Supply and demand still unbalanced

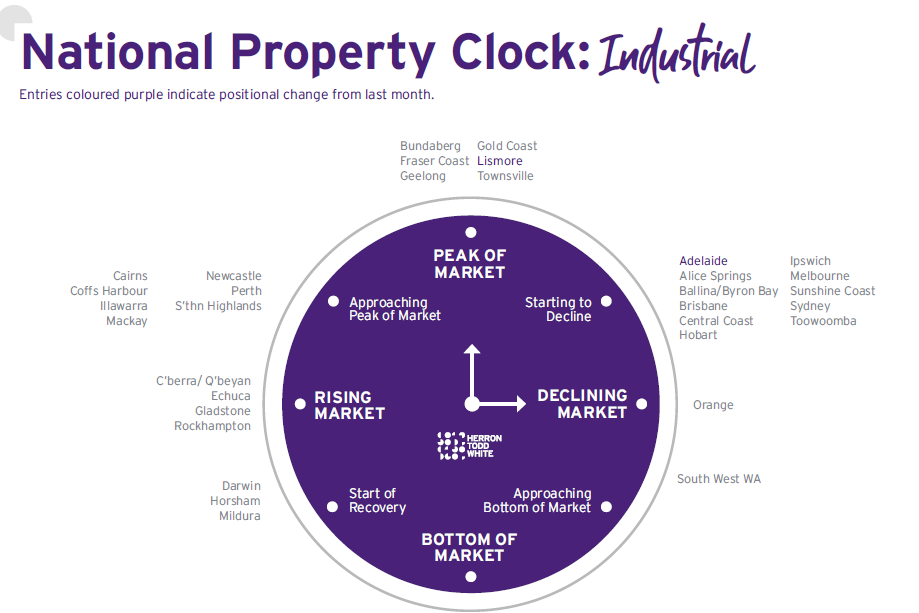

Australia’s industrial real estate market remained strong this year, though not as robust as in 2021 and 2022, due to the Reserve Bank’s aggressive interest rate hikes, which led to disruptions in the financial landscape, especially in debt costs and commercial yields, according to Herrod Todd White.

In Herrod Todd White’s Month in Review for November, David Walsh (pictured above), industrial director, said that limited industrial property supply, driven by high absorption rates over the past three years, has created a demand for more stock.

Rental surge in industrial properties

The scarcity in industrial property supply has led to strong rental growth, while the investment market, especially for higher-grade assets, has shown signs of softening with minimal activity.

“The standout feature of the 2023 industrial market has been the remarkable rental growth achieved in both prime and secondary locations across all major cities and regional precincts,” Walsh said. “Not so good for tenants but well received by landlords.

“After over a decade of stagnant rental growth, factors such as increasing land values and construction costs forced developers to raise rental rates to make their projects viable. Combined with supply limitations, this resulted in rental increases of some 30% to 50% since 2021.”

Brisbane’s industrial sales market resilient

The Brisbane industrial sales market performed well, despite significantly lower overall sales volumes than in previous years.

“Institutional players remained cautious due to various challenges and uncertainties about future cash rate movements,” Walsh said. “In contrast, owner-occupiers in the sub-$10 million price range have been very active, benefiting from strong balance sheets and lower interest rate exposure compared to leveraged investors looking for return on investment.”

The surge in rental rates made buying premises more financially advantageous for those with capital, contributing to increased demand for strata-titled projects.

In Brisbane, the Woolloongabba area saw a lot of interest and demand in 2023, due to its proximity to one of the main Olympic locations.

Regional variances

Adelaide faced a scarcity of new industrial properties, leading to persistent rental growth.

“Supply chain uncertainties, rising interest rates, and capital acquisition difficulties discouraged speculative construction, with high-density industrial parks not expected to complete until early 2024,” Walsh said.

“A shift from interstate investors to owner-occupiers has been observed, creating unique competitive conditions in inner industrial and showroom/warehouse properties.”

Perth’s industrial sector emerged as the top-performing asset class, experiencing substantial growth in land values, especially on the city’s fringes.

“Eastern states investors have been noticeably active in the sub-$5 million market segment and local agents have prioritised buyers’ agents with east coast clients, anticipating higher sale prices,” Walsh said. “Prime, modern industrial rents have nudged approximately $150 per square metre per annum, while existing industrial properties achieved rents above $100 per square metre per annum net. Supply constraints have also been evident due to construction costs and labour availability.”

Sydney and Melbourne continued to see rental growth but faced challenges in construction costs and limited available stock, prompting a trend of repurposing older buildings. The land market remained strong, showing no signs of decreasing prices; in certain instances, values have even increased. Inner city sites that offer both immediate income and future development potential are in high demand.

In Mackay, Queensland, the market for tenanted investment properties was thinly traded due to a lack of listings. As a result, there are not enough transactions to offer clear insights into yield trends, but the overall perspective is that yields remain relatively stable compared to 2022 levels. Similar to other regions, industrial vacancies decreased, and rental rates steadily rose throughout the year.

“All in all, 2023 has been another strong year for the industrial market as a whole and while the supply and demand equation remains unbalanced, we might be in for a similar year in 2024,” Walsh said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.