Scheme will be great for first home buyers, says brokerage

In a move that is expected to bolster homeownership rates in NSW, a major change to the way stamp duty is applied has received the green light from the state's Parliament.

From January 16, 2023, the First Home Buyer Choice Bill will allow first home buyers buying a home up to the value of $1.5 million (or buying vacant land up to $800,000), to choose between an upfront stamp duty payment or a smaller annual property tax.

The annual land tax provides a valid alternative to stamp duty, which has long been criticised as an inefficient tax, and a barrier for people wanting to own a home. However, the reforms could be shortlived if the Labor Party wins power at the next state election in March 2023. Opposition Leader Chris Minns has already said Labor will scrap the legislation, calling it a “forever tax” on homes.

Read more: Stamp Duty overhaul draws mixed response

Theo Chambers (pictured above), CEO of brokerage Shore Financial described First Home Buyer Choice as a great initiative for first home buyers. He said it almost halved the minimum required amount first home buyers needed to save as a deposit before they can buy.

NSW Premier Dominic Perrottet announced on Thursday that the legislation had successfully passed both Parliament’s lower and upper house.

Accessible for eligible first home buyers from November 12, buyers will be required to pay stamp duty on purchases made until January 15, 2023. If they choose to opt into the annual fee, they can apply for a refund of the stamp duty cost, the NSW government said.

Referring to First Home Buyer Choice as a “game changer for first home buyers”, Perrottet said it would help families get the keys to their first home sooner.

“For the first time we will provide first home buyers with a choice, helping thousands of people to shave around two years off the time needed to save for a deposit,” Perrottet said. “People can now save huge sums of money on the biggest purchase of their life.”

NSW Treasurer Matt Kean said First Home Buyer Choice would significantly reduce upfront costs and the time needed to save for a deposit. It would see the majority of eligible first home buyers pay less tax overall, he said.

“We are giving people the opportunity to decide for themselves what best suits their financial situation. Those buying a home to live in for life can still choose stamp duty, but for many, paying an annual tax for the limited time they actually live in the property will make more sense,” Kean said.

Read more: NSW stamp duty shakeup to happen in 2023

Based on an apartment priced at $800,000, a townhouse priced at $1m and a house priced at $1.25m, NSW Treasury data showed the break-even period between upfront stamp duty and an annual property fee would be 36 years, 28 years, and 26 years respectively.

Based on a median holding period of 10 years and a $1m house, the annual property payments over the 10 years would add up to $19, 881 in present value terms, compared with $40,090 in upfront stamp duty, the data showed. This represented a saving of $20,209.

Chambers said there were a significant portion of Australians who could afford the repayments of a home loan, but don’t have enough savings to cover the required minimum deposit and stamp duty.

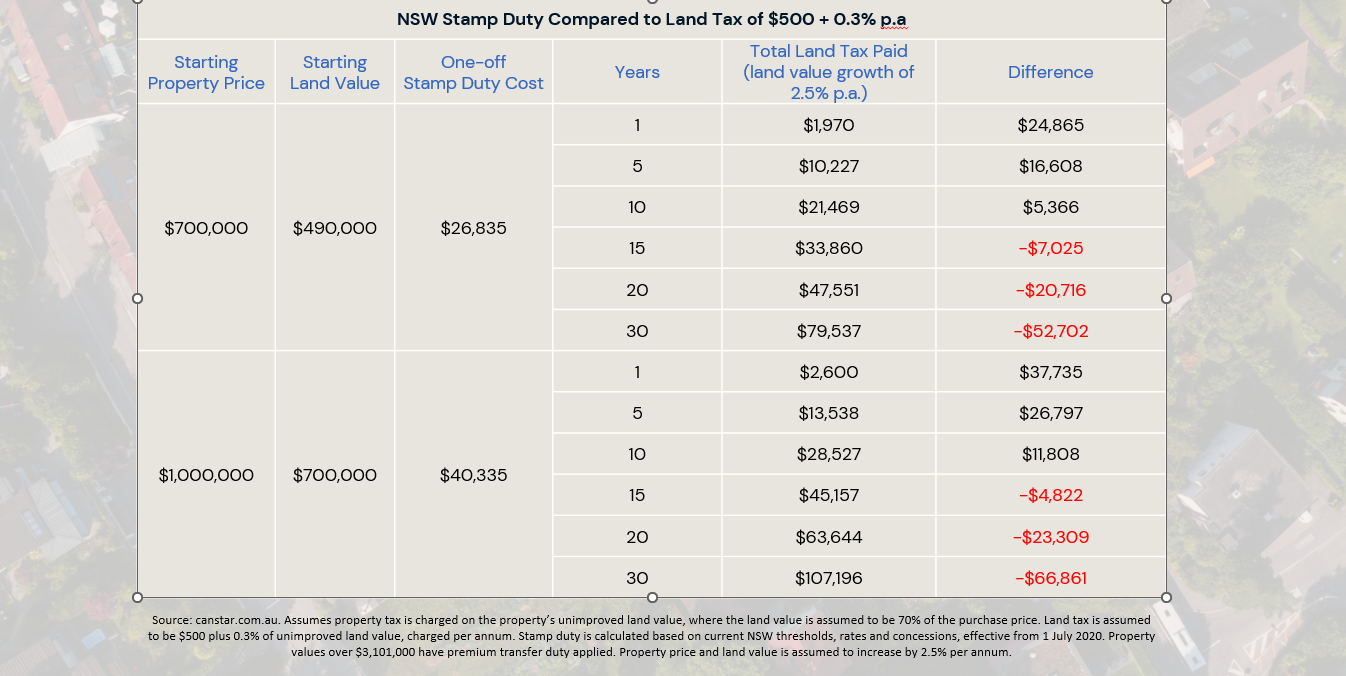

As a comparison to NSW Treasury calculations, Shore Financial has produced a graph (pictured immediately below) comparing upfront stamp duty costs, and the annual land tax.

The two scenarios are based on property prices of $700,000 ($490,000 land value) and $1m ($700,000 land value). They illustrate when the annual land tax may exceed the upfront stamp duty cost.

“Assuming 2.5% growth on land value per year, the annual property tax only works out to cost more than the once- off stamp duty payment after roughly 14 years,” Chambers said.

In response to whether there were any aspects of the Bill that needed further clarification, Chambers referred to a discussion paper on stamp duty reform released in 2021. The paper raised the possibility of a 1% annual tax for residential property investors and a 2% annual tax for commercial property investors, which Chambers said would be an added hurdle to investing in property.

Investors provided housing for tenants, and such a tax would “cripple that market”, he said.

Read next: Stamp Duty overhaul draws mixed response

“Investors already have compressed yields with high interest rates and are dealing with holding costs increasing at a much higher rate than rental yields,” Chambers said. “There is also a substantial lack of properties available to rent at present, plus a significant housing shortage across NSW. This would only further worsen both these problems.”

Chambers said it was important that Australians who have available equity consider purchasing an investment property to help them live comfortably in retirement.

“Australians are already struggling to plan for a retirement, and this move would make the problem far worse by disincentivising investors,” Chambers said.

The NSW government has allocated $728.6m to First Home Buyer Choice over the next four years. The scheme is available to every eligible first home buyer wanting to access it.