Home Loan Connexxion's director on why brokers should back themselves.

So often, a successful career can hinge on a single decision.

For Tracy Kearey, that moment arrived on 29 November 2013. She was already a successful broker at Home Loan Connexion – in fact, the number-one loan writer in the group – when she sat down with owners Ian Cain and Mark Harris to negotiate higher commission and ask where the business was going. She walked out of the room a director of the company, having agreed then and there to buy Mark’s share.

“I shook his hand and then sat in my car and went to pieces and thought, ‘Oh my God, what have I done?’” Kearey recalls. However, she’s never regretted the decision, as becoming a director opened

up a whole range of possibilities. “Once you make the decision, everything falls into place,” she says. “When you sit indecisively, nothing moves or changes.”

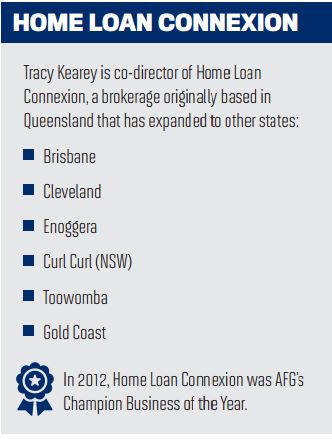

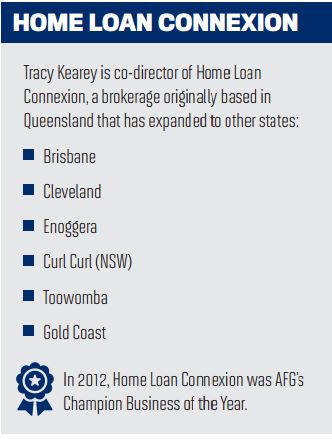

Kearey is now one of Australia’s top brokers and a member of AFG’s elite Chairman’s Club, and Home Loan Connexion is amongst Queensland’s biggest brokerages. Kearey’s actions as a manager – not just a broker – have played a major role in that shift. “I thought it had lost some enthusiasm and energy over the years,” she says, “and I thought I could bring that.”

For those brokers who want to make the step to management, Kearey’s advice is to go ahead and ask the big question. “I don’t know if there ever is a wrong time,” she says. “I think you have to back yourself if that’s where the conversation is going. I guess if you don’t ask, you don’t know. For me, I think it’s simple: If you ask and they say ‘no’, then it’s a ‘no’ right now. If you don’t ask, you’ll always be wondering.”

For those brokers who want to make the step to management, Kearey’s advice is to go ahead and ask the big question. “I don’t know if there ever is a wrong time,” she says. “I think you have to back yourself if that’s where the conversation is going. I guess if you don’t ask, you don’t know. For me, I think it’s simple: If you ask and they say ‘no’, then it’s a ‘no’ right now. If you don’t ask, you’ll always be wondering.”

Broker and director

Kearey’s relationship with the industry goes further back, however, and helps explain how she’s steered Home Loan Connexion. At 30, a recently divorced young mum, she took a job as an assistant at Aussie Home Loans in order to make ends meet. Her boss was Ian Cain, and when he left to found Home Loan Connexion, Kearey went with him and eventually moved into broking.

Today, Home Loan Connexion occupies several offices across Queensland, and can best be described as a sub-aggregation model. Brokers are free to market themselves and follow their own specialities – they service owner-occupier, first home buyer, investor and commercial clients. Kearey herself notes that “across the board, I have a very diversified client base”; recently, her business has been split between owner-occupiers and investors.

She acknowledges that being a director means having a dual focus. “I’m very customer-focused, so I normally like to write the loan and be involved in that process, but I realise that being a director of a group of brokers means I need to put more skills into managing the team, helping with their referrals, their clients, systems and processes.” Until recently, Kearey was managing two offices – a branch office in Cleveland and the head office Woolongabba – but she recently decided to focus on the latter.

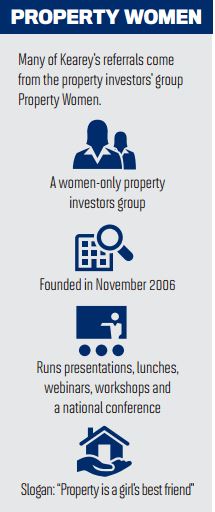

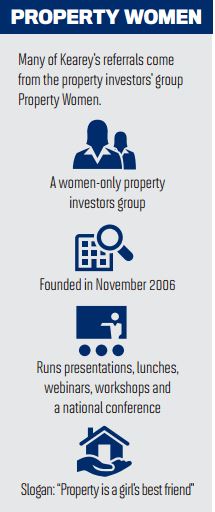

With limited time and a database of satisfied clients, Kearey relies on referrals as her core source of business. “I don’t really advertise,” she says. “Most of my business comes from my existing clients, and I do work with real estate agents and planners, businesses and [an] investment group.” To form a relationship with the latter, a female investors’ group known as Property Women, Kearey drew on both her own experiences as a hard-pressed mum and her technical knowledge as a broker.

Oddly enough, she met the group through some male colleagues who had dealt with the directors of Property Women. “They were looking for a female broker to come to their event and help them, and they approached me,” Kearey recalls. “The first event I went to, I wrote four or five home loans from.”

She regularly speaks to the group about the state of the market and the financing available. “Now with the changes under APRA, it’s important I get out there and let them know I can still borrow money, but the goalposts have changed,” she says.

Women in broking

Not only does Kearey help female investors, but she’s also intent on raising the status of women within the broking industry . She was recently appointed to the advisory panel of the Women in Mortgage Business Network [WIMBN], the MFAA networking group that was originally set up for female brokers but is now expanding its scope to focus on mental health and lifestyle issues for brokers of both genders. As part of the panel, Kearey helps determine the group’s strategy. “I’ll be active in the broking community in Queensland, discussing any shortcomings in the industry like cultural diversity, opportunities for women,

work-life balance and mental health issues.”

WIMBN has a crucial role in supporting women in what has been a male-dominated industry, Kearey explains. “I think that WIMBN could give women a voice to share their successes and challenges and let them know they’re not on their own. Sometimes when you are successful, you don’t know who to go to for help and assistance because you’ve made it; you’re at that point in your career. So I think with WIMBN and a lot of networking groups, it is about support for women. We all have challenges, and sometimes we maybe feel that we can’t ask for help, but it’s OK to.”

In an article for Switzer Broker, real estate icon John McGrath identified women as the key decisionmakers in getting a loan, and Kearey thinks this could give female brokers an advantage. “When I sit with my clients, the female does often make the decision. You know, women do think differently, so maybe there’s compassion or a different understanding when you’re in front of people. So it couldn’t hurt to have more women in this industry.”

She’s keen to make that happen by mentoring younger female brokers – having a female mentor, Kearey argues, could help those young brokers overcome confidence or self-esteem issues by giving them a role model they can relate to. “I would really like to give back to an industry that’s afforded me a really great career,” she says. “I’m definitely interested in mentoring, and if I can encourage someone to join the industry, particularly a young female, then that would be great. I think this industry can offer so many rewards, not just financial.”

Expanding Home Loan Connexion

Kearey may get her chance to mentor sooner than later: Home Loan Connexion is planning to expand. “We’d like to be at the top of our game,” she says. “We are looking at bringing on new younger brokers, and potentially women. Bringing new people into the industry is something I’m passionate about; it helps with succession planning, and they can also learn from the mistakes and lessons I’ve learnt.”

Home Loan Connexion already has brokers in Sydney and Melbourne, and is planning a more extensive move into these booming housing markets over the next few months. Employing younger brokers will help engage a younger clientele, Kearey believes. “Our client base is changing, and we definitely need young people that are tech-savvy,” she says. “The way that young people think about lifestyle and money is different to older people. If you’re being given advice by someone in your own age group, it might feel less like it’s your mum or dad telling you what to do.”

Expansion will create more work for Kearey, which leads to an interesting dilemma: The promise of a good work-life balance, which encouraged Kearey to join the industry as a young mum, is becoming harder and harder to maintain. But for Kearey, that’s just part of the challenge, and she continues to lean in to the industry: “I put a lot of expectation on myself to deliver to my brokers, my clients and my staff and I take a lot of it on-board. I’m invested in this industry – I put forward the money to buy the business – so when you’re backing yourself, you need to go out there and do it.”

For Tracy Kearey, that moment arrived on 29 November 2013. She was already a successful broker at Home Loan Connexion – in fact, the number-one loan writer in the group – when she sat down with owners Ian Cain and Mark Harris to negotiate higher commission and ask where the business was going. She walked out of the room a director of the company, having agreed then and there to buy Mark’s share.

“I shook his hand and then sat in my car and went to pieces and thought, ‘Oh my God, what have I done?’” Kearey recalls. However, she’s never regretted the decision, as becoming a director opened

up a whole range of possibilities. “Once you make the decision, everything falls into place,” she says. “When you sit indecisively, nothing moves or changes.”

Kearey is now one of Australia’s top brokers and a member of AFG’s elite Chairman’s Club, and Home Loan Connexion is amongst Queensland’s biggest brokerages. Kearey’s actions as a manager – not just a broker – have played a major role in that shift. “I thought it had lost some enthusiasm and energy over the years,” she says, “and I thought I could bring that.”

For those brokers who want to make the step to management, Kearey’s advice is to go ahead and ask the big question. “I don’t know if there ever is a wrong time,” she says. “I think you have to back yourself if that’s where the conversation is going. I guess if you don’t ask, you don’t know. For me, I think it’s simple: If you ask and they say ‘no’, then it’s a ‘no’ right now. If you don’t ask, you’ll always be wondering.”

For those brokers who want to make the step to management, Kearey’s advice is to go ahead and ask the big question. “I don’t know if there ever is a wrong time,” she says. “I think you have to back yourself if that’s where the conversation is going. I guess if you don’t ask, you don’t know. For me, I think it’s simple: If you ask and they say ‘no’, then it’s a ‘no’ right now. If you don’t ask, you’ll always be wondering.” Broker and director

Kearey’s relationship with the industry goes further back, however, and helps explain how she’s steered Home Loan Connexion. At 30, a recently divorced young mum, she took a job as an assistant at Aussie Home Loans in order to make ends meet. Her boss was Ian Cain, and when he left to found Home Loan Connexion, Kearey went with him and eventually moved into broking.

Today, Home Loan Connexion occupies several offices across Queensland, and can best be described as a sub-aggregation model. Brokers are free to market themselves and follow their own specialities – they service owner-occupier, first home buyer, investor and commercial clients. Kearey herself notes that “across the board, I have a very diversified client base”; recently, her business has been split between owner-occupiers and investors.

She acknowledges that being a director means having a dual focus. “I’m very customer-focused, so I normally like to write the loan and be involved in that process, but I realise that being a director of a group of brokers means I need to put more skills into managing the team, helping with their referrals, their clients, systems and processes.” Until recently, Kearey was managing two offices – a branch office in Cleveland and the head office Woolongabba – but she recently decided to focus on the latter.

With limited time and a database of satisfied clients, Kearey relies on referrals as her core source of business. “I don’t really advertise,” she says. “Most of my business comes from my existing clients, and I do work with real estate agents and planners, businesses and [an] investment group.” To form a relationship with the latter, a female investors’ group known as Property Women, Kearey drew on both her own experiences as a hard-pressed mum and her technical knowledge as a broker.

Oddly enough, she met the group through some male colleagues who had dealt with the directors of Property Women. “They were looking for a female broker to come to their event and help them, and they approached me,” Kearey recalls. “The first event I went to, I wrote four or five home loans from.”

She regularly speaks to the group about the state of the market and the financing available. “Now with the changes under APRA, it’s important I get out there and let them know I can still borrow money, but the goalposts have changed,” she says.

Women in broking

Not only does Kearey help female investors, but she’s also intent on raising the status of women within the broking industry . She was recently appointed to the advisory panel of the Women in Mortgage Business Network [WIMBN], the MFAA networking group that was originally set up for female brokers but is now expanding its scope to focus on mental health and lifestyle issues for brokers of both genders. As part of the panel, Kearey helps determine the group’s strategy. “I’ll be active in the broking community in Queensland, discussing any shortcomings in the industry like cultural diversity, opportunities for women,

work-life balance and mental health issues.”

WIMBN has a crucial role in supporting women in what has been a male-dominated industry, Kearey explains. “I think that WIMBN could give women a voice to share their successes and challenges and let them know they’re not on their own. Sometimes when you are successful, you don’t know who to go to for help and assistance because you’ve made it; you’re at that point in your career. So I think with WIMBN and a lot of networking groups, it is about support for women. We all have challenges, and sometimes we maybe feel that we can’t ask for help, but it’s OK to.”

In an article for Switzer Broker, real estate icon John McGrath identified women as the key decisionmakers in getting a loan, and Kearey thinks this could give female brokers an advantage. “When I sit with my clients, the female does often make the decision. You know, women do think differently, so maybe there’s compassion or a different understanding when you’re in front of people. So it couldn’t hurt to have more women in this industry.”

She’s keen to make that happen by mentoring younger female brokers – having a female mentor, Kearey argues, could help those young brokers overcome confidence or self-esteem issues by giving them a role model they can relate to. “I would really like to give back to an industry that’s afforded me a really great career,” she says. “I’m definitely interested in mentoring, and if I can encourage someone to join the industry, particularly a young female, then that would be great. I think this industry can offer so many rewards, not just financial.”

Expanding Home Loan Connexion

Kearey may get her chance to mentor sooner than later: Home Loan Connexion is planning to expand. “We’d like to be at the top of our game,” she says. “We are looking at bringing on new younger brokers, and potentially women. Bringing new people into the industry is something I’m passionate about; it helps with succession planning, and they can also learn from the mistakes and lessons I’ve learnt.”

Home Loan Connexion already has brokers in Sydney and Melbourne, and is planning a more extensive move into these booming housing markets over the next few months. Employing younger brokers will help engage a younger clientele, Kearey believes. “Our client base is changing, and we definitely need young people that are tech-savvy,” she says. “The way that young people think about lifestyle and money is different to older people. If you’re being given advice by someone in your own age group, it might feel less like it’s your mum or dad telling you what to do.”

Expansion will create more work for Kearey, which leads to an interesting dilemma: The promise of a good work-life balance, which encouraged Kearey to join the industry as a young mum, is becoming harder and harder to maintain. But for Kearey, that’s just part of the challenge, and she continues to lean in to the industry: “I put a lot of expectation on myself to deliver to my brokers, my clients and my staff and I take a lot of it on-board. I’m invested in this industry – I put forward the money to buy the business – so when you’re backing yourself, you need to go out there and do it.”