A flexible alternative

A flexible alternative

It’s no secret that small businesses in Australia are doing it particularly tough at the moment.

A recent report by OnDeck showed that one in four SMEs had been knocked back for bank finance. Of those that did manage to get funding, 29% were negatively affected by the amount of time taken to organise that funding.

But SMEs are extremely important to the Australian economy.

There are 2.24 million businesses in Australia, and 97% of them are small businesses employing fewer than 20 people. Small businesses make up 35% of Australia’s GDP.

Businesses have not stopped needing funding to ensure their growth, but the banks have adjusted their appetite in the area.

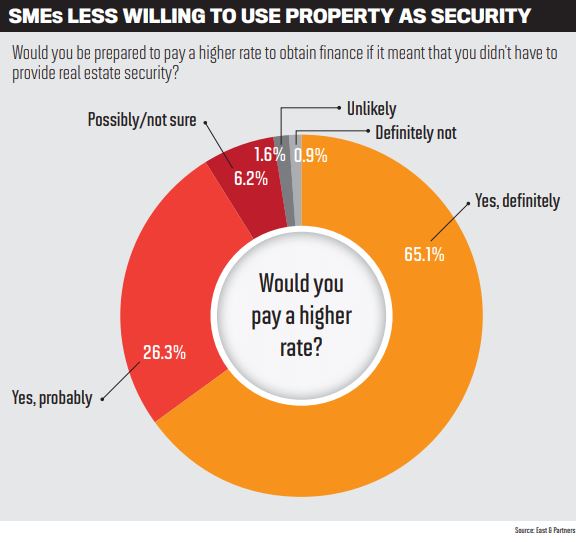

Furthermore, the property downturn has also meant that businesses are less willing to offer up property as security.

Scottish Pacific’s March SME Growth Index showed that 44% of SMEs believe the current property market conditions have made it harder to access business funding.

More than 91% said they would pay a higher rate if it meant they did not have to provide real estate as security.

The Productivity Commission released its draft report into competition in the Australian financial system last year.

It found that a third to a half of the loan value of Australian SMEs was reliant on property as security.

Thirty-five per cent of the value of small business lending by the major banks is secured by real estate, and for non-majors this figure is almost 47%.

While small business owners might not know the options available to them, brokers can help them find alternative lenders that can provide solutions to meet their needs.

Unsecured business loans do not require any assets as security; instead the lender bases its decision on whether the business has the capacity to borrow against its cash flow performance. Lenders will typically ask these clients for a personal guarantee, which the lender has the right to pursue if the business fails to meet its loan repayment obligations.

Unsecured financiers like OnDeck will look at wide and varied data points, including the company’s time in business and business revenue, as well as reviewing recent bank statements.

This information, in addition to Credit Bureau data, allows lenders to make an informed and responsible credit decision regarding the borrower’s ability to repay the loan.

Businesses generally need business loans to support growth and expansion without encumbering business or personal assets, says Michael Burke, head of sales at OnDeck.

The fintech lender offers unsecured business loans of up to $250,000 with six- to 24-month terms. In its AltFi research across 430 SME owners in Australia, OnDeck showed the impact on these businesses of their struggle to get finance through a mainstream bank.

Fifty-seven per cent of businesses which had applied for finance from a bank found that their normal business activities were slowed or halted.

“As SME customers and brokers increasingly look for optionality beyond banks, we expect lenders like ourselves to become increasingly mainstream” Michael Burke, OnDeck

Many others had to delay buying new equipment for their growth, or had to put off debt payments. Twelve per cent even had to delay hiring new staff.

But Burke says there has been a growing awareness of online lenders, particularly among those businesses that have struggled to get funding from the mainstream banks.

OnDeck’s research has shown that 22% of SME owners would consider using an online lender in the future, compared to only 11% in previous research.

Of those businesses that had already been rejected by a mainstream bank, the number grew to 42% saying they were willing to use an online lender.

Worryingly, 27% of SME owners also said they would consider dipping into their own personal funds. While the mainstream banks have pulled back, the online business lending sector has continued to adapt and grow.

Burke says OnDeck has seen its customers’ need for greater choice and product diversity in the sector, and as a result it has been able to expand into new areas of finance.

Noting that around a third of its customers were using their loans to purchase equipment, OnDeck recently launched an equipment loans product to provide longer terms than were available through the unsecured facility.

“Unsecured lenders like us are increasingly seeing this customer need and are broadening their product portfolio as a result,” Burke says.

OnDeck already works very closely with brokers, and Burke anticipates that the commercial space will continue to see more mortgage brokers diversifying.

He says small business loans like unsecured lending are a “logical and relatively straightforward first step”. As it doesn’t look like the banks will be widening their credit appetite any time soon, online and alternative lenders are coming more and more to the forefront.

Burke believes the awareness of the availability of unsecured lending and the benefits that alternative financiers can offer compared to traditional lenders will continue to grow.

“As SME customers and brokers increasingly look for optionality beyond banks, we expect lenders like ourselves to become increasingly mainstream,” he says. Brokers can also benefit from recent changes in the space that have enabled greater transparency.

OnDeck was one of several online lenders to sign a Code of Lending Practice and introduce the loan comparison tool SMART Box.

“At OnDeck, transparency has always been in our DNA,” Burke says.

“This is about brokers being able to better service SME clients, both in terms of providing more timely access to capital and also offering choice and flexibility” Michael Burke, OnDeck

“So our position as a lead advocate and signatory for the adoption of the online lending industry’s Code of Lending Practice in Australia last year was an obvious choice.”

The SMART Box comparison tool is a one-page document designed to make it easier for brokers to explain different pricing terms to their customers, and to help them compare the total cost of the business loan.

Armed with this tool and lenders that are willing to guide brokers through the transition to business lending, brokers are in a prime position to help their business customers.

And they have plenty of customers already in their database that are ready to be reached out to. Typically, around 25–30% of a mortgage broker’s customer base is made up of small business owners.

“Brokers shouldn’t underestimate the opportunity presented by the SME market,” Burke says.

“Ultimately this is about brokers being able to better service SME clients, both in terms of providing more timely access to capital and also offering choice and flexibility where they don’t want to be encumbered with security on their personal or business assets.”

Using lenders like OnDeck will also allow brokers to further solidify their position as trusted advisers to SME clients, Burke says, because of their ability to be nimble and grasp growth opportunities presented to them.

Unlike a major bank, these lenders can make informed credit decisions quickly, so when a broker calls up to talk through a scenario, they can accommodate.

“Our processes are streamlined through some of the best technology platforms there are, and that’s good news all round,” Burke says.

“It means brokers can be confident in their promise to clients that the process will be easy and fast.” Fast decisions – particularly in an area of lending where the lender is not taking security – can worry some brokers in terms of the risks.

But Burke says speed is never at the expense of its responsible lending obligations: OnDeck’s processes are backed up by reliable and extensive credit data.

“Nor is it at the expense of customer contact,” he adds. “Our business is still very much about providing customer service – having a point of contact, picking up the phone and building broker relationships is at the core of our proposition.”