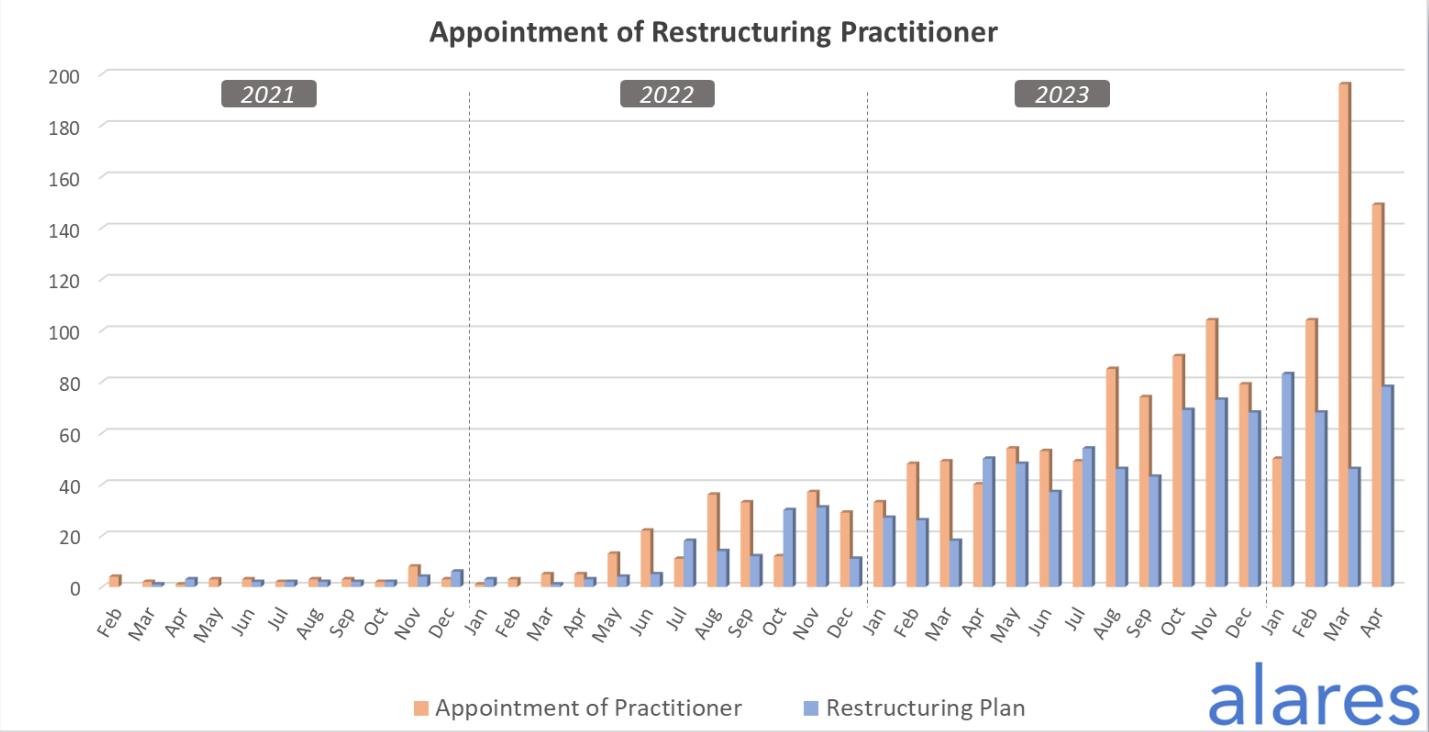

Programs like SBR and VA see surge in uptake since the beginning of the year

As Australian businesses grapple with increasing operational costs and tax debt, more are turning to business rescue programs to stay afloat, according to insolvency and business turnaround specialist Jirsch Sutherland.

Programs like Small Business Restructuring (SBR) and Voluntary Administration (VA) have seen a surge in uptake since the beginning of the year, especially as the Australian Taxation Office (ATO) intensifies its debt collection efforts.

“Tax debt is the primary reason, but higher operating costs are also pushing businesses to or over the edge,” said Andrew Spring (pictured), partner at Jirsch Sutherland.

“It’s obvious that out of necessity, an increasing number of businesses are discovering the benefits of Australia’s business rescue solutions. We have some of the most advantageous legislation in the world: it’s both quick and commercially focused, but it shouldn’t be a last-minute or enforced decision.”

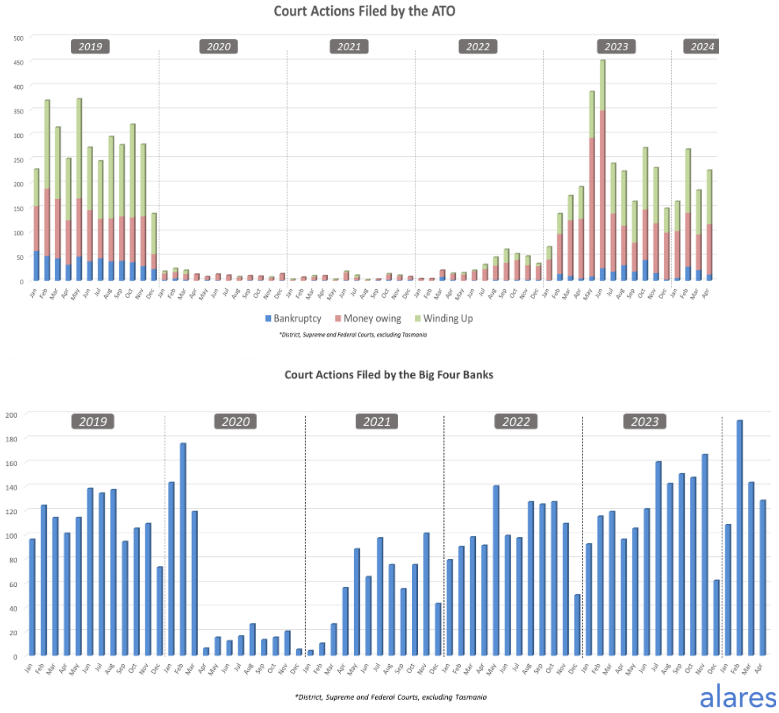

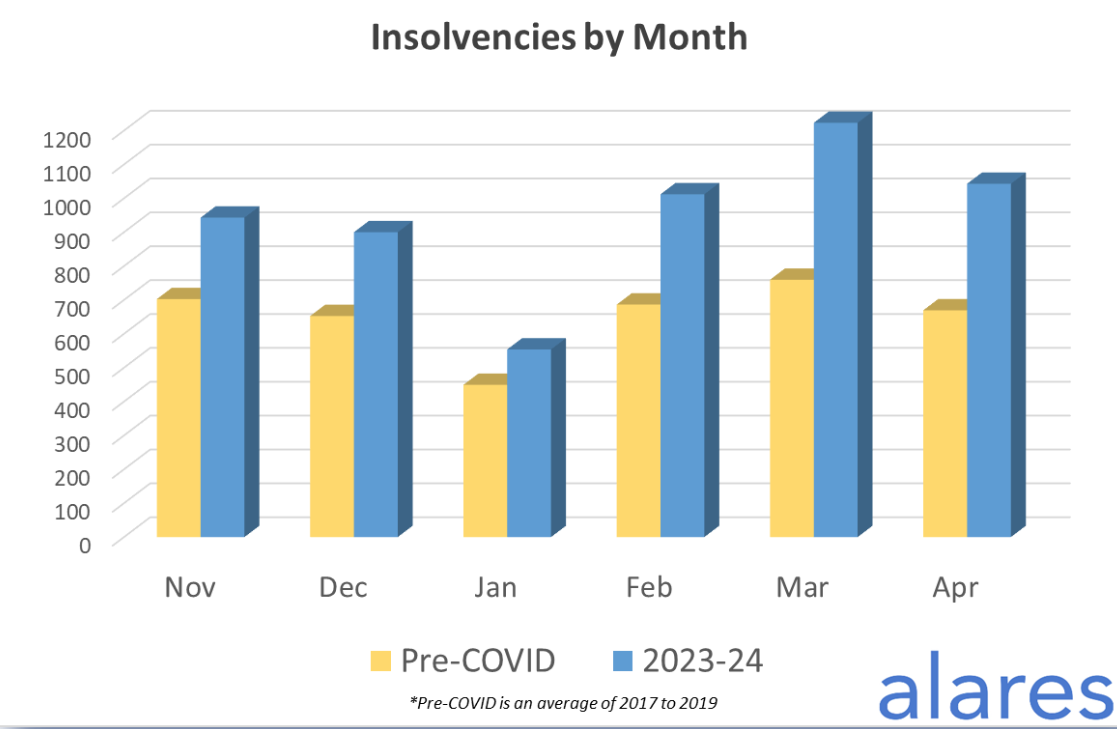

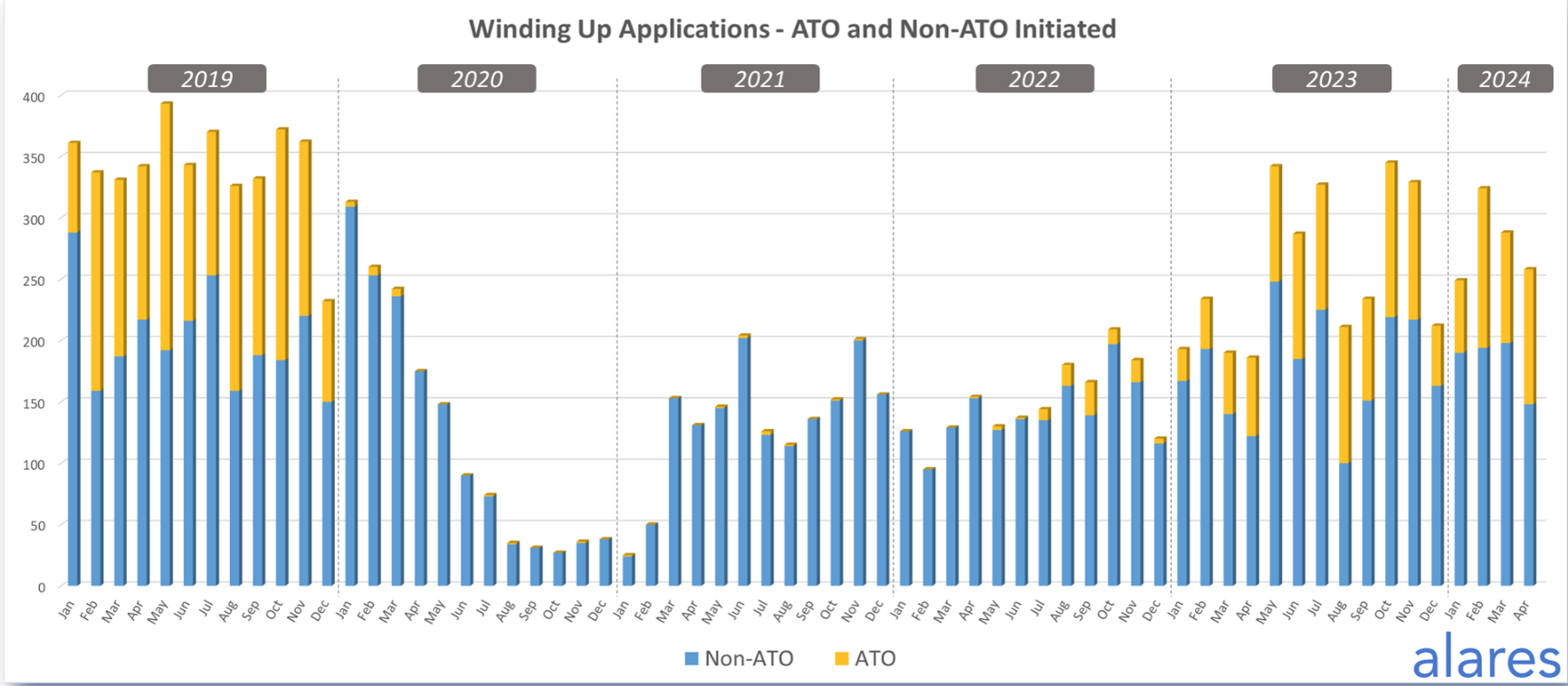

The urgency is underscored by data from the Alares Monthly Credit Risk Insights, which indicated that in April, SBRs made up over 14% of all insolvency appointments, with VAs close behind. Court liquidations accounted for more than 19%, driven by active recovery efforts by the ATO and vigilance from major banks.

“As the ATO continues to work through the record amount of outstanding tax debt, it’s increasingly driving small businesses into SBRs and larger businesses into Voluntary Administrations,” said Patrick Schweizer, author of Alares Monthly Credit Risk Insights. “Our April report shows that insolvencies remained 50% above pre-pandemic levels, reinforcing the long anticipated catch up in insolvencies from the pandemic lows.”

The report also showed that non-ATO initiated winding up applications decreased slightly from March, suggesting that the ATO is a primary force behind the rise in insolvencies.

“The creditor community is becoming less tolerant to operational behaviours that may have contributed to a business’s financial distress, and the ATO is again at the forefront of this changing creditor position,” Spring said. “It’s placing an even higher level of scrutiny on historical compliance when considering a proposal for restructuring. Anecdotally we’re hearing this is also the case with pre-insolvency discussions regarding ATO payment plans.

“As an involuntary creditor, the ATO doesn’t have the option to withdraw credit from a business – nor does it automatically know they’re even in a trading relationship until the liability is self-reported. As such, a high importance on reporting compliance is required to allow an effective and efficient tax system. During the last few ‘pandemic years’ the ATO appeared to move away from this position, and for those that have become delinquent with their lodgement activity, the hammer is about to drop. If a business has fallen behind with their statutory compliance, it’s crucial to act now.”

Spring reiterated that the strong business rescue framework in Australia, including the SBR and VA regimes, offers a lifeline to businesses facing extraordinary challenges, such as bad debts or the impact of adverse weather events and pandemics.

“A robust insolvency framework has many advantages, including recycling underperforming resources such as labour and equipment assets, into viable business ventures,” he said. “It also provides a balance between the debtor and creditor relationship, as well as giving confidence to markets that anti-competitive behaviours by unscrupulous players in the market will be investigated and held accountable.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.