85% LVR for Alt Doc) into a single repayment at the lower mortgage-based rate, reducing overall monthly commitments.

Borrowers need to be diligent about paying these debts off over the original term of each loan rather than capitalising them over the remaining term of the mortgage.

“A notable difference for Resimac compared to other non-bank lenders is that customers can have a different offset for each loan portion,” says Cottam.

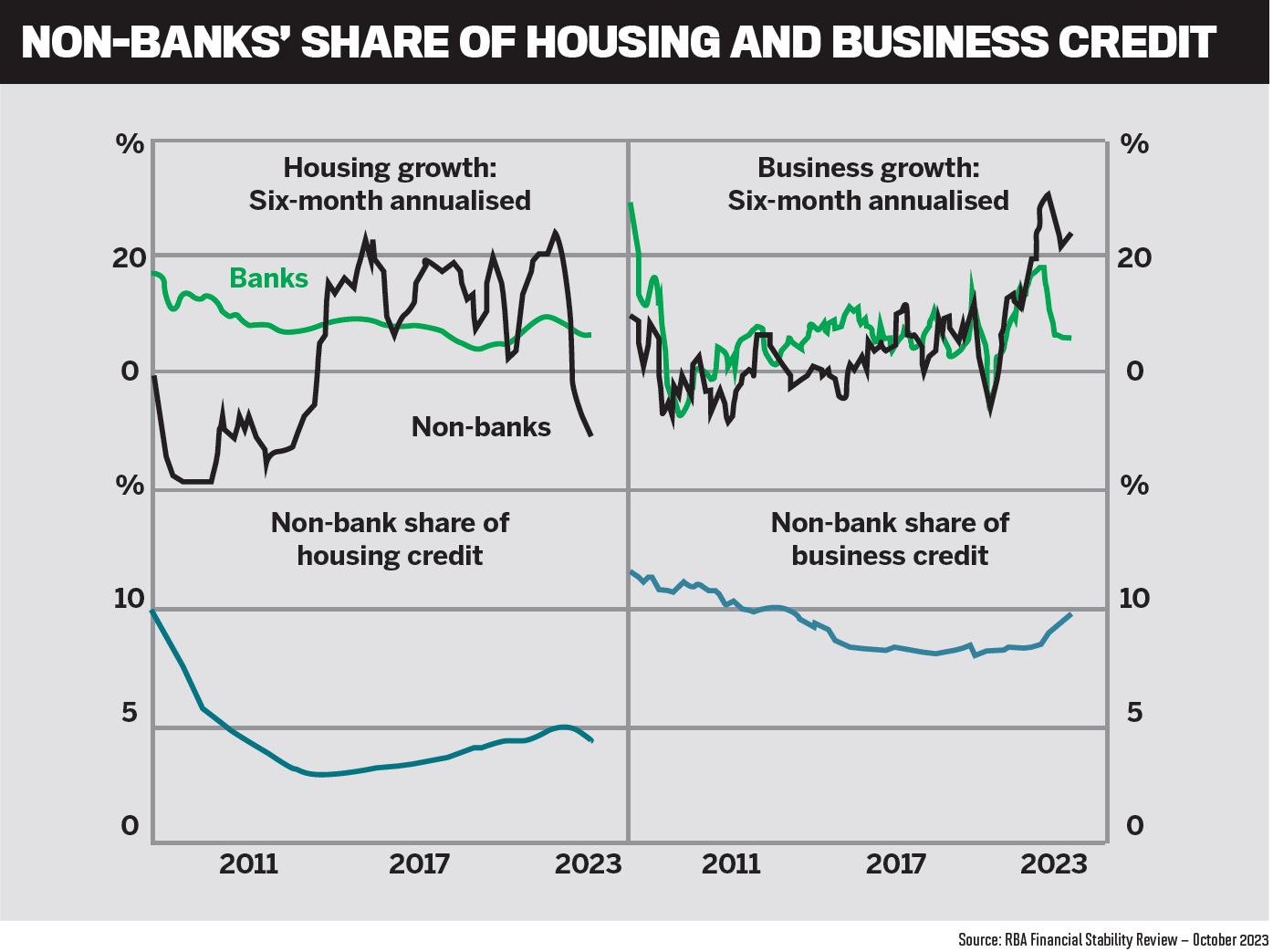

Gair says the current specialist lending market is on a notable upswing, particularly after navigating through a challenging first half of 2023. Initially, the sector faced headwinds due to rising interest rates and aggressive cashback offers from banks.

“However, from August last year, we’ve observed a marked shift back to the non-bank sector, with our own business witnessing substantial growth, culminating in our best performance in the last few months since June 2022.”

Gair says this resurgence is driven by several key factors:

- Serviceability and credit tightening – the tightening of lending criteria by traditional banks has made Rate Money offerings more attractive

- Interest rate stabilisation – with interest rates stabilising, the initial preference for big banks is waning, and customers are increasingly exploring “what we offer as a compelling alternative”

- Market confidence – despite economic challenges, the stabilisation of rates and inflation, along with a resilient property market, is bolstering borrower confidence

Looking ahead to the next 12 months, Gair says the sector is positioned for further growth, fuelled by innovation, and this is why Rate Money has rolled out new products designed to meet the diverse needs of the self-employed.

“Our introduction of simplified full-doc loans and the continuous enhancement of our low-doc offering – both boasting no clawbacks – underscore our adaptability and dedication to serving our clients’ unique financial situations.

“Never has there been a better time to consider entering the world of specialised lending,” says Gair.

How important is specialist lending to your client base? Comment below