The average purchase mortgage rate for a 30-year FRM increased in December, with average borrowers paying the highest APR since July 2016

The average purchase mortgage rate for a 30-year FRM increased in December, with average borrowers paying the highest APR since July 2016.

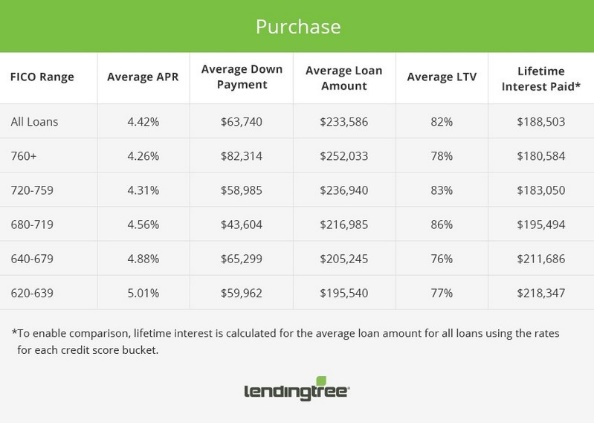

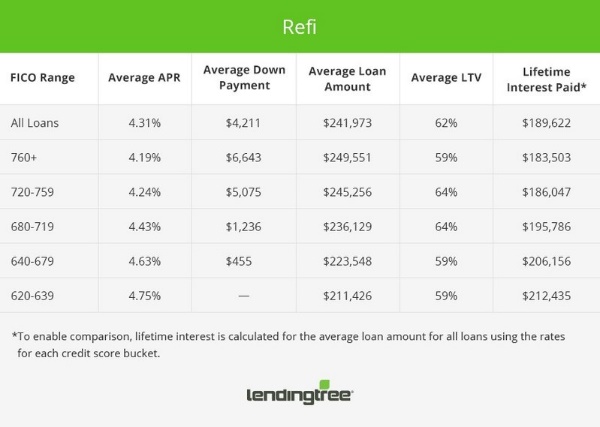

The month’s mortgage offer report from LendingTree reveals that borrowers were offered an average APR of 4.42%, up 12 basis points from November.

APRs for borrowers with credit scores of 760 and above averaged 4.26% compared to 3.56% for those with scores of 680-719. Over a 30-year period, the extra costs for those with lower scores works out at $15,000 for an

average loan of $233,586.

"Interest rates for 2017 were on average lower than had been expected at the start of the year but they did end the year on an upswing," said Tendayi Kapfidze, LendingTree's Chief Economist and report author. "Our report shows that the benefits of improving your credit score are even greater when interest rates are rising, as lenders often pass on higher costs to borrowers with poorer credit first."

Those borrowers with the best credit profiles saw 3.80% as the best offer for a conforming 30-year FRM purchase loan (up 5 percentage points from November) while refinance offers were up 1 basis point to 3.70%.

The report also shows that the average down payment continued its 8-month rise to reach $63,740 in December.

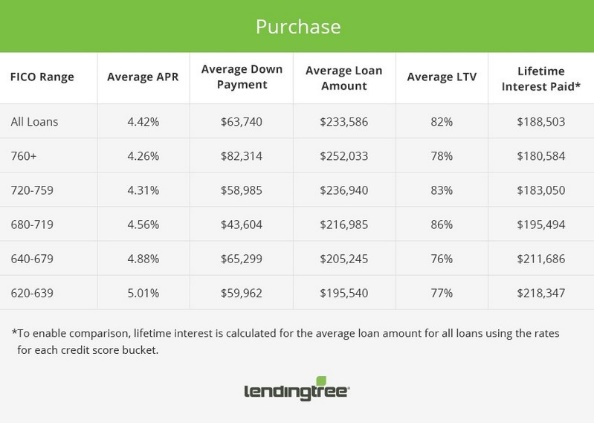

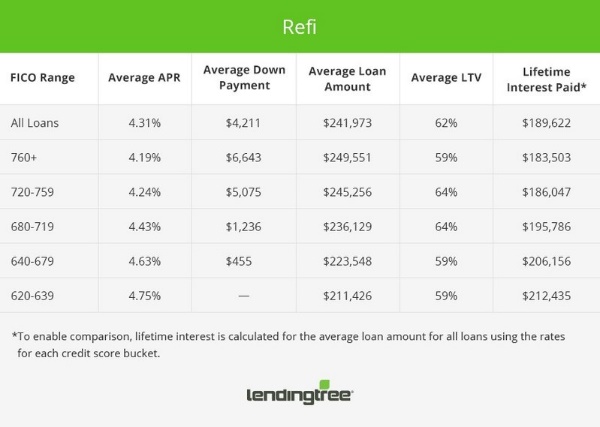

The month’s mortgage offer report from LendingTree reveals that borrowers were offered an average APR of 4.42%, up 12 basis points from November.

APRs for borrowers with credit scores of 760 and above averaged 4.26% compared to 3.56% for those with scores of 680-719. Over a 30-year period, the extra costs for those with lower scores works out at $15,000 for an

average loan of $233,586.

"Interest rates for 2017 were on average lower than had been expected at the start of the year but they did end the year on an upswing," said Tendayi Kapfidze, LendingTree's Chief Economist and report author. "Our report shows that the benefits of improving your credit score are even greater when interest rates are rising, as lenders often pass on higher costs to borrowers with poorer credit first."

Those borrowers with the best credit profiles saw 3.80% as the best offer for a conforming 30-year FRM purchase loan (up 5 percentage points from November) while refinance offers were up 1 basis point to 3.70%.

The report also shows that the average down payment continued its 8-month rise to reach $63,740 in December.