Industry experts call for greater construction to meet demand

More construction is needed to address Perth’s dire housing shortage, according to property and mortgage industry experts.

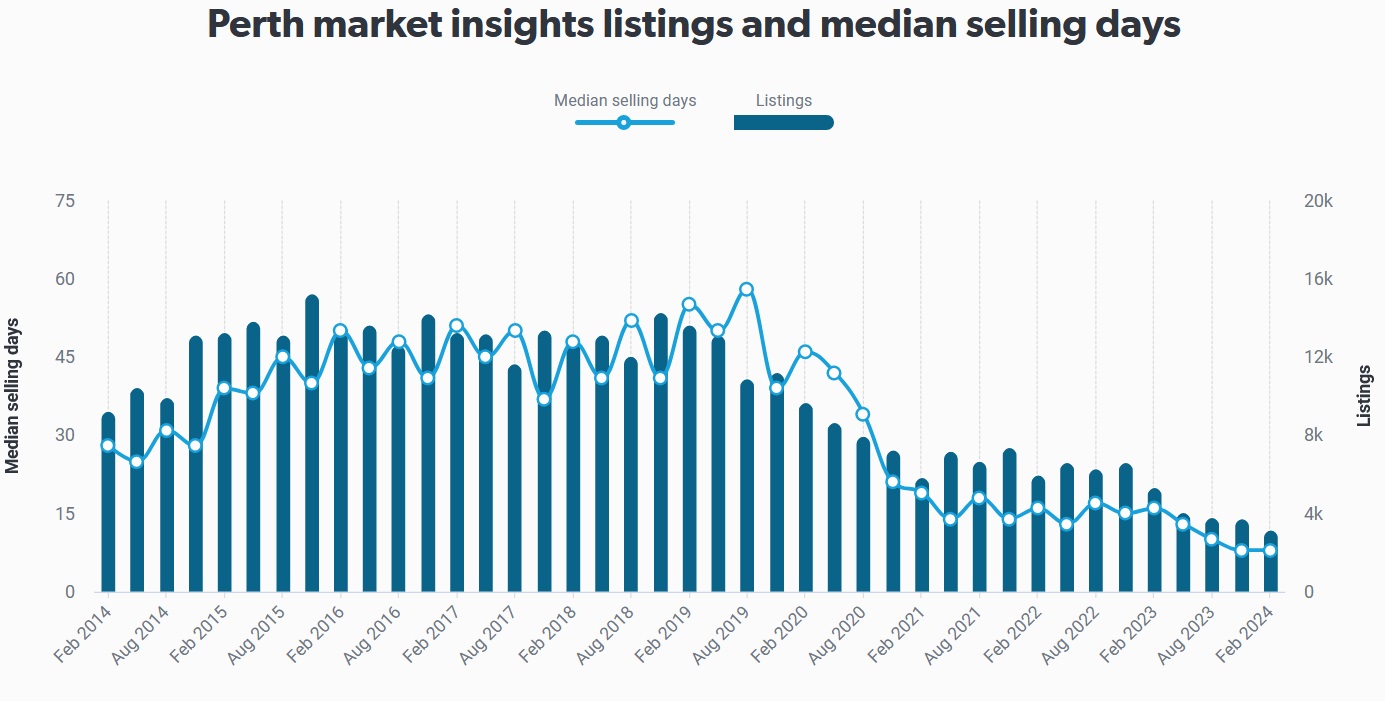

Real Estate Institute of Western Australia (REIWA) data showed the number of properties for sale across Perth plummeted to a record low of 3,648 at the end of December, marking a 23.4% drop from November and a 49% decline compared to December 2022.

More recent data from REIWA, covering the period up to February, shows this trend has continued and further deteriorated.

Peter Gavalas (pictured above left), a buyer’s agent from Perth’s Resolve Property Solutions said housing supply and demand disparities were at historic levels.

“Perth's property market is in dire straits,” Gavalas said. “The gap between the number of homes available and the number of people wanting them has never been wider, fuelling intense competition among buyers and driving up prices."

Gavalas welcomed as a positive step the Western Australia government’s initiatives, such as the Builders' Support Facility. This offers interest-free loans to builders so that they complete new homes that have been under construction for more than two years.

However, Gavalas said the scheme didn’t fully address the underlying issues affecting Perth's housing supply.

“As a result, Perth's property prices and rents are likely to continue rising, adding yet more pressure on potential homebuyers and tenants,” he said.

“Meanwhile, homes are flying off the market, with houses selling in just 10 days on average in December – nine days faster than the previous year.”

Gavalas said one factor fuelling the crisis was WA’s rapid population growth, with the Australian Bureau of Statistics reporting a 3.1% population increase in the year leading up to June 2023, the highest growth rate nationwide.

“This has far outstripped housing supply, which has been plagued with low completions and dwindling approval,” he said.

Gavalas said the Builders' Support Facility should give the construction industry a much-needed shot in the arm, “so it's definitely something that should be applauded.”

“But while it should help wrap up stalled projects, it doesn't do anything to kick-start fresh developments – so it’s like putting a band-aid on a deep wound.”

To bridge the ever-widening gap between supply and demand, Perth desperately needed new construction to keep pace with its burgeoning population, Gavalas said.

“And to be fair, the government does recognise this,” he said. “They're working on streamlining planning processes and reducing unnecessary red tape – for instance, recently allowing homeowners to build granny flats in their backyards without lengthy council approvals.

“But these reforms will take time to significantly impact housing supply. In the meantime, Perth's property prices and rents are likely to continue rising, adding pressure to potential homebuyers and tenants.”

Perth broker’s view on housing market

Perth mortgage broker Leanne Ferguson (pictured above centre), director of Empress Financial Services, described the WA capital’s property market as “mad”.

Ferguson said it was tough for buyers in Perth, with prices being driven up and houses being advertised for around $850,000 and selling “well into the high nines”.

“It's just mad – you can’t even look at a home and budget for the price that’s on it,” said Ferguson. “There's limited stock. I don't know what the government can do to fix the situation. It's gotten horrendous. I recently bought a home and there were 15 offers on the property.”

Ferguson said interstate buyers were affecting the Perth market. “Properties are advertised and are gone within days, so locals maybe are missing out because of property buyers, buyer’s agents getting in first.”

Ferguson said construction delays were also an issue, with build rising from six months to 18 months or more. “People are turned off from building because they can't afford to pay the rent and construct the home at the same time.”

Solutions to Perth housing crisis

Terry Ryder (pictured above right), director of residential real estate property data firm Hotspotting, said Perth was the hottest market in the country, in terms of how fast properties were selling.

“It's become a bit of a concern because I think some buyers and some buyer's agents are behaving recklessly,” Ryder said.

“Because it's so competitive and there's a shortage of stock for sale and so many people wanting to buy, people are acting in haste. You always want to buy carefully, do your due diligence, check things out, make sure you're buying the right property, in the right location at the right price.”

Ryder said in some cases that wasn’t happening in the Perth market.

The solutions to the housing supply crisis in Perth and other parts of the country were in the hands of politicians at state and federal government levels, with many policy solutions suggested over the years.

“They’ve created this problem over a number of years … we need to be building more new dwellings,” said Ryder. “They can help that by freeing up the planning processes, less red tape.”

Ryder said planning processes in capital cities needed to be relaxed to create more housing density.

“In terms of rental properties, it really comes down to encouraging investors. Western Australia is one area where they're actually proactively introducing policies to encourage investors, whereas in many parts of Australia the opposite is happening – we're actually punishing and discouraging investors.”

Investors supplied over 90% of the homes that people rent in Australia, said Ryder. A shortage of rental properties was due to “the deterrents and discouragements” investors had faced in the last five years causing more to drop out.

Ryder praised the WA government for allowing property owners to build granny flats without the usual restrictions, and for encouraging investors with cash incentives to convert from Airbnb short-term letting to long-term letting.