Participation numbers return to pre-pandemic levels

MoneyMinded, ANZ’s flagship financial education program, helped nearly 84,000 people across Australia, New Zealand, Asia, and the Pacific enhance their financial capabilities in the year to October 1.

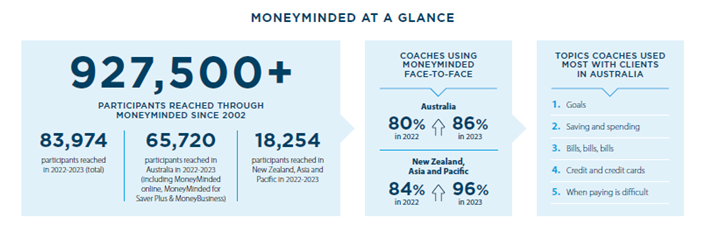

This was according to ANZ’s 2023 MoneyMinded Impact Report, which reported a 54% surge in participants over the past year and a total of 927,500 people benefiting from the program since 2002.

MoneyMinded is a flexible education program that builds management skills, knowledge, and confidence of adults, so they can make informed decisions and manage their money.

ANZ CEO Shayne Elliott (pictured above) said the 54% increase in the number of people signing up to the program is a return to pre-pandemic participation levels.

“Improving the financial wellbeing of people and communities is core to our strategy at ANZ, and it was great to see participants had a particular interest in developing good savings habits and setting financial goals,” Elliott said in a media release.

MoneyMinded is delivered in collaboration with community partners such as Berry Street, Brotherhood of St Laurence, and The Smith Family.

“Our community partners are key to the delivery of this program,” Elliott said. “We’re grateful to the thousands of MoneyMinded coaches across the region who are using MoneyMinded everyday to help improve the financial wellbeing of their clients.”

Key highlights from 2023 MoneyMinded report

Key findings from the 2023 MoneyMinded Impact Report include:

- In the past 12 months, 83,974 participated in the MoneyMinded program, 65,720 of which were from Australia and the Asia Pacific region, and 18,254 from New Zealand.

- Among MoneyMinded’s Australian participants, 74.8% were women, while in New Zealand, Asia, and the Pacific combined, just more than half (53.6%) were women.

- The demographic breakdown revealed that 32.3% of Australian participants were sole parents. In New Zealand, the majority consisted of young adults (88.5%), and in Asia and the Pacific, 42.8% were seasonal workers.

- The MoneyBusiness program, an adaptation of MoneyMinded that aims to enhance the money skills and confidence of Aboriginal and Torres Strait Islander communities, attracted more than 4,700 participants.

- Following the re-launch of the MoneyMinded for family violence program in 2022, victims and survivors of family violence constituted a significant proportion of participants (11.6%) in Australia.

Access the full copy of the MoneyMinded report to discover the enduring impact of the financial education program in communities across the Asia Pacific region.

For additional details about the program, visit ANZ's MoneyMinded webpage.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.