Australians tighten the purse strings to offset the spending spree in the previous month

Following November’s record setting expenditure on credit and debit cards, December witnessed a reduction in spending, with Australians tightening their budgets and the value of transactions dropping.

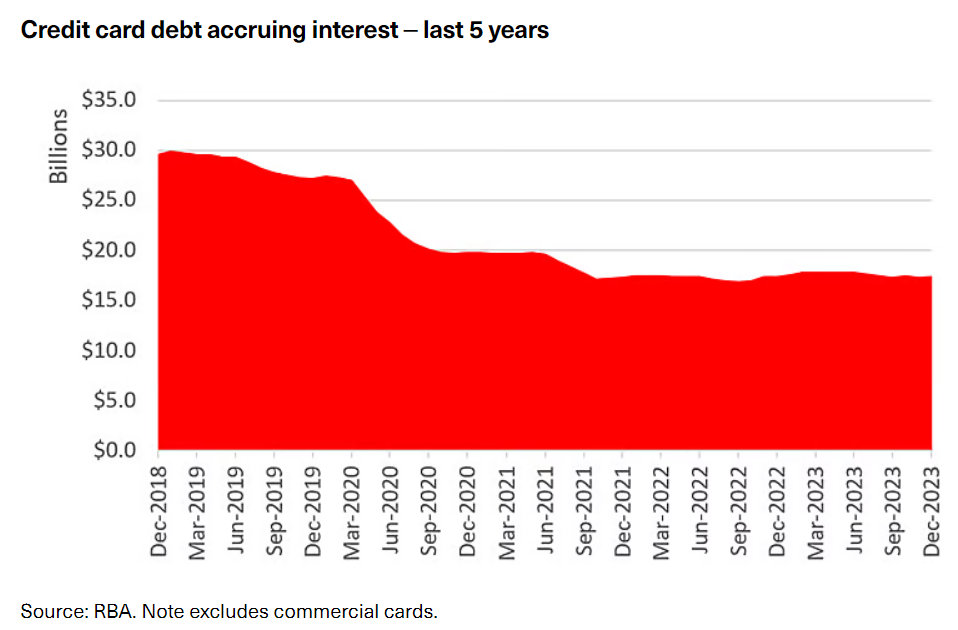

December saw a marginal rise in credit card debt among Australians, with the total amount attracting interest charges increasing to $17.31 billion, a $21 million uptick from the previous month.

Despite this recent increase, the Reserve Bank of Australia’s (RBA) statistics indicate that the credit card debt accruing interest in December was $64 million less compared to the same period in the previous year. This is observed alongside a growth in credit card accounts, with more than 188,000 added over the past year and nearly 280,000 since the RBA began raising interest rates in May 2022.

“Last November, Australians spent more on their credit and debit cards combined than ever before in RBA records,” Sally Tindall (pictured), research director at RateCity.com.au. “With this in mind, it’s surprising we didn’t see a bigger blow out in credit card debt in December.

“While a rise in debt attracting interest charges is never a good thing, the damage could have been a lot worse. What this credit and debit transaction data tells us, is that Australians tightened the purse strings in December considerably, to counteract the spending spree in November.”

Tindall also advised individuals still grappling with credit card debt from the festive season to prioritise repayment, cautioning against waiting for tax returns or tax cuts as a means of financial relief.

“If you still haven’t managed to get on top of your credit card debt after the silly season, put a priority on paying back that money as soon as you can,” she said. “If you’re strapped for cash, the last thing you want to be doing is handing it over to your bank in the form of interest charges,” she said.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.