Brokers’ responses to this year’s survey on non-banks say it all: the non-banks have stepped in where the banks have let brokers and borrowers down. The banks’ long turnaround times and narrow lending appetites have frustrated brokers for much of the last 18 months.

While non-banks have also been affected by the pressure on turnaround times, the majority of broker feedback indicates that their SLAs and procedures have improved.

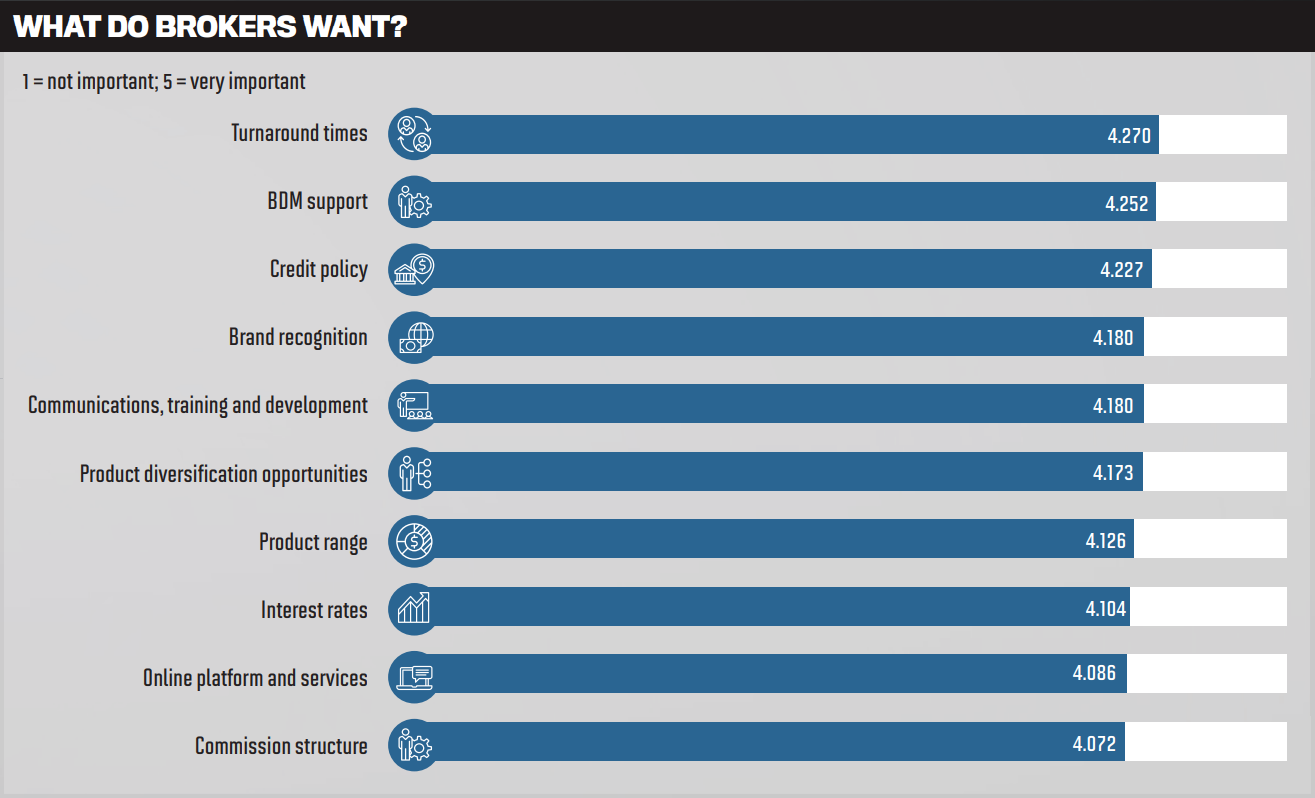

As borrower circumstances have changed, so have broker priorities. While credit policy scored the lowest last year in terms of how important it was to brokers, this year it has risen to be the third most important area.

Brokers praised the non-banks for not having a ‘tick a box’ approach, and for being flexible with their credit policies to accommodate all types of borrowers.

While it is generally accepted that non-banks have higher interest rates – and this was one factor some brokers said was a barrier to using non-banks – the importance of rates fell this year. Interest rates were top of the list last year, but in 2021 they dropped to eighth place, suggesting that brokers and borrowers are willing to accept the higher interest rates if it means they can get a loan.

Some areas remained high on the list of priorities, like turnaround times and BDM support, but interestingly, commission structure fell to the bottom of the pile, despite usually ranking much higher in all surveys.

The brokers who took part in this year’s survey were more likely to have been in the industry for a long time: more than 50% had been in broking for more than 15 years. Only 10% of respondents were aged below 35, with 37% over 55.

Thank you to everyone who responded to the survey during such an incredibly busy time. Thanks also to the top non-banks that took the time to answer questions about their service to brokers.

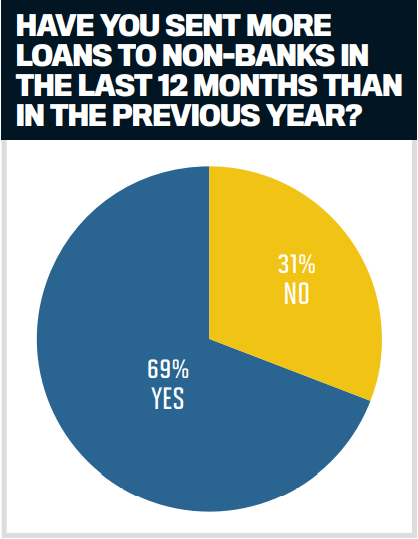

The reasons for using a non-bank have changed over the last 12 months, with more brokers turning to these lenders for their faster turnaround times. However, the proportion of brokers’ loans put through non-banks is dropping

Although more brokers said they had put more loans through non-banks than they did last year, the loans are making up a smaller proportion of their overall business.

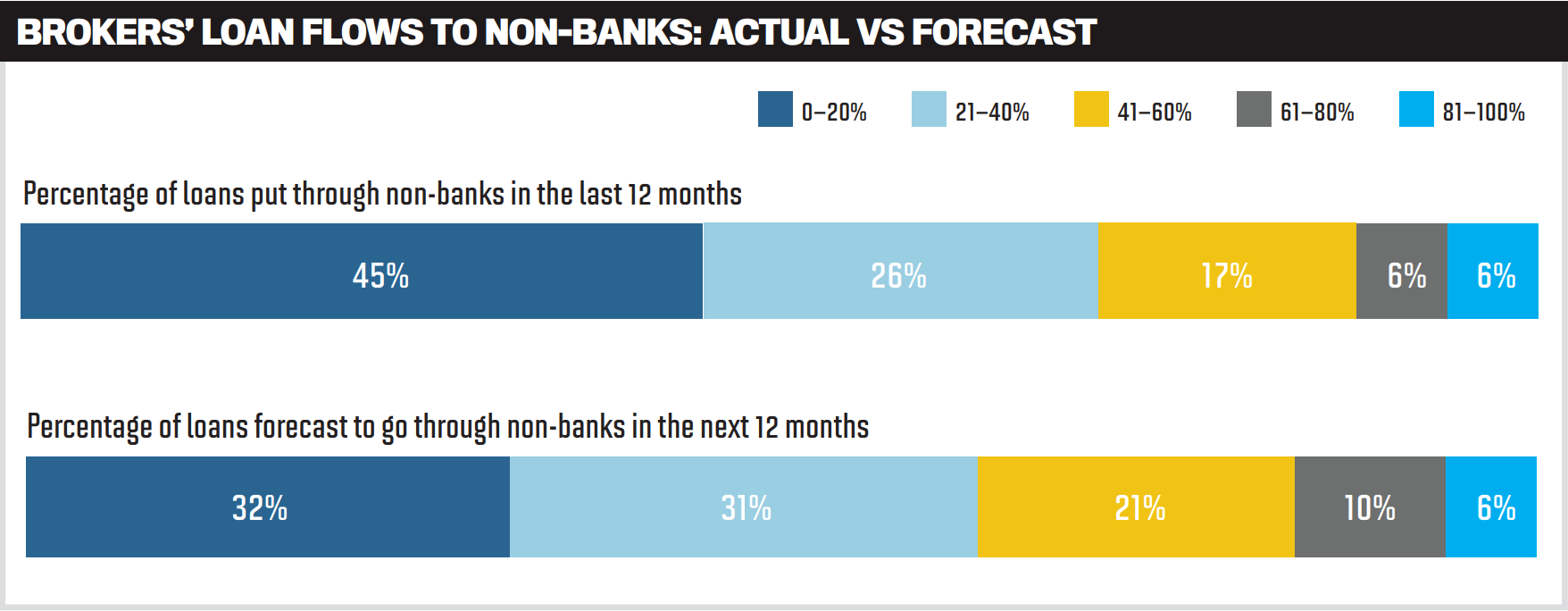

Forty-five per cent of brokers put less than 20% of their loans through a non-bank, up from 38% last year. Just 12% said they put more than 60% of their loans through non-banks, compared with 19% last year and 20% in 2019.

The expected proportion of loans forecast to go through non-banks is also poorer this year than in 2020. Sixteen per cent of brokers said they expected to put more than 60% of their loans through non-banks, down from 22% in 2020 and 27% in 2019.

BDM support

Pepper Money

La Trobe Financial

Liberty

Commission structure

Pepper Money

Liberty

La Trobe Financial

Credit policy

Mortgage Ezy

Pepper Money

Liberty

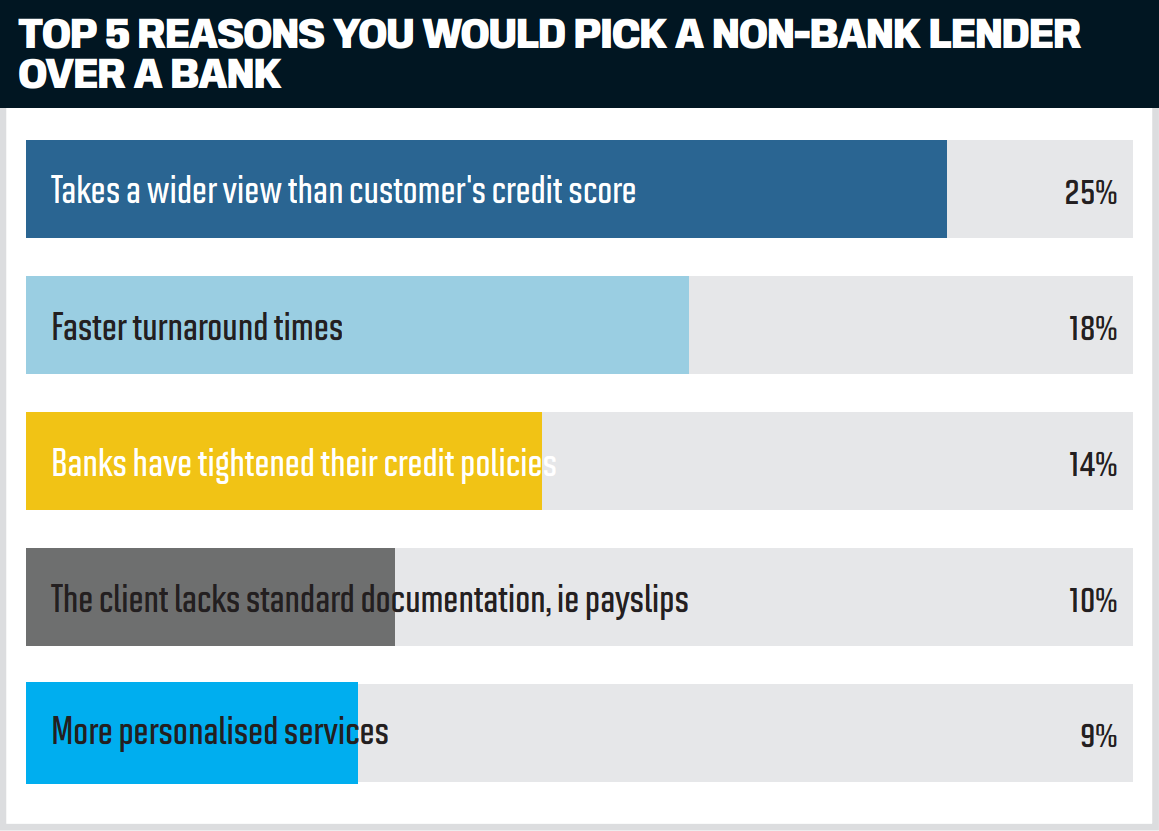

There have been some positive changes, however. Brokers are still turning to non-banks because they take a wider view of their customers than just looking at their credit scores, with around 25% of brokers saying that was the main reason they use them.

In a shift from last year, 18% of brokers said faster turnaround times was their main reason for using a non-bank. Last year, this was at the bottom of the five main reasons brokers would use a non-bank, accounting for just 7% of responses.

In 2019, turnaround times did not feature at all in the top five reasons, and the biggest reason for brokers choosing non-banks was put down to the banks tightening their credit policies (26%).

This year, only 14% of brokers said banks tightening their credit policies was the main reason they turned to non-banks.

Re-entering in last place after dropping off the list in 2020, clients lacking standard documentation was the reason 10% of brokers said they used non-banks. This is hardly surprising given that the COVID-19 pandemic has had an impact on people’s employment and income. Not much has changed in terms of the non-banks that were rated best in terms of the benefits of using a non-bank. Pepper Money won gold for the fourth year in a row for its BDM support, a category that has continued to climb up the ranks when it comes to importance to brokers.

Mortgage Ezy made an impressive leap into first place for its credit policy, despite being ranked seventh in this area last year. The mortgage manager came out on top when brokers were asked which non-banks they would like added to their aggregator’s panel.

Borrowers are increasingly likely to consider non-bank products, despite brokers finding the lack of brand awareness to be an ongoing barrier

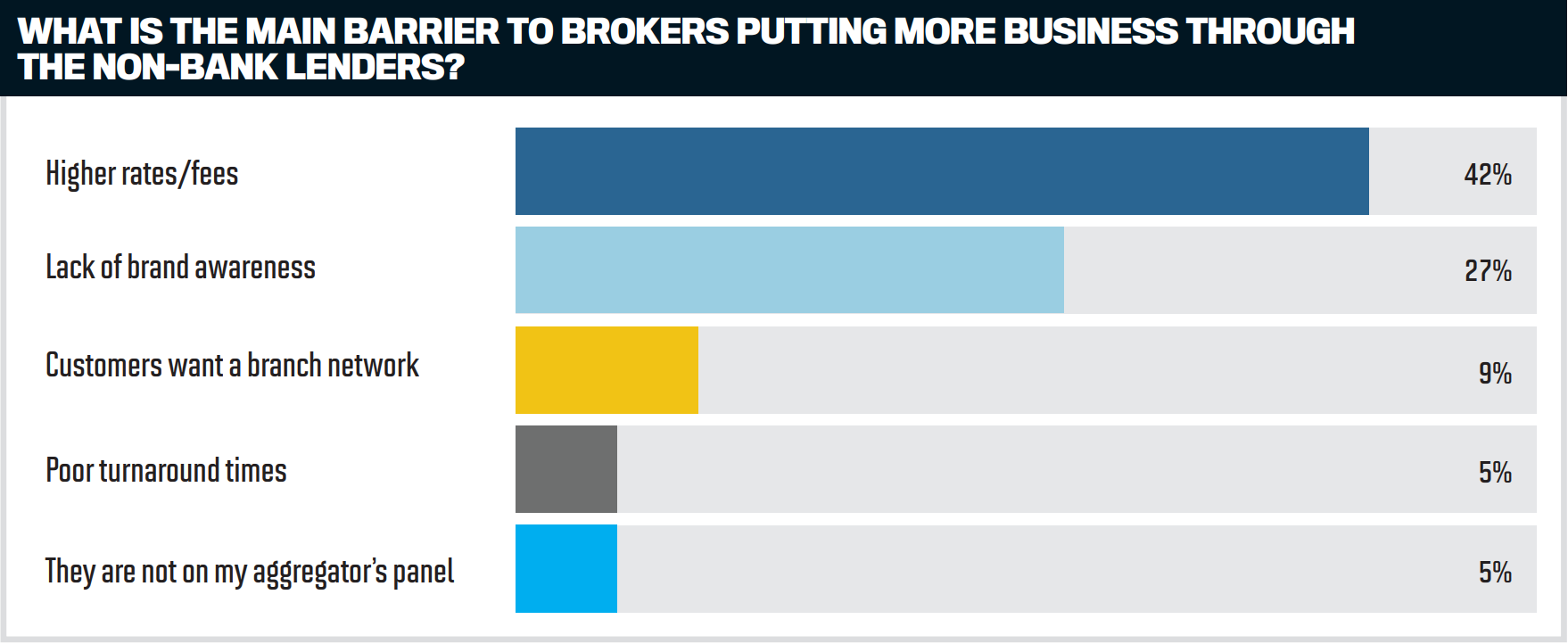

Although turnaround times were highlighted as a reason that brokers were putting home loans through non-banks, they were also considered a barrier to doing so by 5% of respondents. The biggest barrier to using non-banks, however, according to more than four in 10 respondents, was their higher rates and fees.

One respondent said that when they were looking for the right solution for their customer, it came down to policy, “because rates and fees will almost always be higher with non-banks”.

While there is an understanding that rates and fees are typically higher at non-banks, most brokers are still happy to use them if they are the right fit for their clients.

“Whilst there is always room for more competitive rates and less fees, turnaround times and credit policy make the [non-bank] lenders a good first touchpoint when presenting to out-of-the-box clients,” said one survey respondent.

Other brokers believed non-banks had also “stepped up” in terms of their rates and fees, becoming much more competitive.

Mirroring last year’s top barriers to using a non-bank lender, the second-biggest barrier in 2021 was a lack of brand awareness. There was a 3% increase in the number of respondents who said this was their main barrier.

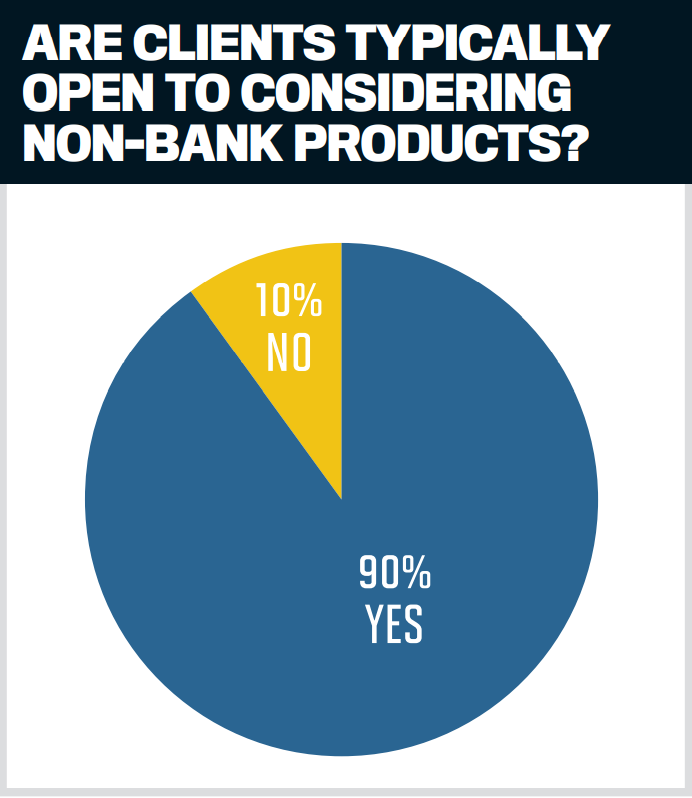

Despite this, there was incredible growth in the proportion of brokers who said their clients were typically open to considering non-bank products. Only 10% of respondents said clients were not open to non-banks, compared to just over 30% last year.

Of those who said clients were not open to non-banks, they put this down to them not knowing the brand, the settlement process not being up to expectations, and interest rates being too high.

Although some brokers said their clients weren’t typically open to non-banks, in the survey comments they noted that the non-banks were making improvements.

“I see an increasing level of participation by non-bank lenders in advertising, and customers are beginning to see the benefits of faster turnaround times and comparatively better products,” said one respondent.

La Trobe Financial not only took home the gold medal for brand recognition this year, but it achieved the highest score in the entire survey.

One respondent commented that while advertising and awareness was lacking when it came to some non-bank lenders, La Trobe Financial was doing better.

“When I mention some non-banks to clients, the normal question is, who are they? La Trobe Financial has been pretty good with advertising and awareness.”

Brand recognition

La Trobe Financial

Pepper Money

Resimac

Interest rates

Pepper Money

Firstmac

La Trobe Financial

Product range

Firstmac

Better Choice

Resimac

Product diversification opportunities

Pepper Money

Firstmac

Bluestone

Brokers have had mixed experiences of the time it takes for non-banks to make decisions, and there are varying opinions on how these lenders can improve

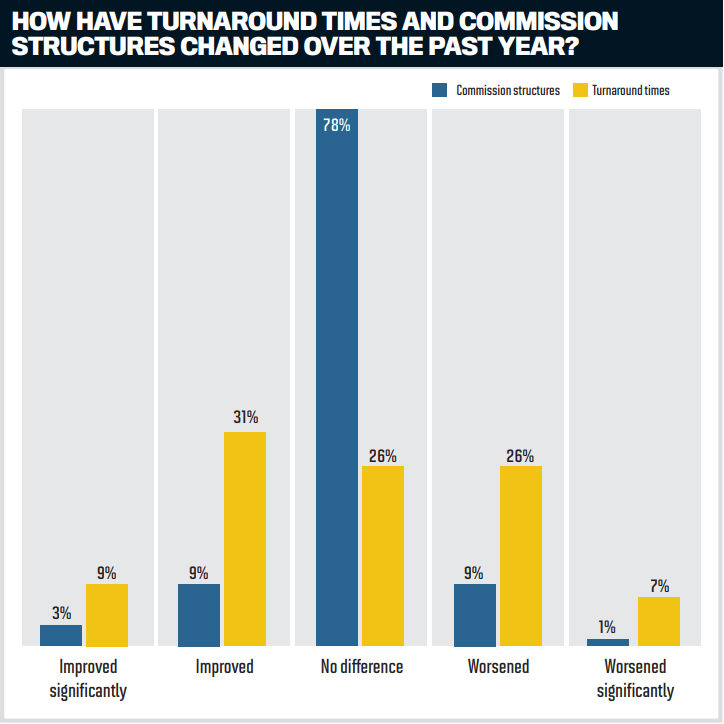

There have been two different broker experiences when it comes to turnaround times: some have seen an improvement, while others say they are getting worse. Forty per cent of brokers said turnaround times had improved – an increase of 7% from last year. Thirty-three per cent said they had worsened, the same as last year.

The feeling that non-banks’ turnaround times have improved over the past 12 months fits with the higher proportion of brokers in this year’s survey who said turnaround times were the main reason they were putting business through the non-banks.

Of those who thought turnaround times had improved, one broker said, “Turnaround time is faster and smoother, which is also because they improved some procedures (eg upfront valuation through RP valuation platform), and they have credit policy published to the broker platform, etc.”

Another broker said, “The lenders I'm dealing with have lifted their game to capitalise on the opportunities in the market.”

However, a third commented: “I believe turnaround times have improved – or have the banks’ turnaround times worsened significantly?”

Several brokers pointed out that it might seem like non-bank turnaround times have improved, just because those of the banks are so poor. “I find that non-bank lenders always have a reasonable turnaround time, and improvement is now considered significant given the performance of so-called mainstream lenders of late,” one said.

In the opinion of one broker who had experienced worsening turnaround times: “Non-bank lenders have attempted to become more mainstream, but this has impacted their service delivery.”

Another simply couldn’t answer the question: “I don’t really know; I can’t remember what happened last week, let alone what turnaround times were like 12 to 24 months ago.”

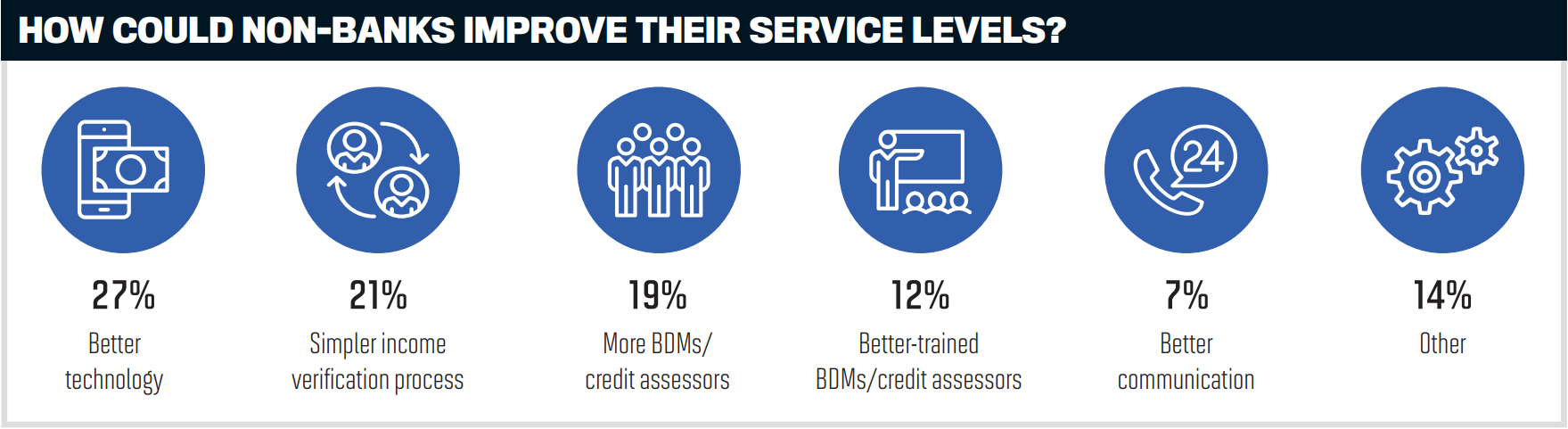

When asked how non-bank lenders could improve their service levels, brokers’ responses were very similar to those in 2020. The majority still think better technology would help, as well as a simplified income verification process.

Thirty-one per cent also called out BDMs as an area needing improvement, whether it was about having more of them or ensuring they were better trained.

Among the 14% of brokers who ticked ‘Other’, some said there was nothing to improve, while others said improvement was needed in all areas. Some of the improvements asked for were clearer and consistent policies, an increase in credit processing resources, and more flexibility.

One broker wanted “better verification of accountant letters”, saying “sometimes the time taken for a lender to call a client's accountant to verify an accountant’s letter can take two weeks”.

Turnaround times

Liberty

Pepper Money

Firstmac

Communications, training and development

Pepper Money

Mortgage Ezy

Liberty

Online platform and services

Pepper Money

La Trobe Financial

Liberty

To be in with a chance of winning a pair of Apple EarPods for the best comment, brokers were asked whether they thought the non-banks had given the banks enough competition over the last year

“Yes. Due to the stricter bank conditions and slow responses, the non-banks have taken advantage of this with their broader lending policy and have improved SLAs to take on more applications”

“Yes. Due to the stricter bank conditions and slow responses, the non-banks have taken advantage of this with their broader lending policy and have improved SLAs to take on more applications”

“Yes. With CCR being rolled out there are a lot more people aware and open to having finance with non-banks”

“Yes. With CCR being rolled out there are a lot more people aware and open to having finance with non-banks”

“Yes, I feel that they have their place in the lending landscape. If they can't compete on rates, they must offer something else, which a lot of them do. But if they want mainstream lending, it will always come down to rates and/or turnaround times”

“Yes, I feel that they have their place in the lending landscape. If they can't compete on rates, they must offer something else, which a lot of them do. But if they want mainstream lending, it will always come down to rates and/or turnaround times”

“Yes, they offer good competition; however, I often have to educate clients around their brands and what they can actually do better than the banks”

“Yes, they offer good competition; however, I often have to educate clients around their brands and what they can actually do better than the banks”

“Yes, they have an offering that extends further than the major banks’, particularly [being] more flexible in the credit area”

“Yes, they have an offering that extends further than the major banks’, particularly [being] more flexible in the credit area”

“The non-banks have come out tops against the banks as the banks’ turnaround times have failed dismally this year; the wait times on the phones are nothing but a waste of our valuable time. The non-banks have nailed this”

“The non-banks have come out tops against the banks as the banks’ turnaround times have failed dismally this year; the wait times on the phones are nothing but a waste of our valuable time. The non-banks have nailed this”

“It’s impossible for non-banks to compete on rate with banks. However, the service of non-banks is much greater than banks”

“It’s impossible for non-banks to compete on rate with banks. However, the service of non-banks is much greater than banks”

“Yes and no – they need to do more campaigning to the public to obtain awareness, but they are now better for service turnarounds, and service by BDMs is much more expedient and their policy in many cases is more accommodating”

“Yes and no – they need to do more campaigning to the public to obtain awareness, but they are now better for service turnarounds, and service by BDMs is much more expedient and their policy in many cases is more accommodating”

“I think they have definitely stepped up and become a viable solution to the banks. Non-banks are now offering on-par products for prime applications, with competitive pricing and often much better turnaround times”

“I think they have definitely stepped up and become a viable solution to the banks. Non-banks are now offering on-par products for prime applications, with competitive pricing and often much better turnaround times”

“Yes, they do. They look at the deal as a real-world scenario, not just at if it fits in a box”

“Yes, they do. They look at the deal as a real-world scenario, not just at if it fits in a box”

“No. I think clients are taken by the so-called ‘cashback’ being given out by main trading banks”

“No. I think clients are taken by the so-called ‘cashback’ being given out by main trading banks”

“No. Customers need everyday banking features”

“No. Customers need everyday banking features”

“Not enough since the big four offered large cashback incentives to clients”

“Not enough since the big four offered large cashback incentives to clients”

“No, the more product diversity and brand awareness can be created, the more business will flow to non-bank lenders”

“No, the more product diversity and brand awareness can be created, the more business will flow to non-bank lenders”

“I don't think the non-banks have provided enough competition, as the traditional banks still have larger brand recognition and service networks”

“I don't think the non-banks have provided enough competition, as the traditional banks still have larger brand recognition and service networks”

“They’re still behind on competitive interest rates and advanced systems such as progress draws, valuation, settlement process, etc., are not up to clients’ expectations”

“They’re still behind on competitive interest rates and advanced systems such as progress draws, valuation, settlement process, etc., are not up to clients’ expectations”

Leapfrogging into first place in the Brokers on Non-Banks survey, Pepper Money was ranked as the best lender in several borrower categories

Specialist lending

Pepper Money

First home buyers

Pepper Money

Property investors

Pepper Money

Commercial

Liberty

Alt-doc

Pepper Money

SMSF

Liberty

Foreign non-residents

La Trobe Financial

Read more about brokers’ number one non-bank

Pepper Money: Investing in the broker

MPA: Your turnaround times were particularly highlighted by brokers this year. How important has this been to brokers? And how have you worked on keeping your turnaround times consistent?

John Mohnacheff , group sales manager: At Liberty, service is at the core of everything we do, and we understand that turnaround times are incredibly important to brokers. Since day one, we have always sought to deliver fast turnaround times as we recognise how this can benefit both customers and business partners alike. For example, an approval has limited value if it only arrives after a cooling-off period lapses.

So, how do we do it? Well, a large part of the reason why we can act so quickly is because our assessors are familiar with assessing deals that aren’t always straightforward. While other lenders might require more time to work through a complex deal with unusual considerations, for us at Liberty this is simply business as usual. And, understanding the importance of speedy approvals, we have built our systems and processes to ensure we can always provide the fast responses that brokers depend on. With direct access to our lending teams, business partners can get answers quickly and keep customers updated every step of the way. We understand that the service we deliver reflects on the broker in the eyes of the customer, so it’s our goal to help support these relationships however we can.

While maintaining consistently fast turnaround times can be challenging, the highly dedicated team members in our Melbourne head office never shy away from a challenge. We recognise the important role that fast turnaround times can play in customers’ lives, and it all comes back to our mission to help more people get financial.

MPA: You took the gold medal for your product range. Why do you think you won it?

Kim Cannon, managing director: It’s because we have a very wide and innovative range of products. Our range includes basic variable, offset variable, non-resident, construction, fixed, and SMSF loans. Our Green Home Loan, which offers a deep discount for energy-efficient homes, is groundbreaking in the market, as is our streamlined residential SMSF offering. We have something to suit the needs of every prime borrower.

MPA: Why is a good product range so important to brokers?

KC: It’s important because no two customers are the same. Each one has different requirements and objectives, and a good product range must cater to all of those.

MPA: How will you continue to work with brokers over the next year?

KC: We’re employing more sales and support staff so that, as our business grows, our service level is maintained. We have a really strong service culture at Firstmac, and that is something we will keep investing in and improving. We’ll also continue to deliver superior turnaround times and service levels to brokers compared to the rest of the market, especially the banks.

MPA: You won the gold medal for your brand recognition, achieving the highest score in the whole survey. How does it feel to be so well recognised by brokers in this area?

Cory Bannister, chief lending officer: We’re very humbled to receive this recognition; we’ve been working incredibly hard over many years to strengthen our brand and ensure that brokers, and their customers, are aware of the genuine alternative solutions available to them across the mortgage market, so that each year more and more people gain access to the financial solutions they need, when they need them the most. The events of the last 18 months further support this notion. We purposely increased our marketing exposure during this period as we recognised that it was likely to be a challenging time for many, and we wanted to ensure people knew we were ready and able to assist them through this period.

MPA: La Trobe Financial was the most preferred lender for foreign non-residential lending. What do you off er that brokers love so much?

CB: We’ve been operating in the non-resident loan market for many years. Over this period, thanks to great feedback from brokers, we have been able to refi ne our product and processes to make our ‘International Borrower’ loans easy to understand and use. In addition to the engineering of the product, our specialist team of credit analysts speak multiple languages, which assists greatly in dealing with customers, and we are told this makes us the preferred lender in this space.