How non-banks help brokers service wider range of customers

Rising interest rates, high inflation, supply chain issues and labour shortages mean sole traders and small business owners are doing it tough.

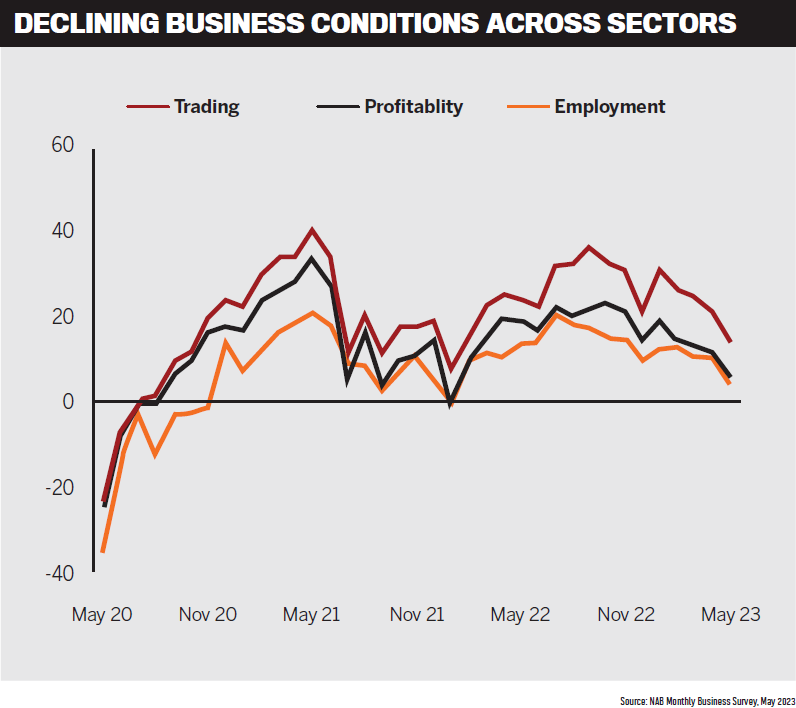

NAB’s Monthly Business Survey shows that business conditions continued to ease in May, with notable declines across trading, profitability and employment.

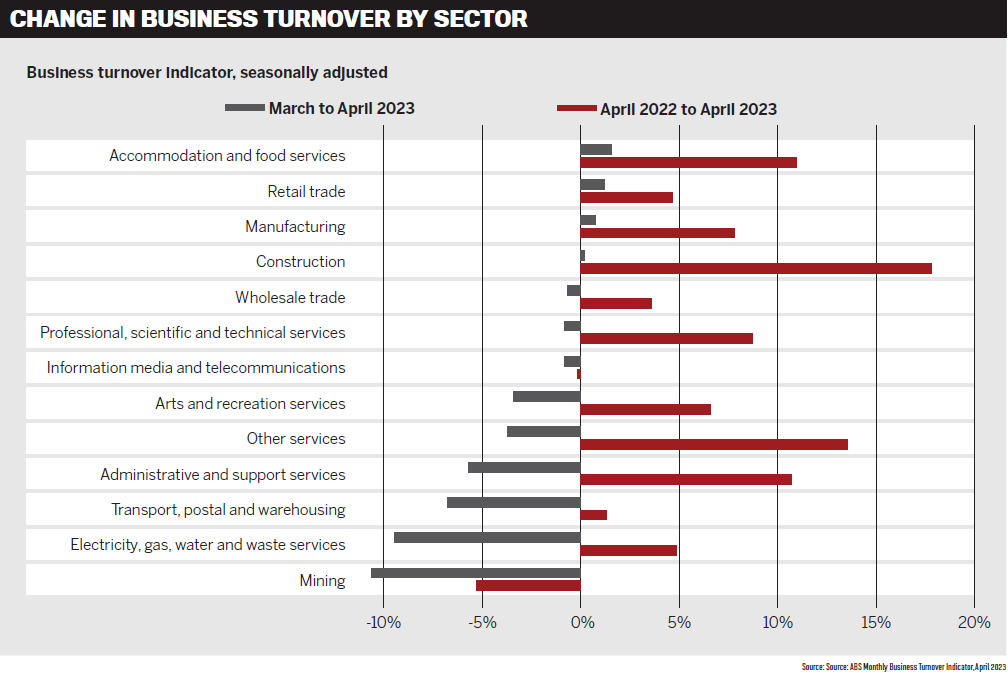

ABS data on April business turnover paints a similar picture – turnover fell in nine of 12 industries. Higher interest rates and inflation are also affecting lending. ABS lending indicators for April show the value of new loan commitments for housing fell 2.9%. On top of these challenges, SME owners and the self-employed often face obstacles from banks when it comes to obtaining finance to buy property or grow their businesses.

Unlike PAYG ‘vanilla’ applicants, customers in this sector don’t tick neat boxes when it comes to steady income from fortnightly or monthly pay cheques. This is where alt-doc loans offered by non-bank lenders can provide a fast, efficient solution that considers each borrower’s unique circumstances.

Alt-doc lending defined

Vala says an alt-doc loan, also known at Thinktank as a mid-doc or quick-doc loan, provides a pathway for self-employed and SME customers who may not be able to or simply prefer not to have to satisfy typical loan application requirements.

“While full-doc loans often require the most recent Notice of Assessment along with detailed salary, bonus and overtime evidence, this type of information may not be readily available for self-employed individuals, or takes valuable time to get together,” Vala says. “Providing complete financial details may also be challenging for several reasons, such as experiencing a material change in trading income, or a delay in completing tax returns.”

La Trobe Financial’s Bannister says, “Simply put, it’s using alternative methods to verify income that are outside of the traditional tax returns, Notices of Assessment and company financials. All other aspects of the assessment process are the same.”

He says there are often two main drivers for borrowers seeking alt-doc solutions.

Firstly, financial statements do not always reflect the full extent of a borrower’s “capacity to repay”. Under the tax system, self-employed workers are incentivised to mini-mise reportable earnings and maximise reportable expenses, in turn reducing their “taxable income” and therefore their borrowing capacity, Bannister says.

Bannister says that when a borrower uses alternative documentation, namely an accountant’s written certification, the analysis of income has already been completed by someone who knows their financial position better than anyone – their accountant – which saves time for both the broker and borrower.

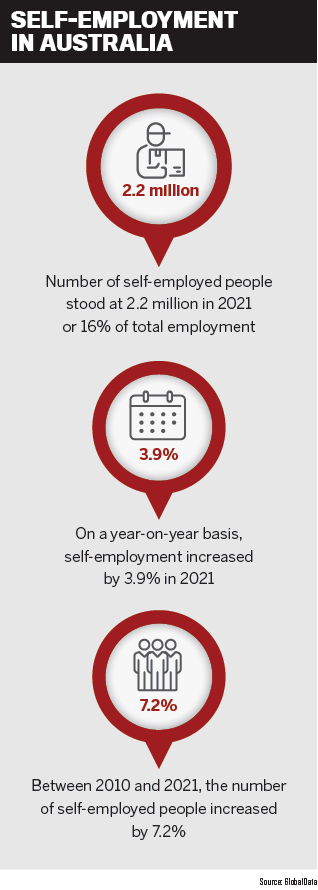

Saoud (pictured above), from Pepper Money, says Australia is often seen as the land of a “fair go”, with millions of self-employed people working on their own passion projects and businesses. “But when it comes to getting a mortgage, these borrowers may not have the usual PAYG or income documentation to prove their income,” he says.

It’s not just the self-employed; it also affects someone who earns income differently, Saoud says. “For example, a contractor or seasonal worker, or a property investor earning rental income from their portfolio. Or it could be business owners looking to consolidate business debt, pay outstanding tax debts or [get] help with cash flow.”

“At RedZed, we maintain a holistic view of business and income, and understand that the self-employed borrower is the one creating the value and employing the PAYG earner,” Dwyer says.

Cottam, from Resimac, says the good news for brokers is that self-employed borrower income can be verified using one of several means – an accountant’s verification, six months of business activity statements, or three months of business bank statements.

“Prime alt-doc lending can serve borrowers who have had ABNs for as little as two years, while specialist alt-doc lending offers even greater flexibility – appealing to borrowers who have had ABNs for as little as six months,” Cottam says. “Specialist alt-doc products may also suit the credit-impaired.”

He says there is plenty of help available for brokers new to alt-doc lending. “Our BDMs are highly experienced and offer training to equip you with these skills. Our team also welcome your call to talk through all scenarios.”

At Prospa, Bertoli (pictured above) says that without traditional income verification methods, small business owners and self-employed borrowers can provide alternative forms of documentation to prove their creditworthiness and ability to repay the loan.

“As Australia’s leading online lender to small business, Prospa knows what works for one business won’t always work for another,” Bertoli says. “For example, while a business that’s experienced a recent surge in income or doesn’t have two years’ worth of tax statements on file could be in a solid financial position to repay their loan, full-doc assessments don’t give them the opportunity.”

Product offerings and advantages

RedZed offers alt-doc and full-doc options for residential and commercial products, says Dwyer. “Our applications are assessed by real people, with no credit scoring.”

The non-bank lender does not restrict the type or number of debts that can be consolidated, and ATO debt funding is available across its entire range of products, including prime.

Saoud says that while Pepper Money accepts several forms of alt docs, its cornerstone is the Pepper Accountant’s Letter, which acts as a “firm and stringent guide for accountants to help customers verify what they earn as an alternative method to the traditional”.

“Some accountants’ letters are standard, but ours is a formalised letter that we put in place to manage alt-doc lending, and it has proven to be something that has stood us in good stead.”

“We also offer fixed rates and no break cost across the entire product suite, including alt-doc and non-conforming,” Saoud says.

Regardless of the loan option, he says customers also choose Pepper Money because it accepts a range of income types, considers non-genuine savings, has no DTI restrictions, and each application is assessed on its own merits, “looking beyond the credit score”.

Prospa’s application process, including to determine whether an applicant qualifies for a business loan or for a business line of credit, is quick and easy, Bertoli says.

For loans of up to $150,000, the applicant must be an Australian business with a monthly turnover of at least $6,000 per month and meet Prospa’s minimum trading history requirements for their industry.

“The traditional two years of financial reporting expected by traditional lenders are not required,” Bertoli says. “When we designed our award-winning Prospa Small Business Loan, we listened and considered the needs of our customers instead of trying to create a one-size-fits-all company lending solution.”

Bertoli says the quick application process is perfect for businesses short on time and in need of cash flow fast. Businesses can apply online in under 10 minutes and link their business bank accounts via Prospa’s secure portal. He says the non-bank strives to give businesses a quick decision. “We do everything we can to make funding available within hours.”

Prospa offers small business loans of from $5,000 to $150,000, with no asset security required up front to access up to $150,000; as well as loan terms of between three and 36 months; flexible payment conditions and early payout options; fixed interest rates; 24/7 account access; and support from business lending specialists.

Bannister (pictured above) says La Trobe Financial’s flagship Residential Lite Doc® loan is likely to be a staple product in the toolbelt of most mortgage brokers. “It caters for a wide range of self-employed individuals, from sole traders through to individuals overseeing complex companies and trusts.”

“Under our lease-doc parameters, if the rent generated from the commercial security property is equal to or greater than 1.2 times the monthly repayment amount – the required interest cover ratio – serviceability can be achieved on a standalone basis,” Bannister says.

Resimac has a prime alt-doc product for self-employed borrowers that is among the most competitive in the market, Cottam says. “One benefit of this product is if a self-employed borrower has a business loan, we can refinance that business loan as part of a residential transaction so they can take advantage of the lower interest rate,” he says.

“Some lenders don’t provide this.”

Resimac also offers specialist alt-doc products, which provide greater flexibility, cover most security locations, help borrowers clear ATO debts, and “may be suitable for customers who fall outside traditional lending guidelines”.

Resimac Asset Finance offers a range of commercial finance options for asset finance brokers, mainly for vehicles and equipment, and feature competitive rates and flexible products, Cottam says. “These include low-doc and lite-doc assessed loans up to $250,000 based on the client’s profile.”

Thinktank specialises in providing a wide range of flexible alt-doc options for self-employed and SME customers, Vala says.

“Our mid-doc loans offer 30-year loan terms for both commercial and residential, with LVRs up to 80%, secured by either residential or commercial property,” he adds.

For mid-doc commercial loans, sizes can range up to $4m, and to “evidence serviceability we require just one supporting document in addition to self-certification of income”. This can be an accountant’s letter, the last two BAS statements, or the last six months’ bank statements.

Vala says Thinktank also offers quick-doc loans for commercial property, which only require an income declaration on the Thinktank Self Certification Form.

“Another benefit that sets Thinktank apart is pricing based on the type of property offered as security,” he says. “For example, a commercial loan that has a residential property as security will attract sharper resi- dential pricing.”

Rising interest rates, inflation

So, how are higher interest rates, rising inflation, labour shortages and supply chain problems affecting alt-doc lending demand?

Bertoli says it’s no surprise that brokers and small business owners are battling with a tough economic climate. Prospa-commis- sioned research by YouGov in May revealed that 88% of small business owners anticipate challenges over the next year with a decline in customer spending, higher inflation, and increased operating costs.

However, Bertoli says the past three years have shown that business owners are resilient; they can navigate difficult environments and pivot to capitalise on opportunities.

Saoud says a third of Pepper Money customers have used an alt-doc solution. “We see a massive opportunity to help mainly self-employed customers and their families get

into homes and have better deals by allowing alternative documentation.”

customer needing to provide two years of tax returns – full doc – and who is a business owner that had been negatively impacted by COVID, with reduced turnover, lower profit and so on, an alt-doc solution is a way for that customer to more accurately state their income for serviceability purposes.”

“Demand for our Lite Doc® loans has certainly increased over recent years as a rising number of self-employed Australians turn to lenders like La Trobe Financial to assist them in navigating a path towards financial outcomes that improve their positions during a challenging period,” he says.

La Trobe Financial prides itself on its ability to work with brokers and borrowers to achieve the desired result. “We have a saying that ‘we run, not walk, at the opportunity to help”, Bannister says, “and this is reflected in our assessment of self-employed individuals that may have found difficulty in obtaining property finance from more traditional means.”

Cottam says consumers have tightened their belts and aren’t spending quite as much. “However, business confidence is strong. Business owners continue to try to capitalise on opportunities, and investors are looking to expand their investment portfolios.”

Vala says Thinktank has observed that businesses’ past financials may reflect a period of reduced trading due to COVID-19 challenges. “However, a high proportion of these businesses have since recovered to pre-pandemic levels or have effectively restructured their operations to adapt, but their historical financial statements do not reflect current trading income.”

Improved trading figures present an opportunity to refinance existing facilities over longer loan terms to improve monthly cash flow and provide relief from the cycle of rising rates, Vala says.

Dwyer (pictured above) says the self-employed sector has faced many challenges over the past two years, but sole traders and SME clients continue to show resilience. In RedZed’s Self-Employed Business Index 2022 Report, 71% of respondents expressed confidence about their business prospects for the next 12 months.

“This provides us with assurance that self-employed individuals will continue to invest in the growth of their businesses in the immediate future,” Dwyer says. “When markets get tough, employees may get made redundant. Many of these people then turn to self-employment and realise how great it is, creating more opportunities for brokers and alt-doc lenders.”

How can brokers embrace alt-doc?

The best way for brokers to embrace alt-doc lending is by learning, Cottam says. He encourages brokers to contact their BDMs or relationship managers.

“Brokers can view our BrokerZone website [broker.resimac.com.au], which has plenty of resources for alt-doc lending. Accredited brokers receive our regular broker updates that keep them informed of the latest news.”

Resimac’s recently increased commissions for alt-doc lending also benefit brokerages, Cottam says. In April, upfront and trail commission was increased on prime alt-doc, specialist full-doc and specialist alt-doc products to better recognise the effort of brokers in this sector.

Cottam says alt-doc loans allow brokers to “say yes” to more customers and maximise opportunities, increasing their chances of more referrals.

Resimac’s strong BDM team offer training for broker newcomers, are highly experienced, and specialise in alt-doc products and finding solutions. “They’re happy to field questions from brokers and workshop applications,” Cottam says.

Bannister says the easiest way for brokers to fine-tune their knowledge of any product or set of lending policies at La Trobe Financial is to “meet with a BDM or contact our credit team direct, both of which are experienced, willing and able to assist”.

He says face-to-face education from BDMs has proven that quality and quantity of submissions and clearer pathways to settlement are directly linked to the regularity of contact between BDMs and brokers.

“We are determined to help each and every broker we meet with achieve their business goals, so if your goal is to write more alt-doc loans this coming financial year, let our Lite Doc® product suite help you get there,” says Bannister.

Vala (pictured above) says brokers who offer a range of solutions to their clients will find they cultivate stronger relationships, create new advocates and unlock potential new revenue streams. “Ensuring clients can maximise their borrowing power in these challenging times is a great basis for conducting a fresh financial health check.”

Brokers should focus not only on the interest rate but also the surplus cash flow the client has available each month, Vala says. Through refinance or consolidation strategies, they can help improve the customer’s standard of living or aid wealth creation by increasing their surplus cash flow.

Thinktank also encourages brokers to reach out to their relationship manager, who can walk them through the entire process, from workshopping a scenario to settlement. Dwyer has a straightforward answer to how brokers can embrace alt-doc: “Get accredited

Saoud says Pepper Money, as the pioneer of alt-doc loans in the Australian market, leads the way on broker education and making things easier. He says alt-doc is no different to recommending a traditional loan “the basic requirements and lodgement process for brokers is virtually the same” – but Pepper Money just asks for a different type of supporting documentation to verify the customer’s income.

“The self-employed are also a good client type for cross-selling opportunities, particularly for leasing, insurance and equipment finance products, and often they are much ‘stickier’ clients with more regular finance needs as their business needs regularly change,” Saoud says.

Bertoli says Prospa’s mission is to help small businesses manage their everyday expenses and take advantage of growth opportunities by providing them with simple, seamless and stress-free lending solutions.

The non-bank works closely with its partners to create awareness of new funding options that enable small businesses to grow, scale and succeed.

Prospa helps brokers to diversify their revenue streams and get involved in business lending, empowering them to engage with their clients about cash flow issues and growth opportunities. The non-bank also provides the tools and training for brokers.

Looking ahead

In the early 1990s, La Trobe Financial recognised the importance of loans that catered for borrowers who were outside the “straight and narrow” – borrowers who were no less credit-worthy, Bannister says. “This led to the development of Australia’s first alt-doc loan, which we continue to call our Lite Doc® loan to this day.”

He says taking into account the challenges of the past few years, lenders that “can see the forest for the trees” and assess borrowers on their individual merits, maintained their product offerings.

“We don’t see this changing in the foresee- able future, and our Lite Doc® product will allow us to do just that.”

“We don’t see this changing in the foresee- able future, and our Lite Doc® product will allow us to do just that.”

Vala says non-bank lenders tend to focus on borrowers and market segments that require alternative lending solutions and unique product offerings, and “more Australians fit this customer profile than many people might think”.

As economic conditions continue to tighten, Vala says Thinktank expects to see more self-employed and SME borrowers looking to purchase, refinance, consolidate debt and release equity – “all of which Thinktank delivers with a high level of expertise, service, and a personalised solutions approach for both brokers and their clients”.

Saoud says that just because customers don’t have standard income documentation “shouldn’t mean they are any less worthy of a loan than someone that does”.

Saoud says this type of documentation is more reflective of the current state of a business and has proven to be more accurate than 18-month-old tax returns. “It doesn’t mean inferior, it doesn’t mean less than, it doesn’t mean you are hiding something. It just means you have an alternative set of documents to what the traditional major banks use.”

Brokers have an opportunity to reassure these self-employed homebuyers that there are still options for them, Saoud says.

Dwyer says non-bank lenders exist because they serve markets that banks have historically failed to serve. “Alt-doc loans are a non-bank innovation designed to give self-employed borrowers what they need – an easier way to prove their income. It has allowed an important part of the Australian economy to finance their growth and employ others.”

The market is heading for some challenges, Dwyer says, with borrowers feeling the impact of rising interest rates and additional taxes. “The long-term outlook is positive, but as arrears tick up, I expect banks will cease trying to dabble in markets that they don’t have the underwriting nuance or processes to serve.”

Prospa research shows that the market outlook is positive, Bertoli says. “Small business owners are confident about the health of their businesses, and we’re excited to be working alongside them as they continue to grow and prosper.”

For Resimac, Cottam (pictured above) says alt-doc loans are important because they demonstrate “why we are different to major lenders”.

Cottam says the next 12 months will be interesting, and he predicts the market will stabilise, with more certainty for borrowers. However, self-employed borrowers will keep looking for relief from high interest rates, and Resimac alt-doc products offer attractive refinancing and debt consolidation to reduce their overall repayments.