The FHFA is going to begin relaxing credit and down payment constraints, and loan applications were up 3.6% last week. All this and more in today's rate snapshot

A nice start this morning; the 10 yr note opened at 2.58%, its granite wall, 30 yr MBS prices early on up 15 bp from yesterday’s 33 bp increase. At 8:30 April PPI was stronger than estimates, up 0.6% against estimates of +0.2%, the core rate up 0.5% against estimates of +0.2%; yr/yr inflation at the wholesale level up 2.1%. 2.0% is the Fed’s inflation wish but the Fed pays most attention to the PCE data than PPI. Tomorrow April CPI will be reported. The advance from the same month a year before was the biggest since March 2012 and followed a 1.4% yr/yr rise in the year to March. Wholesale food expenses increased 2.7 percent in April, the biggest jump since February 2011, led by an 8.4 percent surge in the costs of meats that was the biggest since 2003. Inflation isn’t increasing as much as the data suggested, not much interest in the increase due to one-off issues.

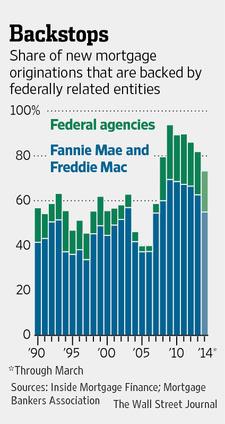

We reported yesterday that FHFA is going to begin relaxing credit and down payment constraints in the mortgage market. The new director Mel Wall is turning his back to the stringent credit and down payment rules set out by our main man Barney the Frank and Chris Dodd and the then-acting director of FHFA Mr. DeMarco. Finally Washington is getting the message, without improvement in the housing sector the economy will continue with little growth as it has been doing since the Dodd/Frank bill that was rammed through Congress in a panic mode led by Barney Frank. An easing in credit, down payments and risk retention forced on banks is coming as Wall St formulates the details. Even most of the minions in Congress are beginning to understand that without housing the economy will not return to solid strong growth. On the same subject; the proposed legislation that was being worked up in the Senate to set a path for the end of Fannie and Freddie has died a rapid death---the legislation initiative is dead! In coming weeks, six agencies, including Mr. Watt's, are expected to finalize new rules for mortgages that are packaged into securities by private investors. Those rules largely abandon earlier proposals requiring larger down payments on mortgages in certain types of mortgage-backed securities.

At 9:30 the DJIA opened -11, NASDAQ -11, S&P -2; 10 yr note-----wait for it---2.57% and 30 yr MBS prices +14 bps from yesterday’s close. The mortgage rate driver is right there once again, trying to cut through the granite wall at 2.58% on a close. A lot of day left but looking good early on.

Early this morning, as usual, the weekly MBA mortgage applications data. The Market Composite Index, a measure of mortgage loan application volume, increased 3.6% on a seasonally adjusted basis from one week earlier. The Refinance Index increased 7% from the previous week to its highest level since the week ending April 11, 2014. The seasonally adjusted Purchase Index decreased less than 1% from one week earlier. The unadjusted Purchase Index increased less than 1 percent compared with the previous week and was 12 percent lower than the same week one year ago. The refinance share of mortgage activity increased to 50% of total applications from 49% the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 8% from 9% of total applications. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.39 percent, the lowest rate since November 2013, from 4.43 percent, with points increasing to 0.22 from 0.21 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) remained unchanged at 4.29 percent, with points increasing to 0.16 from 0.14 (including the origination fee) for 80 percent LTV loans. The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 4.09 percent, the lowest rate since November 2013, from 4.13 percent, with points decreasing to -0.17 from -0.03 (including the origination fee) for 80 percent LTV loans. The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.48 percent, the lowest rate since November 2013, from 3.52 percent, with points decreasing to 0.12 from 0.22 (including the origination fee) for 80 percent LTV loans.

Nothing new in Ukraine/Russia situation overnight; the Ukraine vote on the presidency is still scheduled for May 25th. Until then we don’t expect much to occur but there will still be a safe haven traded in US treasuries keeping rates low. As we reminded yesterday, the safest sovereign debt, the US Treasury debt, is at higher interest rates than rates in Germany and other ‘safe countries’ so foreign investors are attracted to the US 10 yr if looking for a safe haven to park money in case the geo-political scene boils over.

Nothing left on the schedule today; all about watching the stock market and the 10 yr note. From a technical perspective a close below 2.57% should drive rates lower on a breakout of the recent tight range. From a fundamental point of view it is difficult to expect much lower rates unless the stock market succumbs to a huge sustained sell-off. Janet Yellen is scheduled to speak tomorrow; her remarks thus far have moved markets. She put her foot in it a few weeks ago when she said in effect the Fed would begin increasing interest rates in mid-2015. Since that she has swung back to data dependent as the trigger to increase rates. She and Treasury Sec Lew last week were sounding an alarm about the housing sector keeping the economy from growing more rapidly.

RateSnapshot courtesy of TBWSratealert.com

RateSnapshot courtesy of TBWSratealert.com