What's the worst that could happen – that the lender finds out or that they don't?

One in eight Australians admit they have lied on their home loan application either by inflating their income or omitting debts, research has found.

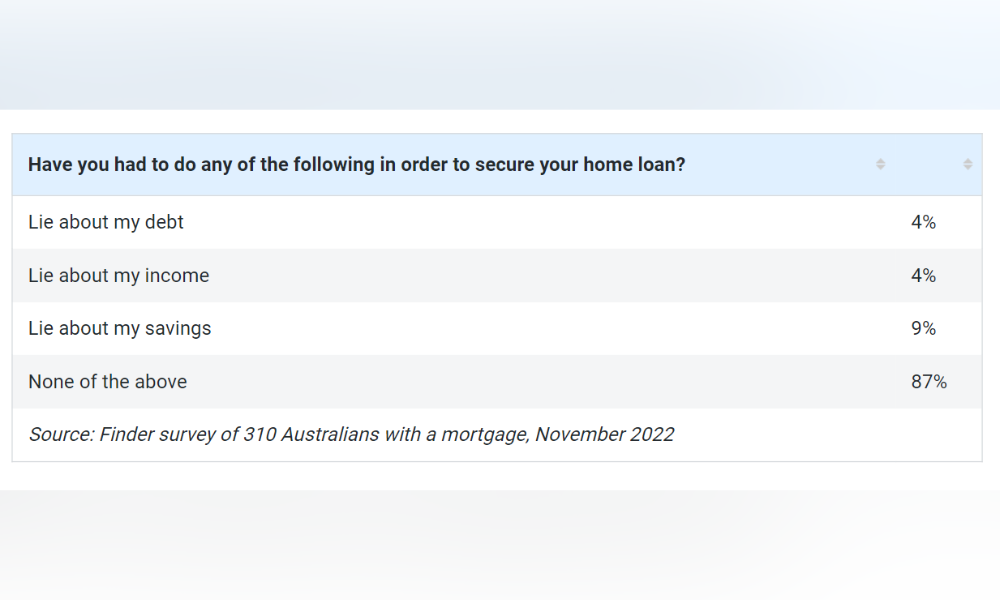

A Finder survey of over 1,100 Australian homebuyers – more than 300 of whom had already successfully secured a mortgage – found that 13%, or one in eight, lied on their home loan application.

The Finder survey showed that 4% of mortgagors specified that they had misrepresented their income, while another 4% had not told the truth about how much debt they were in during the application.

While lying during the home purchase process for the purpose of securing a mortgage could qualify as fraud, Finder home loans expert Richard Whitten emphasised that there were other consequences to fibbing one’s way into a home loan.

In the worst-case scenario, Whitten pointed out, the loan application lie could be discovered by your lender and form the basis for the loss of your home.

“While small inaccuracies may not be the end of the world, if a lender finds a big discrepancy in the figures you’ve given them, or you’ve outright lied about your financial position, the consequences could be severe,” he said.

Whitten was referring to the usual mortgage application conditions which require applicants to provide correct information. Misleading or false statements could prompt a default event and legally entitle the lender to sell the property from underneath the homebuyer’s feet, 9news reported.

“Lenders cross-check everything. [Applicants] who intentionally provide incorrect information could potentially receive a black mark on their credit score and, in severe cases … have their loan called in, meaning they have to repay the loan in a hurry,” Whitten added.

But the damage was done even if the lie did go undetected, because it could (mis)inform the lender’s eventual approval of the homebuyer’s loan application and put the homebuyer in the very situation the loan application was placed to protect them from.

Whitten reminded homebuyers that there was a good reason lenders tried to find out how much a homebuyer could afford to spend and how much they could reasonably be expected to save in a rigorous application process – these data told lenders whether a borrower was capable of making their monthly payments.

”While the lies might go unnoticed, the financial burden of an unaffordable loan could create a lot of stress,” Whitten said. “You’re putting yourself in a risky position if you lie on your [home loan] application and borrow more than you can afford.”

Still, with Australia’s 3.10% rate and more hikes looming in the coming months, Whitten had to admit he was unfazed at the Finder survey results.

“As housing affordability deteriorates, Aussies are scared of being rejected and missing out on getting on the property ladder,” he said.

Any thoughts on the survey findings? Let us know in the comments below.