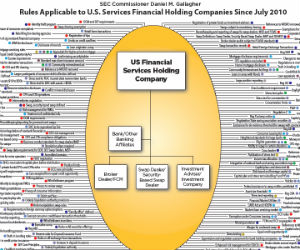

Have your magnifying glass ready. A SEC commissioner has created an overwhelming diagram that shows all the new regulations that have been imposed on U.S. financial services firms since Dodd-Frank.

In an effort to show how heavily regulated the financial industry is, SEC Commissioner Daniel Gallagher has created an overwhelming diagram to show all the new regulations that have been imposed on U.S. financial services firms since enactment of the Dodd-Frank Act in 2010.

"No regulator, as far as I know, has considered the overall regulatory burden on financial services firms when determining whether to impose additional costly regulations," Gallagher said. "We as regulators are, when it comes to the possibility that our rules are causing death by a thousand cuts, the proverbial ostrich—head firmly entrenched in the sand."

He added that he and his staff created the image to help the public fully grasp the breadth of recent rulemaking. "I hope this stark depiction can spark a much-needed debate about the regulatory burden that has been placed on our financial services industry in just the last 4.5 years alone."

"The stakes here are considerable: regulatory burdens divert capital away from the real economy—this acts as a barrier to entry for new market participants and further entrenches those institutions that are increasingly “too big to fail," he added.

Click on the image to view a bigger version.