Investors and lenders interested in potential in the single-family for-lease market should find pockets of opportunity even where yields are in the mid-range

Investors and lenders interested in potential in the single-family for-lease market should find pockets of opportunity even where yields are in the mid-range.

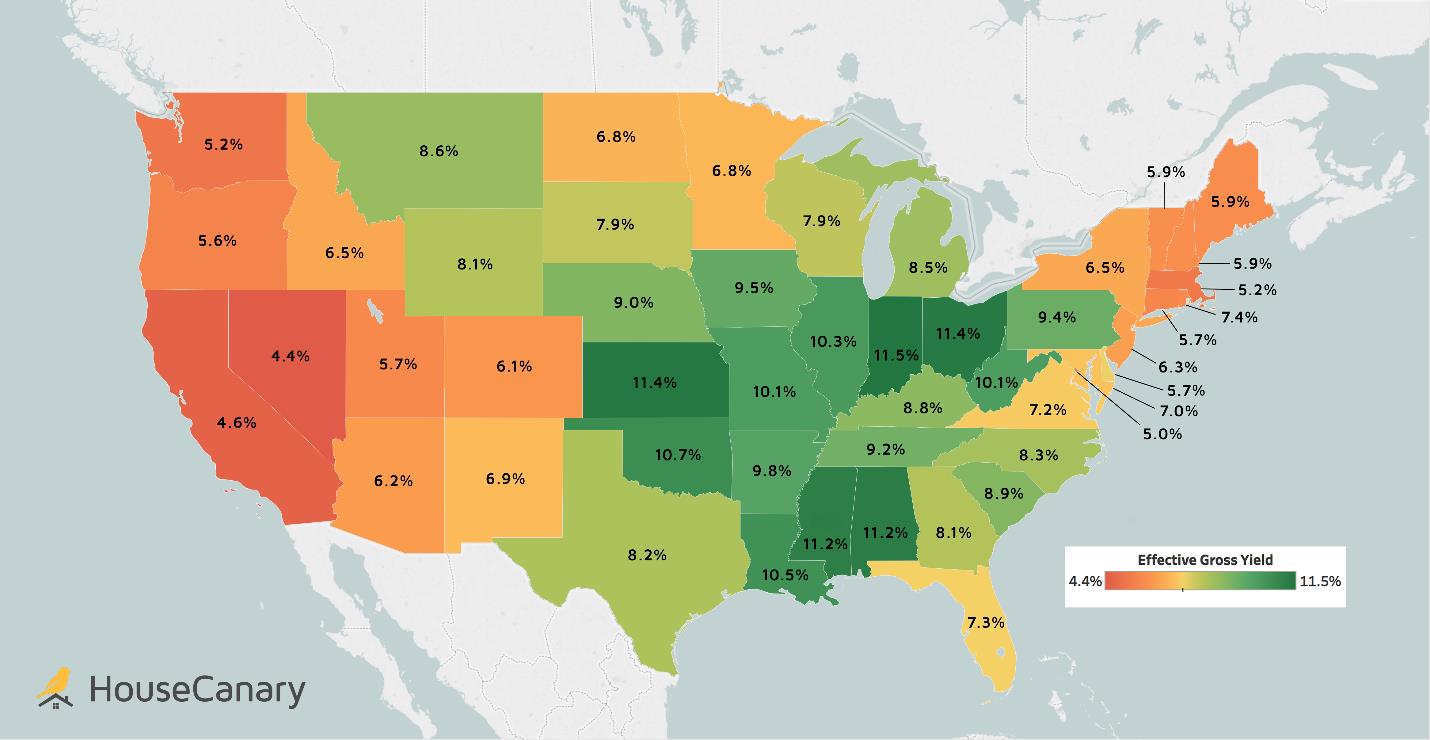

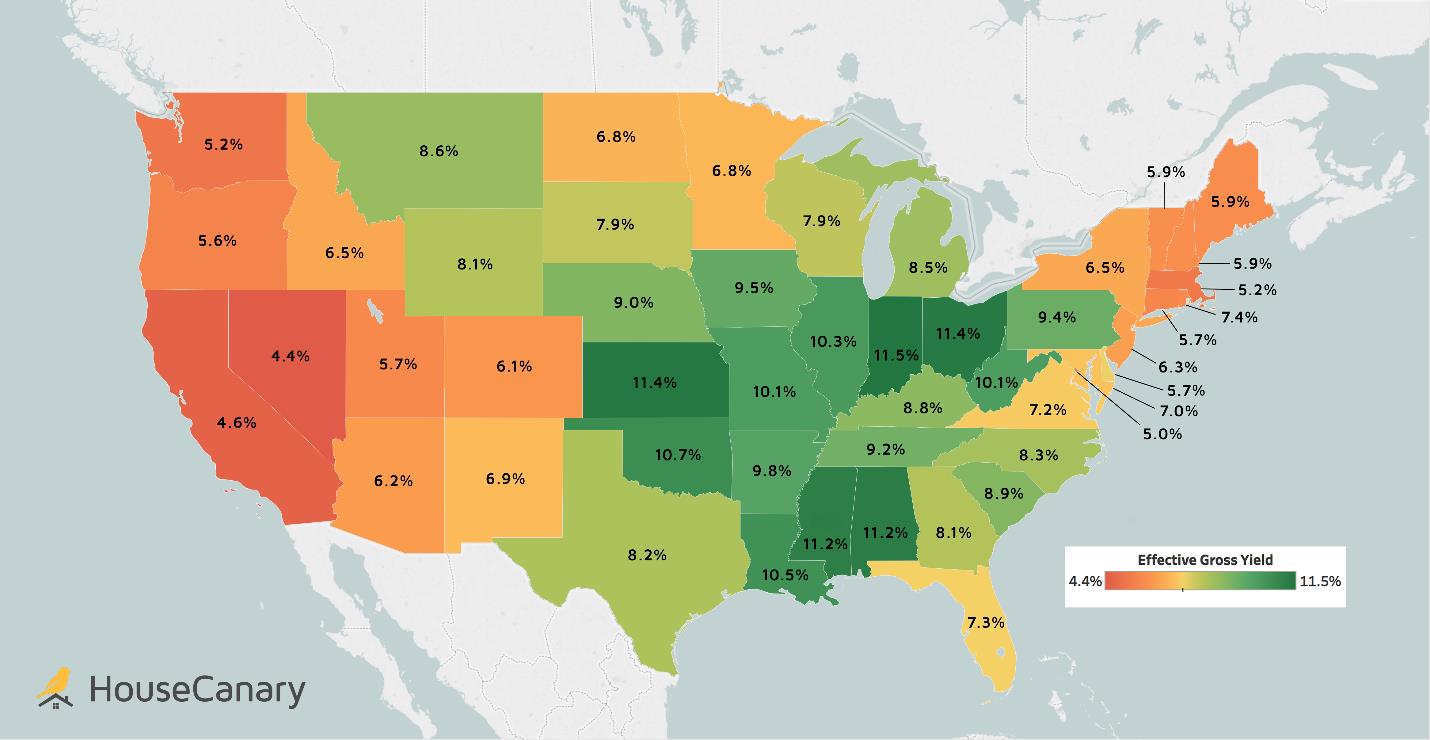

Data from HouseCanary Inc. shows that, in the fourth quarter of 2017, effective gross yield (EGY) nationwide gained by a healthy 7.3% even as house prices escalated.

Even in the areas that haven’t seen strong gains, there is opportunity the firm’s Rental Investment Index reveals.

“The markets where rental yield is either unusually high or unusually low haven’t changed significantly in the past quarter, but our analysis shows that even in markets where EGY is average or middle-of-the-road, rental investors can still find hidden gems that will generate better-than-average returns,” said Alex Villacorta, HouseCanary’s Executive Vice President of Analytics.

Head Southwest for opportunity

The report analyzed 5 metros in the Southwest with an average of below-average EGY - Phoenix, Tucson, Las Vegas, El Paso, and Albuquerque.

“Our latest data show that from Nevada to Texas, metros in the Southwest — like Phoenix and Las Vegas — have certain hyper-local areas where rental investors can find homes that will generate higher-than-average rental yields for them, even where home prices continue to increase,” said Villacorta.

Data from HouseCanary Inc. shows that, in the fourth quarter of 2017, effective gross yield (EGY) nationwide gained by a healthy 7.3% even as house prices escalated.

Even in the areas that haven’t seen strong gains, there is opportunity the firm’s Rental Investment Index reveals.

“The markets where rental yield is either unusually high or unusually low haven’t changed significantly in the past quarter, but our analysis shows that even in markets where EGY is average or middle-of-the-road, rental investors can still find hidden gems that will generate better-than-average returns,” said Alex Villacorta, HouseCanary’s Executive Vice President of Analytics.

Head Southwest for opportunity

The report analyzed 5 metros in the Southwest with an average of below-average EGY - Phoenix, Tucson, Las Vegas, El Paso, and Albuquerque.

“Our latest data show that from Nevada to Texas, metros in the Southwest — like Phoenix and Las Vegas — have certain hyper-local areas where rental investors can find homes that will generate higher-than-average rental yields for them, even where home prices continue to increase,” said Villacorta.